Banks and credit unions that hoped for a bit of a breather after the initial surge of digital banking use in the early part of the pandemic didn’t get their wish. In fact, quite the opposite. Consumers embraced digital banking in 2021 even faster than expected.

The ongoing pressure to change has many bankers losing confidence in the efficacy of their digital transformation efforts. That was one of the key findings of a new survey of community banking leaders in late 2021 by Computer Services, Inc. (CSI).

The company’s annual Banking Priorities Report underscores the opportunities and risks inherent to today’s banking environment and paints a picture of how the digital banking era is affecting financial institutions on a range of issues. CSI’s 2022 survey found digital growth is exposing many operational weaknesses and that bankers often lack confidence in their digital transformation.

Strategies for the New Digital Landscape

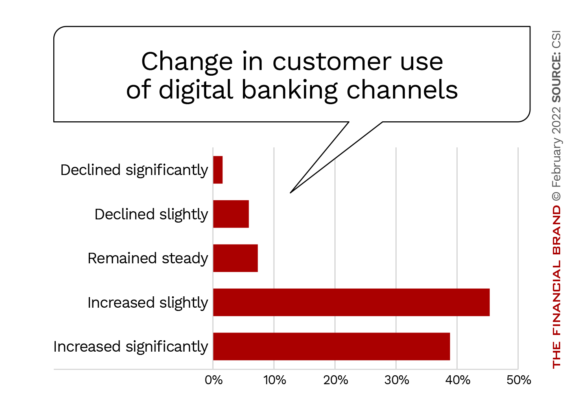

Digital has now superseded in-person banking for many consumers because it is easy, convenient and more aligned with the modern world. 85% of surveyed bankers noted an increase in digital channel usage, while 82% expect digital channel usage to increase further looking forward.

“Heightened digital use has forced bankers to prioritize effective onboarding and customer self-service tools that require no face-to-face interaction,” David Culbertson, President and CEO of CSI, tells The Financial Brand.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

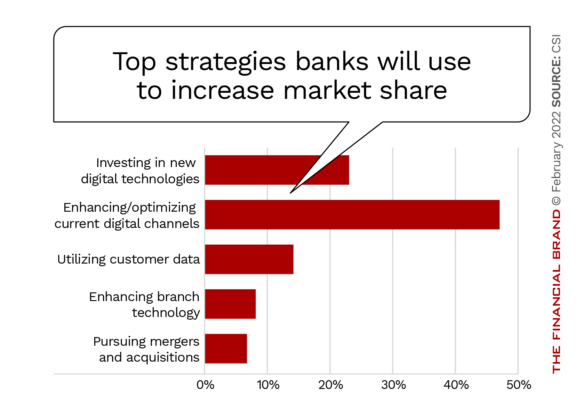

As consumers embrace digital channels, it’s essential financial institutions prioritize meeting the customer experience in that environment. Many of their top strategies to increase market share revolve around digital transformation and the automation of backend processes to attract new customers, far outstripping merger and acquisition plans among this sample.

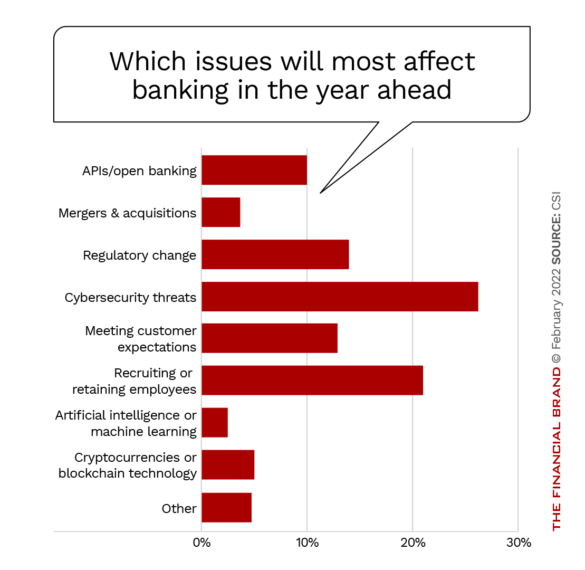

While financial institutions are planning to center their customer experience strategy around digital channels, the survey results revealed a variety of issues that bankers believe will impact the industry in 2022. The greatest concerns include cybersecurity, recruitment/retention, and regulatory changes.

The continuance of the pandemic and growth in digital is also exposing operational weaknesses at many banks and credit unions. This suggests customer expectations are growing at a faster rate than many financial institutions can handle.

“Digital transformation often covers many complex initiatives. That can lead banks to feel like they’re not doing enough due to a belief that they need to tackle it all.”

— David Culbertson, CSI

Some banks still struggle to collect and utilize customer data, and many lack confidence in their digital transformation efforts because they don’t have well-defined goals or parameters for what they intend to achieve, says Culbertson. “Digital transformation is a nebulous term, and it will mean different things to different banks, and often covers many complex initiatives. All of this can lead banks to feel like they’re not doing enough due to a belief that they need to tackle it all.”

Read More:

- 6 Digital Banking Transformation Trends

- Banks Are All Fintechs Now (or Soon Will Be), But Do They Have the Right Talent?

Four Key Tech Areas of Focus for the Year Ahead

The survey shows that respondents intend to enhance their digital capabilities by focusing on four main technologies:

- Digital account opening

- Customer relationship management

- Digital lending

- Mobile banking apps.

Other areas of focus include data analytics, in-branch technologies, website enhancements and online tools.

To enable this technology, core providers will remain integral to banks’ investment decisions. Nearly 90% of the surveyed financial institutions either rely entirely on or refer to their core provider while reviewing third-party vendors when determining new technology investments.

In addition, while more bankers say they understand public cloud technologies, the majority still aren’t sure if they should invest in them. Those that are using the cloud are doing so primarily for data backup and recovery (20%), cybersecurity solutions (14%), and IT infrastructure (13%).

“The decision process for investing in the cloud is truly a journey and dependent on many factors, such as hardware lifecycle, data center versus outsourced infrastructure, as well as risk and regulatory concerns,” says Culbertson.

A majority of bankers also believe an exceptional payments experience is an important aspect of digital transformation. For these respondents, top priorities for payments technologies include: real-time payments (27%), contactless EMV cards (21%), P2P (18%), and digital wallets (18%).

Despite the focus on digital capabilities, many banks and credit unions still rely on paper statements. 80% said they still favor some form of print statements, 38% providing “mainly” print statements, and 40% remain split between print and digital. Less than 20% offer primarily or exclusively digital statements.

Digital statements are an easy digital win that can reduce costs and elevate the bank brand in many customers’ eyes, Culbertson observes.

Enhancing Cybersecurity and Talent Retention

As indicated above, cybersecurity is a top concern for banks and credit unions as growing digital usage opens more systems and people to threats. Even as institutions double down on their cybersecurity efforts, criminals are constantly coming up with harder-to-detect attacks.

Among the top cybersecurity threats bankers anticipate heading into 2022 are: employee-targeted phishing (57%), customer-targeted phishing (51%), ransomware (48%) and social engineering (40%).

Financial institutions will use various tactics to assess and strengthen their cybersecurity posture in 2022, according to CSI. The top tactics include recurring vulnerability scanning (44%), routine social engineering exercises (43%), penetration testing (42%), and employee/board cybersecurity training (41%).

In this environment, banks and credit unions should educate boards and senior management about the need for a holistic approach to cybersecurity. They should also conduct social engineering tests and create fun and engaging cybersecurity tips and reminders for employees, the CSI report states.

In addition, bankers indicated the “Great Resignation” is also impacting their operations. They expressed average difficulty in retaining talent, with more difficulty in acquiring new talent.

More than 20 million people voluntarily left their jobs between June 2021 and October 2021, according to the U.S. Bureau of Labor Statistics. Particularly among white-collar professionals, employees are switching to higher paying or more beneficial jobs, and remote work has become routine.

Traditional bank and credit union employees no longer have to look to their local markets or move to another city to find opportunities at higher-paying institutions. From customer service representatives and IT personnel to compliance professionals and marketing staff, these workers can now do these jobs from their homes or where they want. As a result, financial institutions must present more lucrative job offers or poach talent from elsewhere to fill open positions.