The advertising focus of leading financial institutions and the rest of the industry continue to go in different directions.

The majority of financial institutions did not reduce their broadcast and offline marketing budgets over the last 12 months, according to the Digital Banking Report. As in 2017, 34% of financial institutions allocated 50% or more of their media budgets to traditional media. As was the case last year, there was a lack of commitment to digital channels, with only 15% of organizations committing more than 50% of their budgets to online media, compared to 14% in 2017.

Similarly, virtually no bank or credit union committed more than 40% of their budget to mobile marketing, with only 2% of organizations committing over 50% of their marketing budget to mobile. In fact, the spending curve for mobile was almost exactly as it was for 2017.

However, on the other end of the spectrum, many of the most progressive financial institutions are successfully using digital marketing to align with consumer lifestyles, using new marketing technologies and advanced analytics to target consumers and personalize experiences.

Mintel research finds, for example, that Chase targets Millennials by running banner ads on such niche websites as ThePointsGuy.com. Similarly, Wells Fargo had the lowest total marketing spend, but increased its digital spend starting Q4 2017 to emphasize its “commitment to re-establish trust with stakeholders.”

Three major opportunities exist for financial institutions with digital marketing, according to Mintel:

- Focusing on Experience and Engagement. As opposed to traditional product-based direct mail and email marketing, spending on digital platforms could improve customer experience and enhance engagement. A well-executed digital branding campaign can increase customers’ interactions and benefit from social sharing.

- Leveraging Social Channels. Social media channels can promote financial education, new products, digital banking benefits, and corporate culture messaging to specific audiences.

- Entering New Markets. Digital marketing channels can generate brand awareness and promote financial education to younger, hard-to-reach consumers. Banks and credit unions can also use digital marketing campaigns to enter new markets, generate awareness and support corporate culture messaging.

Read More: How to Nail the Small Business Banking & Lending Market

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

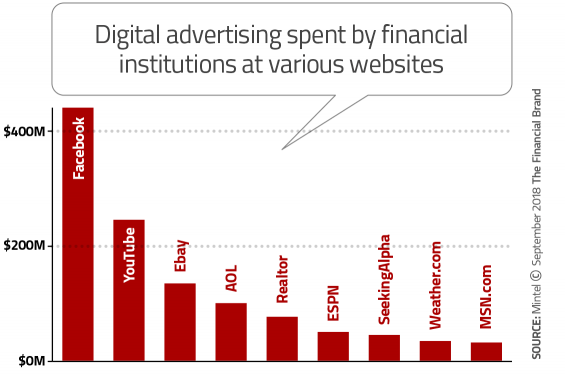

Top Brands Use Facebook, YouTube and Segmented Channels

Mintel research finds that American Express, Discover, Chase and Wells Fargo utilize Facebook the most, with Citi, Discover and Wells Fargo also favoring YouTube as a digital marketing partner. Similarly, Capital One and Bank of America allocate significant funds to AOL, while Bank of America promotes its co-brand partnership via MLB.com. and Capital One does the same with ESPN.

Some of the aforementioned spend was spread across the entire sites, while Chase also focused on travel sites for credit card marketing, and Capital One and Bank of America marketed on news sites. Overall, a great deal of the marketing tends to peak during the holiday season.

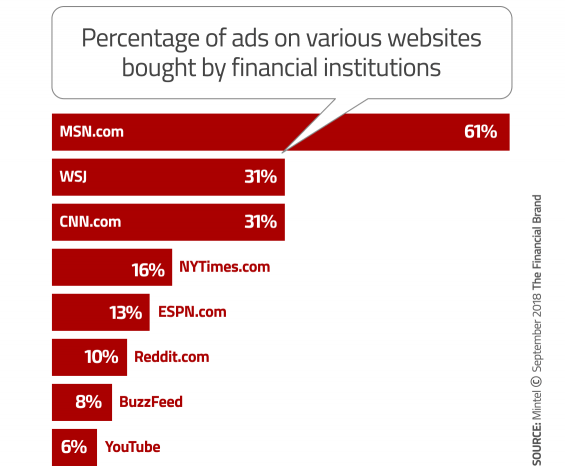

When viewed from another perspective, Mintel evaluated the percentage financial marketers committed to various sites. For highly targeted but smaller sites such as ThePointsGuy.com and Hotels.com, there was understandably a large commitment by financial advertisers (100% and 74% respectively). Larger sites with significant funding from financial institutions are shown below.

(Read More: Google Throws Digital Advertising Curveball at Financial Marketers)

Combining Broad Reach and Targeted Media

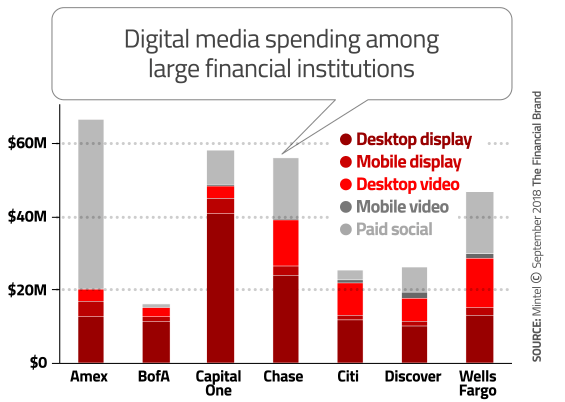

AmEx is not only the top spender in digital marketing, but also utilizes digital spend primarily for paid Facebook retargeting. Most of the spend went toward acquisitions and co-brand partnerships.

“Bank of America, Capital One, Chase, and Citibank promoted general product ads through desktop and mobile channels, but educated customers on how to improve their mobile app experience with Facebook ads,” states Mintel.

While Discover mainly advertised product benefits and functionality (similar to their broadcast ads), Wells Fargo mirrored their broadcast ads to reinforce their commitment to improved customer transparency and customer experience.

“A healthy brand must use a mix of both broad reach and targeted channels to generate returns on its marketing investment,” says Mintel.

Though AmEx was the top-digital spender, only 10% of its marketing budget went to digital+DM spend. This indicates AmEx spent the remaining marketing budget on co-brand partnerships, expanding merchant networks, or offline advertising.

Opportunity with Female Consumers

Mintel Reports states that while a majority of younger men make all their financial decisions themselves, three quarters of women are involved in household financial decisions in older households, making them an important target for digital marketing.

The challenge is reaching them and achieving engagement, because they are less likely than men to want to learn about financial topics. That said, they are also less likely than men to believe that banks are all the same, proving banks and credit unions the opportunity to differentiate themselves with financial education and inclusion messages.

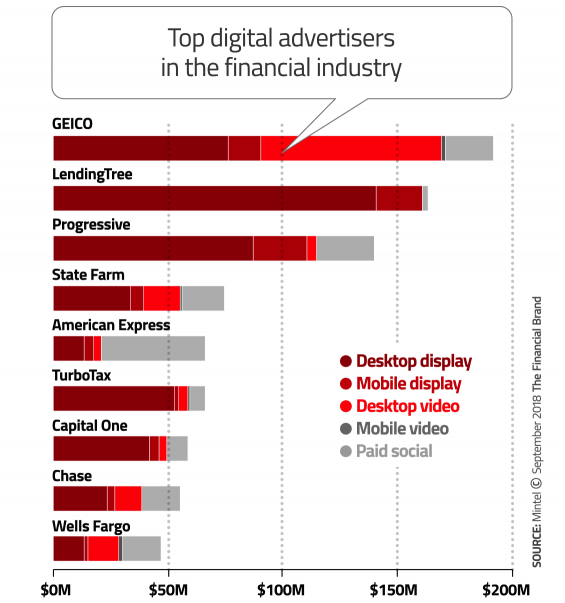

Non-Banking Financial Firms Committed to Digital Channels

Anyone who watches TV or uses a computer is probably aware of the marketing omnipresence of brands such as GEICO, Lending Tree, Progressive Insurance, and State Farm. In fact, these brands dwarf traditional banking firms in all digital marketing categories. Just as importantly, they were the first to fully embrace digital channels as a way to generate awareness, user comparison, digital relationship opening and engagement. While the channels preferred may differ between the brands, all dominate the digital marketing landscape.