The City watchdog is to write to politicians and civil servants asking whether they have been denied banking or other financial services, following the scandal that erupted after Nigel Farage’s accounts were threatened with closure.

The Financial Conduct Authority plans to send letters on Tuesday to politically exposed persons (PEPs) – who include MPs, peers, leaders of UK political parties and senior ranking military officers – to ascertain whether individuals are struggling to secure services and how widespread the problem may be.

It is part of a planned review of the rules surrounding PEPs, which require banks to scrutinise closely the accounts and transactions of individuals considered to be at a higher risk of bribery or corruption.

In some cases, banks may decide that the additional scrutiny requires too many resources, or that the risk is too high, resulting in accounts behind denied or closed.

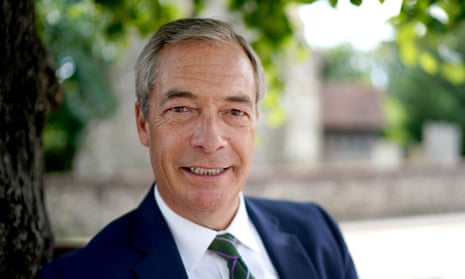

MPs have argued that domestic PEPs should face less scrutiny than their foreign counterparts, leading to the current review. However, the issue has gained more traction in the wake of the scandal surrounding the private bank Coutts’ threats to close the accounts Farage held with it.

The former Ukip leader originally claimed the decision to shut his accounts had been linked to his status as a PEP. And while it was later revealed to have been linked to commercial considerations as well as alleged reputational risks related to his political views, the entire saga poured fuel on the debate about the use of discretion relating to PEPs.

Last month’s row led to the resignations of Alison Rose, the boss of the private bank’s parent company, Natwest, and the chief executive of Coutts, Peter Flavel.

In the wake of Rose’s departure, the policing minister, Chris Philp, said that many MPs or their families had been turned down by banks because of the PEP rules.

The matter gained further traction after it emerged that digital bank Monzo had closed the account for the political party run by anti-Brexit campaigner Gina Miller. Monzo said it was a matter of policy, since it does not accept any political parties as customers.

The chancellor, Jeremy Hunt, then asked the FCA to urgently investigate whether the practice of “debanking of people for their political views” was common and asking for it to be ended.

Last Wednesday the regulator wrote to more than 20 of the UK’s largest lenders asking them to confirm how many of their customer accounts had recently been closed, suspended or denied, and explain the reasons why those services have been blocked.

after newsletter promotion

The FCA said on Monday: “We are reviewing how financial services firms have applied the politically exposed persons regime and whether any changes are needed for UK PEPs.

“We are keen to hear directly from UK PEPs on their experiences, including any problems they have encountered – so we’re proactively reaching out to parliamentarians and other UK PEPs at an early stage.

“We will publish the full terms of reference for the review in September and report back by June next year.”