Gen X is known for its unflappable resourcefulness and resilience. These are the “latch-key” kids whose upbringing instilled a do-it-yourself mentality and high levels of self-reliance — characteristics that have helped them with weathering so much disruption and change in recent years.

As the smallest of the adult generational groups, Gen X tends to get overlooked by the media, but financial services providers would do well to pay attention to this so-called “forgotten generation.” At 65 million strong, Gen Xers make up almost 20% of the population in the United States, and their financial decisions are far-reaching. Those decisions run the gamut — insurance, investments, real estate, retirement savings and more.

Gen X, born between 1965 and 1980, is the current “sandwich” generation, meaning that this group is between two others that it has financial responsibility for on some level: aging Baby Boomer parents on one side and dependent and young adult Millennial children on the other. Gen X reports having a high level of stress around finances and financial issues, according to Business Insider.

But exactly how is Gen X making money, spending money and investing money? And how should financial services providers be engaging with this important group?

Here’s some of what we learned in our study on the future of money, based on a survey of 1,000 U.S. adults plus an augment of 200 Gen Zers ages 16 through 25 in October 2022.

See: How to Define the Generations: The Ultimate Guide for Marketers

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

Modern Customer Journey Mapping

Customers navigate a multi-touch, multi-channel journey before interacting with your brand. Do you deliver successful and seamless experiences at every touchpoint? Download webinar.

Gen X in the Workplace

Generation X, representing one-third of the U.S. workforce, has a reputation for a strong work ethic. But it is also known for pursuing work-life balance, which has been elusive especially in light of the caregiving responsibilities that come with being sandwiched between two larger generational groups. Sometimes referred to as the “work hard, play hard” generation, this group is credited with pushing for flexible schedules and remote working.

Our study found that Gen Xers are relatively loyal at this point in their careers compared with younger cohorts: Only 37% of Gen Xers say they are likely to switch employers in the next year compared with 57% of Millennials and 63% of Gen Zers.

Compared with other generations, a larger share of Gen Xers say they want their employers to provide financial advice – likely a reflection of the financial burden of their caregiving duties. In fact, 72% of Gen Xers overall say they would like employer-offered programs to help them manage their finances, our study shows.

Understanding what Gen X is looking for from employers will help financial services providers craft employer-led programs that target the unique needs of this generation as they navigate caregiving, saving for retirement and building generational wealth.

Cash Is King with Gen X

So what methods does Generation X favor when paying for expenses right now? Overall, in the current economic climate, each generation is reporting a reduction in how much they buy. When they do spend, the preference across all generations is to use cash or debit cards. But Gen X is particularly attracted to cash.

According to our study, 79% of Gen Xers use cash as their most frequent payment option because it feels like the most secure way to pay and 74% use cash to help them manage their budgets.

While cash may be king, this generation also doesn’t steer away from payment apps, even though the general perception of such apps is that they are targeted mostly at Millennials and Gen Zers.

Read About Gen Z:

- Is Gen Z the Answer in Banking’s Struggle to Acquire New Customers?

- Gen Z Takes Money Seriously and Will Leave Banks That Don’t Deliver

Payment Technology: Gen X Is Big on PayPal and BNPL

Generation X was brought up in an era of technological and social change. So this generational group tends to be comfortable with technology and open to change.

Though Millennials and Gen Zers represent the largest share of those using buy now, pay later (BNPL), Gen Xers are proving to be fast adopters of this payment option, according to data cited by PayPal.

Another Way to Pay:

The percentage of Gen X using PayPal for direct payments:82%

The fintech giant continues to dominate the payment space for all generations. Our research shows the majority of Gen X — 82% — use PayPal for direct payments and 65% say they are likely to use PayPal Pay in Four when making a BNPL purchase.

In order to meet the steadily growing usage of payment technologies for this generation, financial institutions should invest in robust app and digital strategies. They also should streamline user experiences within digital platforms, to keep this group engaged and satisfied.

Read About Payments:

Money Management: Saving and Investing Are Priorities

The current market volatility is causing 20% of Gen Xers to take on more debt. But 34% report that they are saving more right now than they were six months ago and 39% say they expect to increase their savings in the next 12 months.

While a lot of Gen X’s wealth is spent on caregiving — whether it be for children and their education or parents’ care — they still invest. In keeping with the traits of their generation, Gen X tends to be careful, steady and prudent about investing as they have an eye on retirement.

According to our study, Gen X is less likely to be buying more stock in the next 12 months than their Millennial and Gen Z counterparts.

Financial Advice: What Topics Appeal to Gen X?

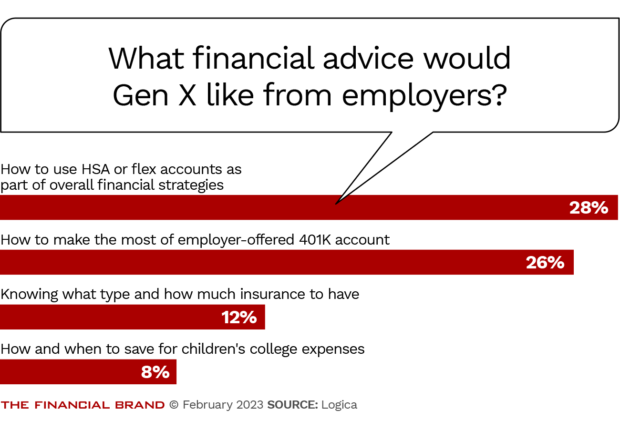

Though Gen Xers are in their prime spending years, they are navigating significant financial challenges in their “sandwich generation” role, while also preparing for retirement. There are a variety of financial topics that can be used to connect with Gen X, including strategies on covering college expenses for their children, handling the cost of caring for aging parents and their health care needs, navigating the impact of inflation, and optimizing retirement plans and savings.

Gen X respondents in our survey say they do want help, which points to an opportunity for financial advisors. The findings include:

- 58% of Gen Xers are looking for advice on how much to save to reach their goals.

- 57% want to know more about insurance, such as what type to have and how much to have.

- 53% say they need input on how to make the most of their retirement accounts.

Gen Xers are mixed on where they look for investment and financial advice. Our study shows that overall they prefer advice directly from a one-to-one meeting with a professional financial advisor, but they will use easy do-it-yourself apps for savings advice and set-up.

While they are not as heavily reliant on social media as Gen Z or even Millennials, you will still find them poking around on YouTube, Facebook, Instagram and even TikTok, according to 2020 research from the audience insights firm GWI.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Buying Power: Second Only to Boomers

Far from fading into obscurity, Generation X is active on the financial front with a reach that extends beyond their own generational group. Gen Xers are second only to Baby Boomers in buying power, which makes them a key demographic for all financial services providers.

As the oldest of them head toward retirement, their financial needs will continue to evolve, and those that work to best understand — and address — these changing needs are the ones that will succeed in growing these relationships.