It’s a sign of how bad things have got for Sir Keir Starmer that the Labour leader felt the need to float his idea for British recovery bonds in his speech on the economy. Opposition leaders tend to keep specific policy proposals under wraps in the early stages of a parliament because they know there is a risk they will be filched by the government if they are any good.

Instead, they prefer to focus on the big picture: the current lot are making a total hash of things, there must be no return to the failed policies of the past, we must invest in the future. And most of Starmer’s speech was indeed made up of that sort of stuff, coupled with the usual harking back to the postwar Attlee government.

It would be naive in the extreme to imagine that recovery bonds will change voter perceptions of Labour overnight but, if more than a gimmick to liven up a so-so speech, the idea is an interesting one. The thinking behind them is that only a fraction of the excess savings built up during the pandemic will be spent so the rest could be doing something more useful than sitting in bank accounts

Labour says the recovery bonds would have the same attractions as traditional national saving bonds – interest-bearing, safe and long term – with the difference that the proceeds would be earmarked to pay for the post-Covid recovery. George Soros recently came up with a similar proposal for the EU, with the difference that governments would issue perpetual bonds on which the capital would never be repaid.

At present, savings rates on money lent to the government through National Savings and Investment (NS&I) are at nugatory levels, so if Starmer’s idea is to have any hope of working, the interest rate on the bonds would need to be much more attractive. But if they proved popular they could act as a test run for a much bigger project – financing the greening of the economy.

Barclays dividend payouts signal fewer long-term Covid scars

It goes without saying that Barclays has had better years. Provisions against loan defaults have rocketed and as a result profits have taken a hit. But – and it’s an important but – the bank has weathered the Covid-19 storm reasonably well. A sign of its confidence is that it has resumed dividend payouts to shareholders, albeit only at a modest level.

The performance of Barclays – the first of the big UK lenders to report its results – highlights the difference between the current recession and the last one, back in the late 2000s. Then, the financial system was central to the problem: banks had too little capital to cover losses made on risky investments and when the crash came the flow of credit stopped abruptly. A financial crisis morphed into an economic crisis.

This time, the banks are peripheral. Naturally enough, they can expect to suffer losses because many of the businesses that have been closed as a result of government restrictions will not reopen. Consumers have been paying off their credit card debts, which is good for the financial health of the individuals concerned but bad for bank profits. But unless there is another, far more serious, leg of the pandemic to come, the banks have enough capital to cope.

That means there is unlikely to be a dangerous feedback loop whereby recession leads to a financial crisis which in turn deepens the recession. Although 2020 saw the biggest one-year contraction in the economy in more than 300 years, it may leave fewer long-term scars than the ostensibly less severe downturn of a decade earlier.

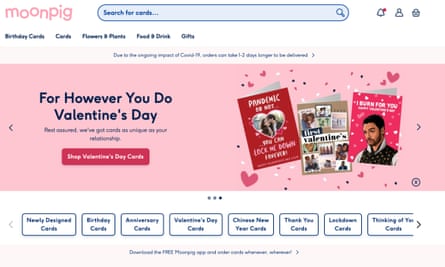

Hip and knee profits down, online greetings cards up

Annual operating profits at the artificial hips and knees maker Smith & Nephew fell by almost two-thirds as a result of a collapse in elective surgery. The online card and gift company Moonpig expects revenues to double this year. Hard to find a more succinct summing up of Britain in lockdown.