For many banks and credit unions the secret to competing with Google Plex accounts — the result of a partnership between the tech giant and about a dozen financial institutions — lies not in watching what Google is doing. Instead, their competitive future may depend on rethinking what they themselves are doing.

So says industry analyst Ron Shevlin. Much of what financial institutions fixate on as they eye inroads by fintechs and big tech firms is the quality of the customer experience. Shevlin, Research Director at Cornerstone Advisors, insists that that shouldn’t be their main focus.

“Banks and credit unions need to fight back with product innovation,” Shevlin says. He believes the checking account as financial institutions have known it is obsolete. Many think that the user experience with fintechs’ mobile apps and the upcoming Google Plex accounts is what excites consumers. But Shevlin says the best of the banking industry’s apps already meet or even exceed those of nonbanks, and even those of the rest of the industry are decent enough. And, he says, the fact that many nonbanks tap legacy financial institutions for banking as a service proves that basic account functionality is not what the competition is about.

“Fixing the user experience of an obsolete product is like bolting an escalator onto the side of a horse buggy. Does it add convenience? Absolutely. Is it innovative? You bet. Is it going to have any economic impact? No way!”

— Ron Shevlin, Cornerstone Advisors

Shevlin insists that traditional providers must rethink checking accounts. “It’s not about CX,” says Shevlin. “It’s about ‘featurization’.”

Read More: Introducing the World’s First Interactive Directory of Digital-Only Neobanks

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Google Plex: Who Is Really Holding the Cards?

The appeal of what’s been revealed thus far about Google Plex accounts comes down to this, according to Shevlin: “It’s about checking accounts that offer differences in terms of features, flexibility and convenience — but also some cool stuff.”

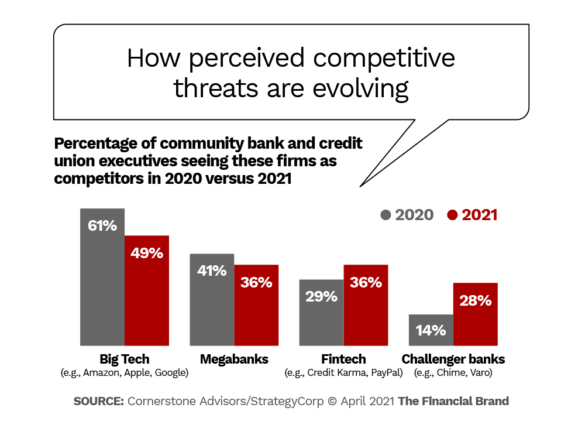

In fact, while executives view of competition has moved away from Google towards fintechs and challenger banks, Shevlin thinks many fail to get what’s really going on. Banking service is being treated as a throw-in or a means of facilitating other things. Take Walgreens’ intent to get into digital banking. “They’re saying, ‘We’ve got a set of services we’ve always provided and we now believe we can add a checking account to that.”

During the webinar and in a study, “Competing With Google Plex and Digital Banks: How Community-Based Financial Institutions Can Regain Their Mojo,” Shevlin predicts the competitive challenge posed by Google Plex will be significant, and then laid out how institutions can prepare now to battle back.

Bottom Line:

Banking institutions will have to enlarge what they consider “banking” to be, to encroach on other industries’ turf with competitive features as much as those businesses are moving into banking.

Read More:

- Big Techs in Finance Will Test Regulation and Policy Levers

- The Future of Banking: More Competition Means More Disruption

- An OCC Insider’s Perspective on Fintechs and Bank Charters

- Global Fintech Funding Explodes During First Quarter of 2021

Understanding What Google, Chime and Others Are Really Doing

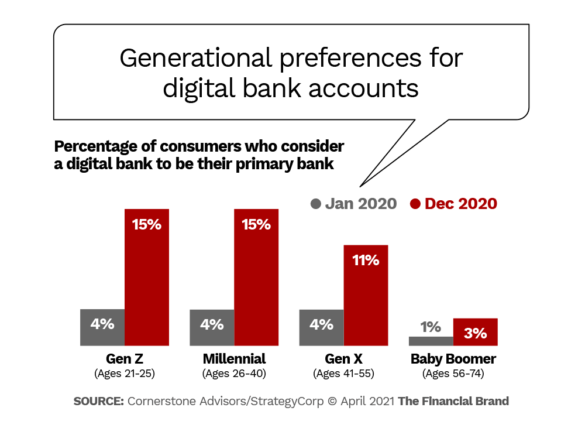

The founding of Varo Bank, the creation of Chime and the initial announcements concerning Google Plex predated the pandemic and its accelerating effect on use of digital channels. However, says Shevlin, “the pandemic helped create a challenger bank insurgency in 2020.”

In Cornerstone’s research, a massive shift before and after the arrival of Covid-19 occurred. This is in the percentage of consumers who see a digital bank as their primary bank.

This shift has happened as more Americans have started to open multiple checking accounts. At the same time, the importance of the checking relationship has changed. Once it was the fulcrum of cross-selling, but now consumers are much more likely to use an account only for specific purposes, according to Cornerstone’s research. So victories depend on smaller moves.

For instance, an important factor for 18% of consumer surveyed was the ability to gain early access to paychecks, a service Chime particularly pushes. This is an example of a key product feature, according to Shevlin, rather than anything to do with mobile experience.

Features like this play to a fundamental consumer need today: concerns over financial health. The research found that less than half the time does anyone’s primary bank get credit for helping to improve the performance and health of their financial life.

“The problem isn’t that consumers say their primary banks detract from their financial performance and health,” the report states. “It’s that they say their primary providers have no impact on their financial health and performance.”

On the other hand, often fintech and big tech entrants play up how they will help, through tools and other product features. Google has spoken of plans to bring personal financial planning and financial management to Google Plex using the company’s facility for data.

Read More:

- Rethinking Checking Account Strategy in a Digital Banking World

- Does Being a ‘Primary Financial Institution’ Mean What It Used To?

- The Secret Financial Lives of Consumers Banks Don’t Know About

- Financial Institutions Don’t Give People What They Need (But They Could)

Big Techs and Fintechs Play Fears about Financial Health

Google is creating multiple levels of convenience and help in the developing Plex accounts. “They are not just addressing ‘What should I do?’,” says Shevlin, “but also, ‘What’s out there,’ ‘What’s good for me?,’ and ‘What do you recommend?” This represents ease in accomplishing a prime objective.

“It’s going to be Google’s customer. It’s Google’s checking account, via banking as a service — you know, rent-a-charter.”

— Ron Shevlin, Cornerstone

Shevlin raises the concern that Google’s data capabilities will leave them with the better deal in their partnerships with traditional players.

“It’s going to be Google’s customer,” says Shevlin. “It’s Google’s checking account, via banking as a service — you know, rent-a-charter.”

Shevlin says many worry about what Google will do with so much consumer financial data, but he isn’t worried about individual data being sold. Google will use it for trendspotting.

Actually, “I’m less concerned about what Google does with the data than about what access banks and credit unions will have to the data,” says Shevlin. He wonders how much data, and perspective on it, institutions will have as Google partners.

Frame Your Future:

Institutions that can build robust new features on checking account chassis on their own will be winners. Partnership with Google isn’t the only way to advance.

Something that many bank and credit union executives fail to understand is that Gen Z and Millennials have been conditioned to seek solutions to financial challenges through apps. “They’ve grown up hearing, ‘There’s an app for that’,” says Dave DeFazio, Partner at StrategyCorps, moderator for the company-sponsored webinar. They seek tools, not people, for help.

Marketing is less likely to sway them when what institutions promote is a yawn, according to Shevlin. He points out that younger consumers understand that the difference between a 0.05% rate and a 0.1% rate on savings isn’t going to build savings. So “rate special” means nothing today. But an automated savings tool can help a consumer save $500 more a year.

Read More:

- 6 Keys to Designing a Best-in-Class Financial Wellness App

- How Financial Institutions Can Help People Gain Economic Peace of Mind

- How Financial Marketers May Be Unintentionally Disrespecting Mothers

- LendingClub (Now a Bank) Aims to Become a ‘Financial Health’ Brand

What Consumers Seem to Like About Google Plex

Google Plex accounts will be used through the Google Pay digital wallet. This already had a large base and in November 2020 Google began promoting a revamped version of the wallet. Shevlin says it is important to realize that many of the features that will make Google Plex stand out will reside in the wallet. The financial institutions are bringing account functionality and relationships to the table, potentially with special extras not available outside of the Plex universe.

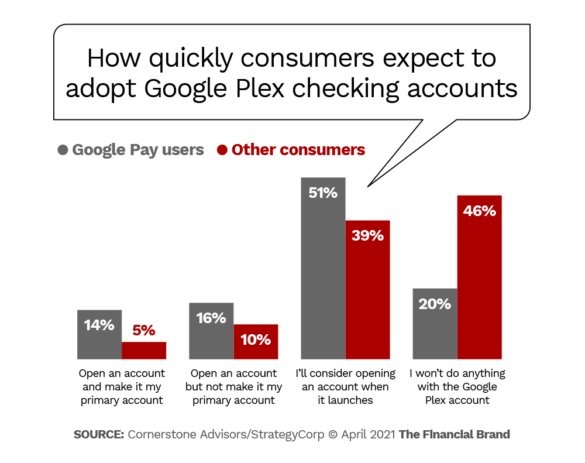

Shevlin’s research indicates that 30% of Google Pay users surveyed plan to open Plex accounts as soon as they become available. That is twice the rate at which consumers without a Google Pay relationship would sign up. Another 51% of the Google Pay consumers say they will consider opening Plex accounts.

The consultant has long been skeptical about consumer intent to do this or that — they often don’t follow through. However, he says that even if only a third of that 51% goes for the accounts, added to the 30% who definitely intend to sign up, that means nearly half of Google Pay users will be on board early.

Google began to flesh out the Plex offerings in late 2020. The study asked consumers how interested they were in specific features. The table below reflects those “very interested,” by generation. Clearly the accounts will have the greatest appeal to Millennials and Gen Z.

Consumer interest in expected Google Plex features

(% responding “very interested”)

| Gen Z Ages 21-25 |

Millennial Ages 26-40 |

Gen X Ages 41-55 |

Baby Boomer Ages 56-74 |

|

|---|---|---|---|---|

| A “Get gas” button that will find the nearest gas station and automatically pay for gas | 48% | 41% | 30% | 13% |

| Person-to-person (P2P) payments | 45% | 45% | 33% | 13% |

| A “Get food” button that will find a restaurant and automatically pay for the order | 43% | 42% | 28% | 11% |

| Insights into spending activity that automatically scans transactions rather than requiring manual entry | 42% | 41% | 27% | 9% |

| Group P2P payments | 40% | 38% | 24% | 7% |

| Personalized offers from merchants based on payments and search history (which can be opted out of) | 36% | 35% | 25% | 10% |

| The ability to access users’ Gmail and Google Photos accounts to automatically scan for receipts | 36% | 39% | 27% | 9% |

| Generic offers from merchants NOT based on payments and search history | 29% | 30% | 21% | 8% |

Source: Cornerstone Advisors/StrategyCorps

When the two generations were lumped together, and both “very interested” and “somewhat interested” answers were totaled, the top three features were P2P, automated spending insights and a tie between the “get gas” and “get food” buttons.

Read More:

- Google Claims It Has ‘No Interest In Ever Becoming a Bank’

- Jamie Dimon Says Competitive Threats Are Eroding Banking’s Future

- PayPal Wants To Become The Banking World’s Next ‘Super App’

- New Google Checking Accounts Threaten to Shake Up Banking Industry

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Digital Solution for Prepaid, Incentive and Reward Cards

Join experts from CPI for an informative webinar to learn where digital cards are today and what they will look like in the future.

Read More about The Digital Solution for Prepaid, Incentive and Reward Cards

Thinking Like a ‘Hub’ and Other Anti-Plex Strategies

“The Google Plex account is intended to become the hub for accountholders’ payments and financial management activities,” the Cornerstone/StrategyCorps report states. “Community-based financial institutions are in no position to replicate what Google is planning to do. But they can rethink and reinvent the current checking account to become more of a hub for a set of services that consumers want and need — and will pay for — and get from their bank or credit union.”

Shevlin and DeFazio had these recommendations:

Get your pricing right —already. Shevlin believes that banks and credit unions blew the opportunity to implement two-tier pricing decades ago. Today marketers tend to call this the “freemium” model — introductory-level service is free, more sophisticated levels cost something, typically via subscription. More and more “free” fintech apps have been introducing advanced levels that carry a price, or adding on fee-based services. Opportunity to improve pricing could still be there if bank and credit union premium levels offer real value.

Design packages with features consumers really value. The package account, with a fee, is nothing new to banking. But over the years much of what was in those early packages grew stale — think tiny safe-deposit boxes and travelers checks. People crave innovative features and savings on services they already obtain from other sources.

- Five of keen interest based on current usage, according to the research, are roadside assistance, cell phone damage protection, identity theft protection, discounts on prescriptions, vision and hearing, and purchase protection and warranty extension.

- Five more services that consumers increasingly think would add value include subscription-canceling, bill negotiation, data breach protection, storage of personal and family data and auto deductible reimbursement insurance.

Examine what seems to drive interest in big tech and fintech offerings and replicate what makes sense for smaller players. DeFazio says the “word on the street” is that one of the nation’s top ten banks is going to adopt the early access feature that helped put Chime on the map. He says once one big institution makes this move, the others will follow. Not all smaller banks and credit unions can accommodate that. However, other measures could address consumer needs. Some institutions have already introduced features that make overdrafts less likely, for example.

Delve into what services your consumers believe will assist their financial health. This is clearly a major concern for many Americans and the report suggests that so few institutions pay it any attention that the opportunity is ripe.