“Many community bankers would probably look at me like I’m crazy,” admits community bank CEO Brad Scrivner. Even the founder of the institution he heads warned him bluntly: “Brad, don’t blow up the bank.”

Scrivner is leading Vast Bank through an ambitious four-year plan to change from a traditional commercial bank into a digital leader. The family-owned bank, based in Tulsa, Okla., has about $670 million in assets.,

It’s a massive challenge. Simultaneously, the bank is swapping out the bank’s core system for an open, agile system untried in the U.S. before now and partnering with a little-known fintech to provide a subscription-based banking “club” service nationally. And, not least, the bank is changing the cultural mindset of owners, managers and employees along the way.

Why would a small midwestern bank take such wrenching steps voluntarily?

Survival.

As Scrivner tells The Financial Brand he believes only three viable paths exist for a financial institution to survive and thrive in the near term:

- Build scale

- Find a niche specialty

- Become a digital leader

Most community banking institutions don’t fall into any of those categories. A few have evolved into niche specialists (medical practice lenders, for example), and some still have a what could be called a geographic niche. But only a handful so far have sought to become digital leaders.

Vast Bank chose option three. “We’re putting our money where we think the future of banking is,” says Scrivner.

An avid follower of banking industry trends, the CEO believes that Gartner, the respected technology research firm, wasn’t that far off when it predicted in 2018 that 80% of “heritage” banking institutions would be gone by 2030. Scrivner’s view, formed five years earlier, is that somewhere between 60%-70% of traditional institutions will be gone within a similar timeframe. Given that conviction, pursuing the status quo, or simply making small changes around the margin, did not seem like a way to ensure Vast Bank would survive for the long-term, much less thrive.

Scrivner — who was a regional president with UMB Bank, a financial advisor at Merrill Lynch, and a Xerox sales executive previously — joined Vast in 2012. At the time the bank was operating under a regulatory consent order. It wasn’t until 2017 that he and the owners, the Biolchini family, could really begin to look more toward the future.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Two Big Steps to Digital Leadership

Once out from under its troubles, Scrivner, with board support, committed to a four-year transformation of the bank into a modern digital organization. The two primary components to this were a technology overhaul and a change in organizational mindset.

Vast is the first U.S. bank to install the open-source core banking platform from German technology company SAP. This transformation was still in process as of late 2019. As Scrivner says, the SAP system is not the “bank in-a-box” solution used by many smaller financial institutions. The system, similar to what powers the Apple App Store, has great power and flexibility to stand up new digital functions, he notes, but as a result, the migration has been complex.

But a key point of the effort to change is that the new platform will allow Vast Bank to implement continuous improvements. “Customer preferences don’t stay the same for long,” Scrivner states.

Equally important was the human change. As the CEO observes: “New technology can damage more than it helps without organizational change.”

This is not a quick fix either. In fact the organizational change actually began before the decision to switch tech platforms. Part of it was cultural, weeding out the all-too-common attitude: “This is the way we’ve always done it.”

“We do everything we can to say, ‘It’s about everyone working towards our vision of making banking surprisingly easy’,” Scrivner states. “It’s about rolling up our sleeves, checking our egos at the door and working together to solve problems for the benefit of the customer.'”

All this was difficult enough. But then came an opportunity the bank couldn’t pass up: Meed Banking Club.

Read More:

- Why Community Financial Institutions Make Perfect Fintech Partners

- Citibank CEO Warns Traditional Banks Risk Becoming ‘Dumb Utilities’

- The Case For Transforming Banking (Even When Profits Are Strong)

Taking a Chance with Subscription Banking

It’s quite likely that many financial institution executives may not be aware of who or what Meed Banking Club is. That the Vast Bank team would commit significant resources to partnering with the little-known fintech says a lot about what they think of the Meed business model’s potential.

Meed is not a bank, says Scrivner. Rather it is, as its name states, a club. Vast Bank provides the banking service for the club — or as it says on the app, which is available in the App Store or from Google Play — “Powered by Vast Bank.” Any consumer signing up for Meed Banking Club becomes a Vast Bank customer.

A handful of other financial institutions — Bancorp Bank and Lincoln Savings Bank are two — provide the banking connection, including deposit insurance, for fintech “banking apps” such as Varo and Chime. But Meed Banking Club is a different animal and this appealed to Vast Bank’s management.

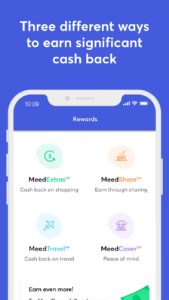

Meed offers a package of services including a debit card connected to a checking account, savings, insurance, a line of credit (based on your savings balance), merchant discounts and travel rewards. Rather than transaction fees or individual account fees Meed charges a flat membership fee of $9.95 per month for the complete bundle of services.

Meed also pays customers a referral fee, which grows and accumulates in time if the person referred stays as a club member. “The more you talk about it and help grow the Meed community, the more the community shares with you,” Les Riedl, Meed CEO, told Bankrate.com. The fintech estimates that a consumer could cover the annual cost of membership and then some with this arrangement. The club also pays cash back on purchases with participating travel partners and merchants.

- Innovation Platform Widens Access to Fintech Banking Solutions

- 4 Myths Preventing More Fintech+Banking Partnerships

What’s in it for Vast Bank?

The Tulsa community bank is not diminishing its commitment to customers in its traditional footprint. Quite the contrary. The platform and organizational modernization are intended to help it provide better, more intuitive, fintech-like service to all customers. Rebranding from Valley National Bank to “Vast Bank” in 2018 was a reflection of this strategy.

“Customers can expect everything from better apps and innovative products to streamlined underwriting and faster loan processing,” Scrivner states.

However, the Meed partnership gives the local institution a national footprint. It also gives existing Vast Bank customers a choice. And Scrivner is fine with the idea that in some cases the bank and its partner may compete. Meed also controls the messaging, although Scrivner tells The Financial Brand that the bank has input to ensure it is comfortable with the consumer communications.

The CEO declined to give specifics about the revenue arrangement the bank has with Meed other than to say that, “there is the subscription fee, which is more Meed-based. We would be more traditional-based in terms of the type of things that we are doing.” He also indicates there are cost- and revenue-sharing arrangements as is typical in many business partnerships.

Scrivner notes that for many fintechs and neobanks the model is, “Let’s figure out how to get users. We won’t charge them anything, but once we get to scale we will try to sell them something.” The banker doesn’t agree with that approach. There has to be some way to monetize a banking service, he maintains. “I wonder how much money some of those scale players are making and how they’re going to pay for what they’ve booked.”

“We’re being completely transparent up front saying, ‘This is what you’re going to pay and this is what you’re going to get.'” Scrivner believes that’s a better business model and will lead to customers who stick around longer.