The revelations that Credit Suisse has been used by crooks, money launderers and corrupt politicians are a public relations crisis for the banking giant.

But the Suisse secrets investigation by the Guardian and its reporting partners is only the latest in a string of controversies to beset Switzerland’s second-largest lender.

We take a look at some of the bank’s biggest scandals over the past few decades.

1986: Fake names for Ferdinand and Imelda Marcos

Credit Suisse is implicated in helping to store some of the estimated $5bn-$10bn that the Philippine dictator Ferdinand Marcos and his wife, Imelda, stole from the country during his three terms as president.

It later emerged that Credit Suisse opened accounts for the couple under the fake names “William Saunders” and “Jane Ryan”, helping to shield their funds from scrutiny.

In 1995, a Zurich court ordered banks, including Credit Suisse, to return $500m of stolen funds to the Philippines.

1999: Japanese ‘shredding party’

Japanese authorities fined Credit Suisse and revoked its licence over a “shredding party”, at which bankers destroyed evidence related to an investigation into whether it was helping companies conceal their losses.

A bank spokesperson said: “Serious lessons have been learned, corrective actions initiated and disciplinary steps completed.”

2000: Banking funds linked to a Nigerian dictator

Switzerland’s Federal Banking Commission reprimanded Credit Suisse for accepting about $214m-worth of funds linked to corruption by the Nigerian military dictator Sani Abacha in the 1990s.

The lender was criticised for failing to recognise that his two sons were politically exposed. Credit Suisse said it had improved its monitoring procedures and staff who dealt with Abacha’s regime had left the bank.

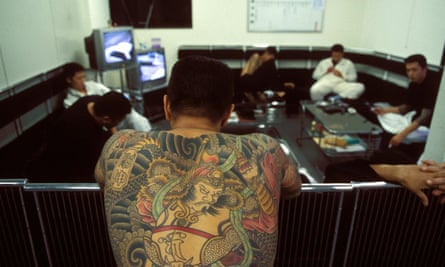

2004: Money laundering for the Japanese yakuza

A Credit Suisse banker was arrested for allegedly helping launder at least 5bn yen linked to Japan’s largest yakuza gang. The banker was acquitted on the basis that he was unaware of the source of the funds.

2009: US sanctions breaches

Credit Suisse was fined $536m for deliberately circumventing US sanctions against countries including Iran and Sudan between 1995 and 2007.

The bank said it had “enhanced” its procedures and was “taking action internally”.

2011: German tax evasion

Credit Suisse agreed to pay €150m to settle an investigation into tax evasion by about 1,100 of its German clients.

“A complex and prolonged legal dispute has been avoided, with an agreed solution that provides legal certainty,” the bank said.

2012: US sub-prime bond fraud

US authorities charged four former Credit Suisse bankers with fraudulently overstating the price of $3bn of sub-prime bonds during the 2007 credit crisis.

One former managing director, Kareem Serageldin, was the only individual jailed in relation to the US financial crisis.

2014: US tax evasion

Credit Suisse was fined $2.6bn and pleaded guilty to helping Americans evade taxes for decades in one of the bank’s most explosive scandals to date.

The investigation was launched when the former UBS banker Bradley Birkenfeld passed information to US authorities in 2007.

A Senate investigation uncovered aggressive tactics used by Swiss banks, with Credit Suisse having recruited clients at high-end events, courted a potential customer with free gold, and even delivered sensitive bank statements hidden in the pages of a Sports Illustrated magazine.

Authorities eventually pressured Switzerland into unilaterally disclosing account information about US taxpayers from 2014.

Credit Suisse said: “We deeply regret the past misconduct that led to this settlement.”

2016: Italian tax evasion

Credit Suisse reached a €109.5m settlement with Italian authorities over allegations it helped clients hide funds and dodge taxes through complex insurance policies, which were reportedly routed through its Liechtenstein and Bermuda subsidiaries.

Credit Suisse said it welcomed the deal.

2016: US anti-money-laundering fine

A US regulator fined Credit Suisse $16.5m after identifying “significant deficiencies” in the bank’s anti-money-laundering programme. The lender said it was “taking appropriate internal remedial efforts”.

2017: Anti-money-laundering fine related to 1MDB

Singapore’s financial regulator fined Credit Suisse $700,000 for breaching money-laundering rules in transactions linked to 1MDB, the Malaysian investment fund at the centre of a $4.5bn corruption scandal.

Credit Suisse said it took its money-laundering obligations seriously and was “firmly committed to upholding the high standards of the Singapore financial centre”.

2017: European tax evasion

Authorities raided homes and offices in the Netherlands and France, and launched investigations into Credit Suisse employees in the UK, Germany and Australia, in connection with suspected tax evasion involving 55,000 accounts.

Credit Suisse said it was cooperating with authorities and later took out a series of adverts in British newspapers declaring that it “applies a strict zero-tolerance policy” on tax evasion.

2018: Weak controls linked to dealings with Petrobras, PDVSA and Fifa

The Swiss regulator ordered Credit Suisse to improve its anti-money-laundering controls after identifying shortfalls in its dealings with Fifa, the Brazilian oil corporation Petrobras and Venezuelan state oil company, PDVSA.

The bank said it took its compliance responsibilities seriously.

2018: Lescaudron fraud conviction

A former Credit Suisse banker, Patrice Lescaudron, was sentenced to five years in prison after admitting to forging client signatures to divert money and make stock bets without their knowledge, causing more than $150m in losses. His clients included the former Georgian prime minister Bidzina Ivanishvili, who is still trying to recover his funds.

Credit Suisse said the relationship manager “was not supported by any other employee of the Credit Suisse in his criminal activities”.

Lescaudron killed himself in 2020.

2018: Hong Kong jobs-for-business scandal

Credit Suisse agreed to pay $47m to US authorities over a “corruption scheme” in which it tried to win business by offering jobs to family and friends of Chinese officials between 2007 and 2013.

A spokesperson for the bank said it had improved its compliance processes.

2019: Corporate espionage

The bank was caught in a corporate espionage scandal, and eventually admitted to hiring private detectives to track two outgoing executives. It triggered a regulatory investigation and culminated in the departure of its chief executive, Tidjane Thiam, in 2020.

A group of executives were later found to have ordered surveillance in a further five cases between 2016 and 2019.

Credit Suisse said it had banned surveillance “unless required for compelling reasons, such as threats to the physical safety of employees”.

2020: Bulgarian drug trafficking

Swiss prosecutors issued an indictment against Credit Suisse for allegedly failing to run proper checks on clients and investigate the source of funds linked to a Bulgarian drug ring that allegedly laundered at least $146m through accounts between 2004 and 2008.

The criminal trial, which began in February 2022, is the first against a Swiss bank in the country’s history.

Credit Suisse said it would “defend itself vigorously” and “unreservedly rejects as meritless all allegations in this legacy matter raised against it”.

2021: Archegos collapse

Credit Suisse recorded a $5.5bn loss due to its risky exposure to the US hedge fund Archegos Capital Management, which collapsed in early 2021.

Credit Suisse said it took action against 23 staff and fired nine, and subsequently promised to put risk management “at the heart” of its decision-making.

2021: Greensill scandal

Credit Suisse was forced to suspend $10bn of investor funds after the collapse of the supply-chain lender Greensill Capital, whose loans were packaged and sold to Credit Suisse clients.

The Greensill scandal, which stemmed from risky loans it extended to companies owned by the metals magnate Sanjeev Gupta, spiralled after it emerged the former UK prime minister David Cameron lobbied ministers and government officials on its behalf.

The bank is still trying to claw back money for clients and said “actions have been taken against a number of individuals” in relation to the case.

2021: Mozambique tuna bonds

Regulators fined Credit Suisse £350m to settle the bank’s role in the long-running Mozambique “tuna bonds” loan bribery scandal that pushed the country into financial crisis from 2016.

Credit Suisse was implicated in $50m-worth of kickbacks that a government contractor handed to its bankers in exchange for better terms on nearly $1.3bn-worth of loans arranged for the People’s Republic of Mozambique between 2012 and 2016.

The bank said it “condemns any unjustified observations and has already taken decisive steps to strengthen its relevant governance and processes”.

The Democratic senator Elizabeth Warren is urging the US labour department to deny Credit Suisse the ability to manage workers’ retirement funds as a result of the bribery settlement.

2022: Chairman resigns

António Horta-Osório resigned as Credit Suisse chairman on 17 January after twice breaking Covid quarantine rules in Switzerland and the UK, including to attend football and tennis matches in London.

“I regret that a number of my personal actions have led to difficulties for the bank and compromised my ability to represent the bank internally and externally,” he said.

Credit Suisse immediately appointed the board member Axel Lehmann as its chairman. Lehmann was at the helm for only five weeks before the publication of the Suisse secrets leak.

Credit Suisse response to Suisse secrets disclosures available here.