Please note: You are reviewing an article with information from a previous year. View 2022 marketing salary data.

Bank Marketing Salary Trends for 2022

The way Marketing operates within financial institutions has hugely changed with the shift from traditional methods to much greater reliance on digital marketing tools and techniques. Yet changes in marketing management have been more uneven. The efforts to elevate the position of the Chief Marketing Officer to a place on the executive management team, for example, remains a work in progress.

There are numerous individual examples of where bank and credit union CMOs have a key role in shaping the institution’s overall customer experience — and sometimes its digital transformation efforts — but this is not yet the default practice. Marketing salary trends reflect this evolving situation. New broad-based salary data compiled by The Creative Group, a unit of Robert Half International, show that salaries for the top two marketing positions remained flat from 2018 to 2019. The data come from Robert Half’s 2020 marketing salary guide, and are not industry specific, but are indicative of the overall trends in marketing.

U.S. Marketing Management & Related Salaries

| Position | 25th Percentile | 50th Percentile | 75th Percentile | 95th Percentile |

|---|---|---|---|---|

| CMO | $136,500 | $164,000 | $196,000 | $247,750 |

| VP Marketing | $120,500 | $145,000 | $171,750 | $219,000 |

| UX Director | $110,250 | $129,250 | $152,250 | $195,750 |

| Marketing Dir. | $86,500 | $108,000 | $125,500 | $155,750 |

| Mktg Analytics Mgr. | $84,250 | $96,000 | $116,750 | $130,500 |

| Digital Mktg Mgr. | $67,000 | $82,000 | $95,500 | $125,750 |

Source: Robert Half Int’l/The Creative Group 2020 Salary Guide

Even though CMO salaries have been flat on average over the past 12 months, the position remains the highest paid marketing job by a comfortable margin. In the Robert Half data, CMO salaries run higher than all other marketing titles in each percentile.

Average CMO compensation in 2019 varies depending on the source. For Robert Half’s latest data, the average is $186,062. As shown below, other sources come in a little lower except for Salary.com at $235,410, which seems to be above the norm, and Mondo, where the simple average (calculated from the range) is $207,500. Data from the U.S. Bureau of Labor Statistics gives additional context, although it is not specifically for CMOs.

Selected Other U.S. Chief Marketing Officer Salaries

| Source | Average | Median | Range |

|---|---|---|---|

| Salary.com | $235,410 | – | $192k – $297k |

| – | $180,000 | $75k – 300k | |

| PayScale | $171,459 | – | $87k – $257k |

| Glassdoor | $171,000 | – | $75k – $305k |

| Mondo | – | – | $165k – $250k |

| ZipRecruiter | $143,994 | – | $95k – $200k* |

*25th/75th percentiles

U.S. Bureau of Labor Statistics Marketing Manager Salaries

| Average | Range* | |

|---|---|---|

| All Industries | $147,240 | $96k – $182k |

| Finance/Insurance | $155,550 | – |

*25th/75th percentiles PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect. Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation. Read More about Creating A Community with CQRC’s Branch Redesign

Why Industry Cloud for Banking?

Creating A Community with CQRC’s Branch Redesign

Digital and UX Specialists Lead the Way

The two positions in the Robert Half data that had year-over-year growth in their average base pay were Digital Marketing Manager and UX Director. Although the UX position (where it exists) does not necessarily report to the CMO at all banks and credit unions, the increased importance of user experience has elevated the importance of UX Director. Likewise, the shift away from traditional to digital marketing, has increased the importance of marketing titles that relate to digital.

Further evidence of these changes comes from Mondo’s annual marketing salary guide, which lists ten jobs with top-end salaries of $175,000 or more:

- CMO: $165,000 to $250,000

- VP of Martech solutions: $135,000 to $205,000

- VP of digital marketing: $135,000 to $200,000

- Marketing automation architect: $155,000 to $180,000

- VP of interactive: $135,000 to $180,000

- VP of eCommerce: $125,000 to $180,000

- Director of UX/UI: $125,000 to $175,000

- Director of interactive: $110,000 to $175,000

- Director of web analytics: $110,000 to $175,000

- UX specialist/information architect: $110,000 to $175,000

Nearly two-thirds (61%) of marketing executives say they plan to add digital marketers to their team in 2019, according to McKinley Marketing Partners. Only one third say they plan to hire traditional marketing staffers.

Read More: Financial Institutions Will Have to Pay More for Martech Talent

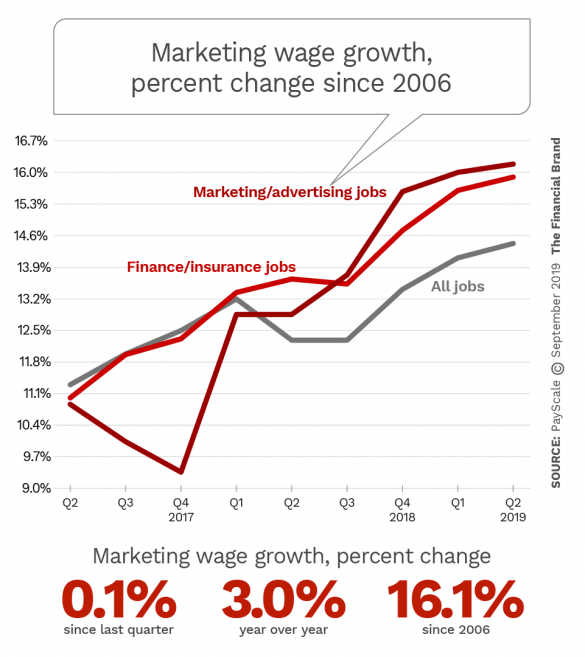

The job market in the U.S. for marketing talent overall remains tight. Despite indications that base pay for CMOs and Marketing Vice Presidents is flat, wage growth for marketing and advertising jobs in general has been rising since the fourth quarter of 2017, according to PayScale’s quarterly index.

Pay growth for marketing jobs overall has outpaced pay growth for all jobs, and is slightly ahead of wage growth for all financial industry jobs. However, the increases have slowed in the last two quarters. Nevertheless, Robert Half observes in its 2020 report that with unemployment rates continuing near record lows in the U.S., marketing candidates with the right digital skill sets can “virtually write their own ticket.”

Read More: 9 Digital Marketing Trends Banks and Credit Unions Can’t Ignore

CMOs’ Changing Role: Team Builders and Collaborators

CMO responsibilities have been expanding at some financial institutions to include delivering personalized customer experiences and increasing user engagement and retention. In addition, they must build teams or capabilities in regard to data analytics, marketing technology, content strategy, social media, and voice search. According to Robert Half, 45% of marketing managers say their team is understaffed in digital areas, and three quarters say it’s “challenging to find and retain professionals with up-to-date digital skills.”

That’s on top of traditional duties including increasing sales and revenue; overseeing market research, the marketing budget, and ad campaigns; product planning and marketing policy. Despite that long list of responsibilities, Forrester finds that many CMOs are not members of their companies’ executive committees. The research firm believes more should be.

“The CMO plays a key role in orchestrating and coordinating experiences across channels and departments,” Thomas Husson told The Financial Brand in an earlier article.

Reasons for the seeming disconnect between importance and recognition of the CMO in banks and credit unions include the fact that even when an institution uses the CMO title, the role can sometimes mean responsibility primarily for sales support, communication, and branding. In addition, at some institutions a host of new “C” titles compete with CMOs for expanded roles. These include Chief Experience Officer, Chief Innovation Officer, and Chief Digital Officer.

Further, not every senior marketing officer has the clout or confidence of, for example, Ally Bank’s Andrea Brimmer, who says that CMOs today must have their pulse on the ways in which the customer experience is evolving, and must have the right internal voice to be able to weigh in to impact that customer experience.

Confident or not, seven in ten CMOs say the ability to lead organizational growth and change is now essential to their professional success, according to IBM research. The most critical of these are:

- Increase sales/revenues

- Improve the omni-channel experience

- Reinvent CX through digital innovation

- Demonstrate marketing ROI

- Champion a customer-centric corporate culture across the enterprise.

This has led some in the marketing field to talk about “hybrid CMOs” — individuals who understand the quantitative data, and also can talk with empathy about customers’ needs and concerns.

Negotiation Factors for Financial Marketers’ Pay

Bank and credit union senior marketing officers face challenges as they simultaneously seek to strengthen and expand their roles within their organizations and further develop the digital capabilities of their team. The payoff in terms of wage growth likely will come to more marketing executives in time, to the extent they meet these challenges.

For now, the options are somewhat limited. For one thing, financial institutions tend to pay their CMOs lower base salaries, but higher bonuses, according to marketing staffing consultant Richard Sanderson. An executive with search firm Spencer Stuart, Sanderson told Forbes that the primary elements of CMO compensation are base pay; short-term annual bonuses; long-term incentives, which typically are equity; signing bonuses (with associated clawbacks); severance and guarantees.

The consultant says most CMOs focus primarily on base salary in the early stages of pay negotiations. Partly that’s because bonuses are usually a nonnegotiable percentage of base pay, and only parts of long-term equity-based compensation are negotiable, such as the number of options.

That’s the reality of the marketplace at present. However, as financial institution CMOs able to use their position to facilitate collaboration within their organizations, especially as marketing continues to shift from product-driven to experience-driven, their value likely will increase.