Today, technology has permeated nearly all aspects of banking and its role is rapidly evolving. Having graduated from ‘simple’ back office automations, technology has become a core driver of shareholder value.

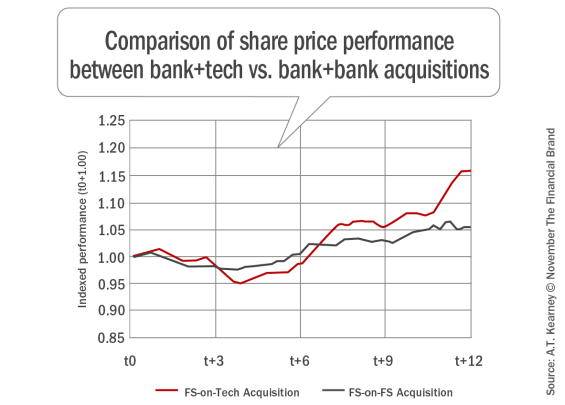

This trend is particularly evident when looking at how investors choose to reward financial services M&As. An analysis by A.T. Kearney shows that returns from financial services companies buying technology companies far exceeded those from financial services firms acquiring other ‘like’ financial services peers.

Looking at M&A data from the past four years for the thirty largest retail global banks (by assets), we sought to isolate the ‘reward’ component of the M&A decision. We began our analysis by re-indexing bank performance to the time (t0) of the acquisition announcement, and then further rebasing the values against the S&P Bank Index. This yielded an approximation of the relative impact of the acquisition announcement on the bank’s share price. The two categories of acquisitions we evaluated were:

- FS-on-FS acquisitions (e.g. Banco Santander’s acquisition of Poland’s commercial bank, Kredyt Bank SA)

- FS-on-Tech acquisitions (e.g. Citibank’s acquisition of a local provider of money transfer services, PayQuik.com)

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

What we discovered is that while FS-on-FS acquisitions achieve ‘above market’ returns of 4%-6% after 12 months, FS-on-Tech acquisitions returned 10%-15% over the same period.

The FS-on-FS results are not altogether surprising, since the business rationale behind FS-on-FS acquisitions is clear and opportunities for saving/ scale are well-documented. Conversely, a technology acquisition appears to signal to the market that a bank is planning for or investing towards an increasingly digitized future.

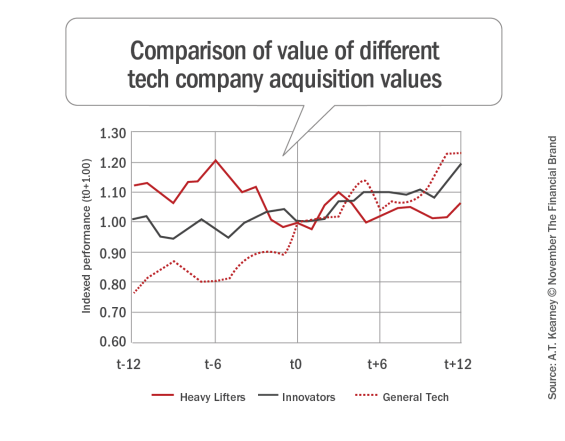

The results however, raise a few questions. For instance, are all FS-on-Tech mergers made equal? Or, are some tech categories more attractive targets for banks? With the wide range and variety of technology businesses, it is important to understand which technology acquisitions offer a greater ‘reward’ – i.e. what offers the greatest “bang for the M&A buck”.

A.T. Kearney set out by dividing technology acquisitions into three categories: Heavy Lifters, Innovators, and General Tech. We defined the categories as follows:

- Heavy Lifters offer unique executional capabilities that could disrupt a banks back and middle offices. The 2012 acquisition of FSV payments by US Bank would be a good example of an acquisition in this category where FSV is a US-based prepaid card processing company.

- Innovators focus on social media, web and mobile. A good example of an acquisition in this category would be Barclay’s acquisition of Analog Analytics, a US-based software services company that provides online, mobile, print and alternative media coupons and gift certificates for local publishers and advertisers.

- General Tech is a ‘catch-all’ category for traditional software/ hardware development acquisitions. A acquisition representative of this category would be Barclays acquisition of a stake in Malta-based general software solution provider, RS2 Software, plc.

The results of this analysis show that Heavy Lifters had the highest average share price return at over 20%. The acquisition of innovative firms in the mobile/ web space delivered gains of 15%-20%. Finally, General Tech resulted in a 5%-10% increase in stock price on par with finance on finance M&As.

It is not surprising to see that Heavy Lifters are returning the most value over time. Not only do banks benefit from immediate cost reductions, but companies in that space are widely considered to be primed for disruption.

Interestingly, mobile/web acquisitions also resulted in strong value creation. Buying an Innovator seems to signal to the market that the acquirer is growing its digital presence and planning for the future. While the financial benefit may or may not pan out, investors seem to be rewarding a management team with an ‘eye on the future’.

Finally General Tech acquisitions appear to signal that the bank does not have a well-defined growth strategy, resulting in the lowest reward amongst tech investments.

The results raise interesting questions. What about those firms that are firmly rooted at the crossroads of Heavy Lifters and Innovators? How soon will it be before an American Express, Citi or Chase begin eating-up the PayPals of the world?

Such a transaction would be in alignment with the disruption we are seeing in financial services today – where new technologies continue to change the players and the stakes. This is why banking-technology mergers will most likely dominate the future finance M&A landscape.

Arjun Sethi is a partner with A.T. Kearney, where he leads the Strategic IT Practice for the Americas. He focuses on developing strategies that transform clients’ middle and back-office functions and enhance revenue growth. He leads engagements for C-Suite executives, guiding them to rethink existing operating models and implementing broad-based IT-enabled business transformation. Arjun’s clients include leading financial institutions, high-tech, and consumer products companies.

Arjun Sethi is a partner with A.T. Kearney, where he leads the Strategic IT Practice for the Americas. He focuses on developing strategies that transform clients’ middle and back-office functions and enhance revenue growth. He leads engagements for C-Suite executives, guiding them to rethink existing operating models and implementing broad-based IT-enabled business transformation. Arjun’s clients include leading financial institutions, high-tech, and consumer products companies.