The embattled Chinese property developer Evergrande is inching closer to the potential default that investors fear, after missing an interest payment deadline.

The company, which has total debts of about $305bn (£222bn), has run short of cash, and investors are worried that a collapse could pose systemic risks to China’s financial system and reverberate around the world.

A Thursday deadline for paying $83.5m in bond interest passed without remark from Evergrande, and bondholders had not been paid nor heard from the company, two people familiar with the situation told Reuters.

The firm is now in uncharted waters and enters a 30-day grace period. It will default if that passes without payment.

“These are periods of eerie silence as no one wants to take massive risks at this stage,” said Howe Chung Wan, head of Asia fixed income at Principal Global Investors in Singapore. “There’s no precedent to this at the size of Evergrande … We have to see in the next 10 days or so, before China goes into holiday, how this is going to play out.”

China’s central bank again injected cash into the banking system on Friday, seen as a signal of support for markets. But authorities have been silent on Evergrande’s predicament and China’s state media have offered no clues about a rescue package. Shares in Evergrande fell by 11.6% in Hong Kong on Friday.

The saga of Evergrande has been closely watched by local as well as international media outlets, with some going as far as calling it “China’s Lehman Brothers moment”.

Some Chinese banks disclosed the sums they were owed by the developer, insisting they could cope with a potential default. One of Evergrande’s biggest lenders, Zheshang Bank, said it was owed 3.8bn yuan (£430m), adding that it has “sufficient collateral” and that “the overall risk is controllable”.

Others, including Shanghai Pudong Development Bank, said their lending was small, tied to individual projects and secured by claims to land. Changshu Rural Commercial Bank in the eastern province of Jiangsu said it was owed 3.9m yuan.

Evergrande promised to hold a phone meeting with some individual investors. Other creditors are waiting to see whether the government will step in to oversee a restructuring.

Economists said that if Beijing were to become involved, it would most likely focus on making sure families get apartments they have already paid for, rather than trying to bail out banks or other creditors.

China’s housing regulator is stepping in to protect funds earmarked for housing projects from being diverted to creditors, Bloomberg reported. The Evergrande funds must first be used for construction to ensure project delivery, it said, citing people familiar with the plan.

Evergrande is one of China’s biggest private-sector conglomerates, with more than 200,000 employees, 1,300 projects in 280 cities and assets of 2.3tn yuan. Other major developers such as Vanke, state-owned Poly Group and Wanda Group have not reported similar problems. However, hundreds of smaller developers have shut down since regulators started tightening controls on financing in 2017.

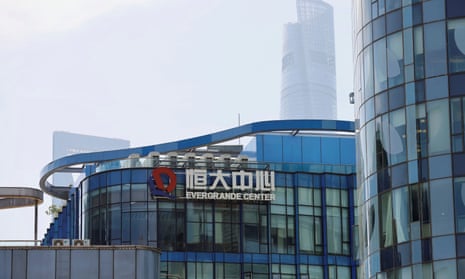

In the past few weeks, protesters have gathered outside Evergrande’s headquarters in Shenzhen, southern China, to demand payment.

On Thursday, the rating agency Fitch downgraded its forecast for China’s economic growth because of concerns about a slowdown in the country’s colossal housing market and fears about the unfolding Evergrande saga.

At the heart of the concerns is the risk of a possible spillover effect to the broader Chinese economy and its consequences for social stability. In the past few days, local governments have been asked to contain the ripple effect of Evergrande’s demise. According to reports, officials were tasked with preventing unrest and mitigating the impact on homebuyers and potential job losses.

However, it is unclear whether officials think Evergrande should eventually impose losses on offshore creditors. If it does, it will dampen foreign investors’ mood when making investment decisions in China in the future, analysts say.

“A lot of Chinese people have a lot to lose if their property prices plummet as a result of a disorderly collapse of Evergrande. It will hurt people’s confidence,” said Dexter Roberts of the Washington DC-based Atlantic Council’s Asia Security Initiative. “But on the opposite side, if the government is seen to have helped Evergrande too much, it will cause moral hazard.”

The trouble engulfing Evergrande is only the tip of the iceberg in China’s once unrestrained property market. UBS estimates there are 10 developers with potentially risky positions with combined contract sales of 1.86tn yuan – or 2.7 times Evergrande’s size.