I was a victim of identity theft and £40,000 was stolen from my HSBC cash Isa. But, nearly a year on, I’m no nearer to getting a refund. The money had been transferred in seven £5,000 payments to a new HSBC current account which, unbeknown to me, had been set up in my name. I reported it to HSBC and a day later another £5,000 was transferred.

Whoever set up the new account closed it and the £40,000 disappeared with it. I was told that an investigation would take six weeks, but it’s been 10 months of continual chasing from me. Each time I’m told that since the money was transferred into an account in my name there’s no problem, and I have to explain from scratch. I am 70 and these savings are vital now I am retired.

YK, London

You have been dismally let down by HSBC. The bank should have secured your Isa and frozen the compromised current account as soon as you’d reported the fraud. It failed to keep in touch during its investigations – and, seemingly, to keep records of your case – and you say you had to endure waits of an hour or more to speak to the helpline.

It’s small comfort that things moved very quickly once you turned to the media. The bank immediately refunded the stolen money, along with £1,000 in goodwill and £250 interest that would have accrued. It blames “miscommunications” and “admin errors”. Staff failed to record the current account as compromised when you reported the thefts, although the bank insists correct security protocols were followed when it was opened.

This suggests that the fraudster has gained crucial information about you, possibly through phishing emails.

HSBC says: “We strive to deliver a high level of service and support to our customers, and, in this instance, we have fallen short of these standards. We have addressed the failings in this case to make sure it doesn’t happen again.”

Another HSBC customer says she spent a total of 25 hours on hold trying to speak to the bank.

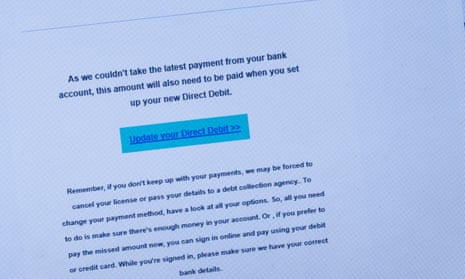

DS of Truro fell victim to a phishing scam after responding to a text supposedly from Netflix, requesting updated subscription details. She called the bank’s fraud hotline immediately, but gave up after waiting three hours on hold. Eventually, she managed to cancel the card, but says she was not warned about the potential of fraud.

Fraudsters used the harvested card details to masquerade as HSBC’s fraud department on a spoofed number, and mislead her into believing her account had been compromised. She was persuaded to transfer £9,500 to so-called “safe accounts”. This time, when she realised she had been scammed, she waited a fruitless six hours to get through to the helpline.

HSBC only agreed to refund £4,750, half the stolen sum. It told me it accepted 50% of the blame for failing to provide adequate warnings, insisting customers should educate themselves about scams.

I put it to HSBC that if DS had been able to get through to the fraud helpline after the phishing email, she might have been spared the ensuing theft. It says Covid restrictions and increased fraud are to blame. “We are conscious of extended call waiting times, and, while we have recently increased the size of the team, we are in the process of bringing on board additional colleagues to cut waiting times.”

DS’s next step is to complain to the Financial Ombudsman Service which can decide whether HSBC gave her adequate warning and protection.

Email your.problems@observer.co.uk. Include an address and phone number. Submission and publication are subject to our terms and conditions.

Comments (…)

Sign in or create your Guardian account to join the discussion