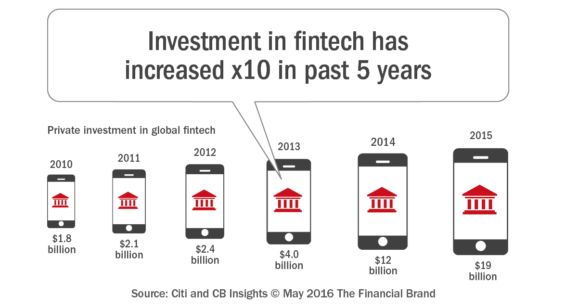

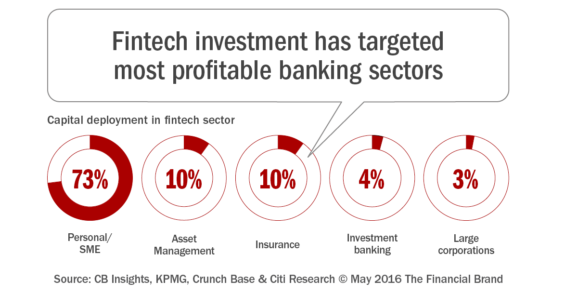

As noted in the recent Citibank white paper, “Digital Disruption: How FinTech is Forcing Banking to a Tipping Point”, investments in financial technology have grown exponentially in the past decade – rising from $1.8 billion in 2010 to $19 billion in 2015 – with 73% of this investment focusing on the personal and small business segments.

The focus on consumer and SME is primarily because of the impact of the smartphone being able to deliver an improved consumer experience on a personalized level compared to the more complex delivery of wealth, insurance and commercial solutions.

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

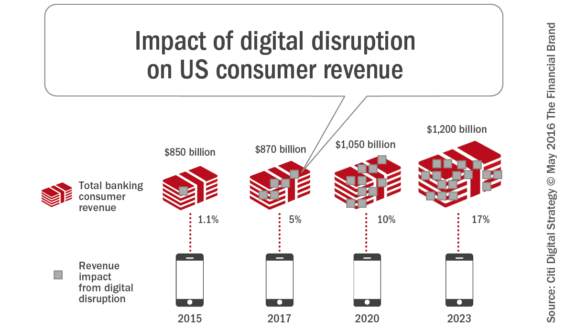

Despite all of the investment and continuous speculation about banks facing extinction, however, only about 1% of North American consumer banking revenue has been disrupted by fintech players according to the report. And, while the impact of fintech is expected to rise significantly over the next several years due to the fintech advantages of a stronger digital focus and being more agile, incumbent organizations of all sizes still have the benefits of an established customer base, trust, capital and knowledge of compliance and regulatory requirements.

The question remains as to whether legacy banks can reposition their service offerings and delivery to reflect the digital market realities. As noted in the Digital Banking Report, one of the keys will be to build partnerships with the same fintech firms seen as competitors as recently as 12 months ago.

Partnerships are beginning to occur with larger banks, but what about smaller banks and credit unions? While many small bankers appear eager to embrace digital capabilities, 55% of small, community and regional banks have not set up any meetings or presentations with potential partners, according to Al Dominick, president and CEO of Bank Director.

From Competition to Cooperation

Much of the distrust and anxiety over fintech competition has transformed into a reappraisal of how partnerships between legacy organizations and start-ups can be a better road to success in the future. “It’s not the institution versus the startup anymore; it’s how to partner,” said JP Rangaswami, chief data officer at Deutsche Bank. “There will always be people smarter than you. You have to learn how to engage: None of us can scale without partnering.”

“There’s been a tremendous acceleration of activity between banks and the alternative finance industry over the last 18 months, whereas before there was incredible skepticism,” said Rob Frohwein, co-founder and CEO of Kabbage, headquartered in Atlanta. Kabbage makes loans to small businesses, with near immediate loan decisions using machine learning to predict repayment likelihoods. This improved customer experience is the hallmark of most fintech start-ups.

Santander, Scotiabank, and ING have invested in Kabbage, with Kabbage offering loans in partnership with banking organizations. Kabbage’s partnership with banks gives them the freedom to offer lower rates and to reassess the accounts daily.

A big benefit of the relationship from Kabbage’s perspective is the regulatory experience and lending platform that a bank brings to Kabbage. From the bank’s perspective, back office costs can be cut and loan processing is improved. Being able to outsource small business customer acquisition to a start-up like Kabbage also provides smaller banks a broader base of potential clients to pursue.

Working with Accelerators

While many big banks are investing in fintech startups directly, some are taking the route of participating in fintech accelerators that can allow for a preview of many different solutions at the same time, spreading the risk. The concept of building a partnership with a fintech accelerator is not limited to big banks, however. Smaller banks can also participate.

For instance, Startupbootcamp FinTech NY provides funding, mentorship and office space to 10 selected fintech startups that were selected from 400 that applied to its first program in New York. With the goal of developing financial solutions that will become successful global companies, participating banks get early access to new technology and ideas they may not otherwise discover on their own.

Beyond Startupbootcamp FinTech NY, there are literally hundreds of other accelerators including ones financed by FIS and Fiserv. Fiserv has stepped is providing a new fintech accelerator INV in partnership with Bank Innovation and with support from U.S. Bank, Cross River Bank and other partners. Even with the initiation of accelerator programs, it still may be difficult for the four major core vendors to keep up with the changes in the industry.

The challenge with accelerators is that business incubation is notoriously difficult and accelerators are not cheap to run. According to Forrester, good accelerators require a lot of work upfront to sift through applications and select the most promising startups to promote. Some accelerators may accept only 1% to 2% of all applicants. This takes both time and money. And, being this selective doesn’t guarantee success.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Working Directly with Fintech Firms

If an organization doesn’t want to invest as much time (or money) to fund an accelerator, there is the option of hosting a hackathon or rewards-based competition that could be focused on a single solution (e.g. mobile payments, small business lending, etc.) or be an open competition. This option is both simple to implement and a cost-effective way to engage with innovative people and firms interested in the financial services industry. This option can also be conducted using internally generated ideas and resources as opposed to engaging outside organizations.

While not always resulting in a successful idea, the upside in changing internal culture and fostering an environment of innovation is a valuable starting point. If the pilot is successful, the partnership can grow within the bank, in the communicate and could lead to a valuable new relationship.

Searching for more mature fintech partners, using young fintech technology and/or cultivating an innovation culture within an organizations could be a more desirable long-term approach for digital banking growth. Banks that go down this path will still work with startups, but in a more focused and potentially more successful way.

Working with Trade Associations

Small banks may also combine resources through industry associations to build relationships with startups. For instance, more than 200 community banks have signed on to a deal with Lending Club on pitching consumer loans. The partnership was put together and overseen by BancAlliance, an industry cooperative group based in Maryland that develops products for small banks by banding together and giving them a scale they wouldn’t have alone.

While some industry observers believe there are risks in partnering with non-traditional organizations (like sharing of databases), others believe community banks have little choice as they try to compete with digital alternatives in expanding their customer bases. Community banks with less than $10 billion in assets made slightly more than 75% of all consumer loans in 1990, according to SNL Financial, but that amount has plummeted to less than 9% of the market in 2015, with larger banks seizing much of that business.

Under the partnership agreement, customers get loans in a co-branded manner using Lending Club’s highly efficient online process. The bank receives a small portion of the upfront fee, but expands the customer relationship. For most organizations, not losing the customer’s business is worth the nominal financial payback. In addition, banks have the option of funding the loans made, or buying into pools of loans made through Lending Club.

Fintech Partnership Risks

Working with outside fintech providers is not without risks. The Federal Reserve’s SR Letter 13-19, “Guidance on Managing Outsourcing Risk,” references risks associated with using vendors, including fintech companies. Risks include operations, compliance, and reputation. With the increasing potential for data breaches and website attacks, banks need to safeguard systems containing customer data that fintech partners may have access to.

Banks will need to determine if additional disclosures are needed and properly include these disclosures as part of any partnership. To reduce the overall level of risk exposure, banks will need to develop a comprehensive risk management program that incorporates appropriate risk assessments when using fintech solutions that are not created internally.

Finally, banks will need to have both adequate due-diligence processes and vendor-monitoring procedures to ensure that fintech partners have effective controls in place to protect the bank. Key risk management functions should be appropriately scaled to the amount of risk associated with the activity, according to the Federal Reserve. For example, riskier activities should receive a higher level of review and monitoring.

Playing ‘Fintech Roulette’

Time will tell whether fintech companies are better partners or competitors to the banking industry. Most likely, they will be both for the foreseeable future. However, smaller banks and credit unions can not afford to stay on the sideline while larger banks and non-bank fintech competitors better serve the digital consumer.

The vast majority of fintech companies will benefit from building alliances with traditional banking organizations as they seek greater scale and profitability. Legacy banks of all sizes provide the benefit of an established customer base, an understanding of the regulatory and compliance landscape and access to needed capital. Placing a variety of ‘fintech bets’ helps smaller banks stay current with the marketplace and could provide an additional source of new customers, revenue and even cost savings unavailable through current business practices.

For most, the risk is worth taking.