The great Millennial generation, with all its size, promise of massive buying power, and preference for things digital is now being referred to as the “burnout generation” and the “disrupted generation.”

What happened? In two words: life happened.

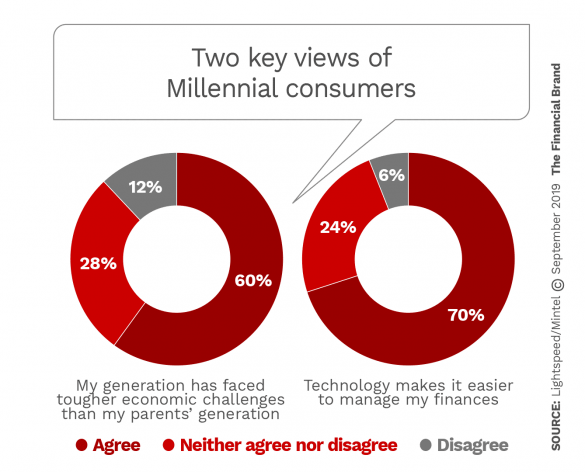

Every generation is shaped by its own particular circumstances. In the case of people born between 1981 and 1995 (some experts go back to 1977), they have grown up in a world of turbulent political and economic trends, beginning with Sept. 11, 2001 and the global recession that followed as many of them entered the workplace. The sharp increase in college education expense over the past decade has been another big hurdle.

In its annual Global Millennial Survey, Deloitte has observed a marked shift in outlook of this giant generation from one of optimism to distrust.

“Millennials are expressing uneasiness and pessimism — about their careers, their lives in general and the world around them,” the report states. “They appear to be struggling to find their safe havens, their beacons of trust.”

“Millennials aren’t the future — they’re the present. They can make or break entire enterprises, and they aren’t afraid to let their wallets speak for them.”

— Deloitte

Much of that could be said of any generation dealing with the current economic and political circumstances. However, the Millennial generation — now the largest, by some counts — is vital to financial institutions’ success. Retail banking executives and financial marketers need to adjust their approaches, products and messaging to keep pace with the evolving views of this younger, but maturing, generation.

“Millennials and Gen Z make up more than half the world’s population and, together, account for most of the global workforce,” notes Deloitte. “They aren’t the future — they’re the present. They can make or break entire enterprises, and they aren’t afraid to let their wallets speak for them.”

Millennials by the numbers

- Worldwide almost 1 in 4 people (1.8 billion) is a Millennial

- 1 in 3 Americans will be a Millennial by 2020

- 50% of the world’s workforce will be Millennials by 2020

- Current Millennial buying power is $600 billion worldwide

- By 2020, Millennial buying power will be $1 trillion

Source: Futurum Research

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

The Financial Challenges of Millennials And How to Meet Them

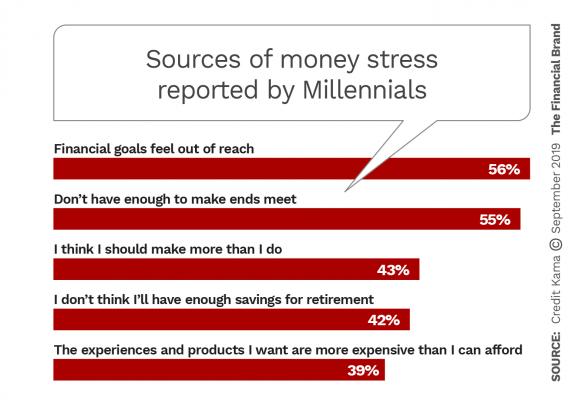

Millennials as a whole have lower real incomes and fewer assets than previous generations at comparable ages, according to Federal Reserve data. As a result, it’s not surprising that a Credit Karma survey found that 61% of Millennials say money was their top source of daily stress, with more than half (55%) saying they frequently feel stressed about paying the bills.

Rent and mortgage payments topped the list of expenses causing the most stress, followed closely by “Asking to borrow money from a friend or family member,” “Overdrawing an account,” and “Unexpected medical expenses.” Credit Karma also probed why money was such a source of stress.

In addition to not being able to pay all their bills, Millennials cited not being able to achieve their financial goals as another a major cause of stress. One common goal for many people at this stage of their lives is home ownership. Yet fewer Millennials have taken that step compared with earlier generations.

The homeownership rate among households headed by someone under 35 is 35% per Census Bureau data cited by The Wall Street Journal. That compares with 40% in 1999.

The burden of debt, especially high student loan debt, is a contributing factor. Student loan debt has grown by more than 128% in the last decade, as noted in Mintel’s Millennials and Finance report for 2019. A survey of 1,000 Millennials by Money Under 30 found that, astonishingly, just over 7% said they wouldn’t be able to pay off their student debt before they died, and 52% didn’t think their college degree was worth the price.

Although many Millennials have waited longer to have children, more than half of them are now parents, Mintel observes, and over a million Millennial women are becoming mothers each year. This delayed Millennial “baby boom” may impact the housing demand in time. Currently, however, Mintel reports that nearly a third (32%) of Millennials worry about being able to afford their children’s education and a quarter are significantly stressed by the costs of providing for their children.

Takeaway: Down but not out. Given the state of the world politically and economically, slightly more than half of Millennials think their personal financial situations will become worse or remain the same, according to Deloitte. 43% anticipate improvement within the next 12 months. However, nearly two thirds (64%) of Millennials surveyed by Mintel say they believe the American Dream is achievable. That compares with 62% of Gen Z and 71% of Gen X.

Read More:

- Why Some Financial Brands Win With Millennials (and Some Don’t)

- Millennials, Gen X and Even Boomers Will Ditch Banks for Amazon

A Preference for Digital Banking, But Not Exclusively

Of a total of 75 million Millennials in the U.S. nearly three quarters (55.4 million) will use digital banking in 2019, eMarketer forecasts. That will grow to 78% by 2022, the firm predicts. However, these Millennial digital banking users are not all fans of digital-only banking, that is, banking with an online- or mobile-only institution such as Ally, Chime, or Varo Money.

According to Marqeta, about 47% of consumers in the Millennial age range would not consider moving their primary banking account to a digital-only institution. “Though they may use branches less that older consumers, they don’t want to forgo the option of going to a physical location,” states Mark Dolliver, eMarketer principal analyst.

“If I were buying a home for the first time, I would not rely on a Google search for such a big decision. I would want to sit down with somebody who could explain what all this stuff means to me.”

— Millennial entrepreneur Tyler McIntyre, Novo

Tyler McIntyre, the Millennial founder of Novo, a startup digital bank serving small businesses, tells Bankrate.com that if he were buying a home for the first time, he would not rely on a Google search for such a big decision.

“I would want to sit down with somebody who could explain what all this stuff means to me … almost like a consultant,” McIntyre states.

That’s not to minimize the importance of meeting the digital expectations of Millennials, not to mention Gen Z and even older consumers. An efficient, intuitive digital experience, particularly for account opening, is simply the baseline for younger adults who grew up with the internet.

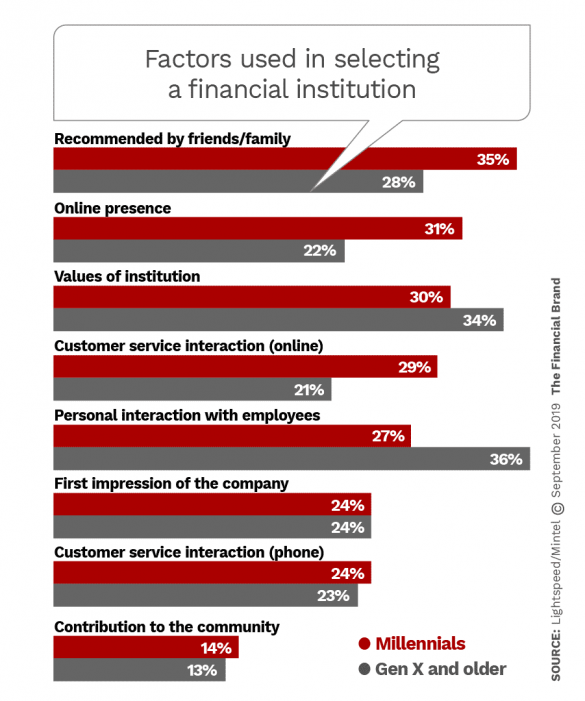

In some areas, the Millennial generation overall may be more attuned to online interaction than the members of Gen Z, the oldest of whom are now just entering the workforce. The chart below shows that Millennials put more importance on a financial institution’s online presence and online service than do younger people, who value “personal interaction with employees” more highly.

Still, as Mintel analysts observe, Millennials are more likely than older generations to rely on recommendations from friends and family.

Two Issues That Matter to Millennial Consumers

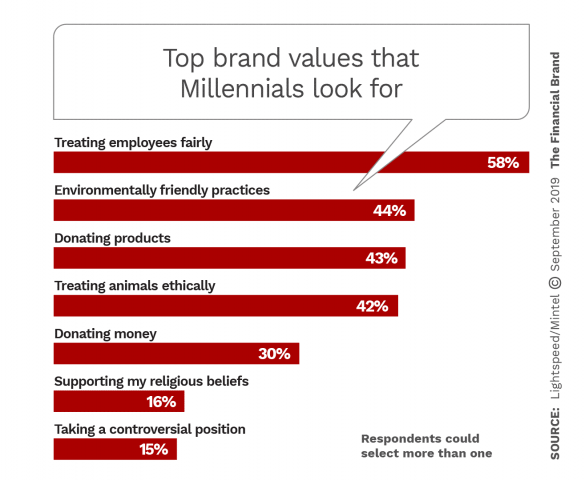

1. Sustainability. In its 2019 Millennial survey, Deloitte found that overall this generation’s view of business as a force for good continues to diminish. Specifically related to financial institution product marketing, the consulting firm found that Millennials (and Gen Z as well) start and stop relationships with companies for very personal reasons.

“42% of Millennials say they have begun or deepened a business relationship because they perceive a company’s products or services to have a positive impact on society or the environment.”

— Deloitte

For example, “42% of Millennials said they have begun or deepened a business relationship because they perceive a company’s products or services to have a positive impact on society and/or the environment. Further, 37% said they have stopped or lessened a business relationship because of the company’s ethical behavior.” About the same percentage, conversely, began or deepened a relationship because they believed a company was ethical.

The top societal concern of Millennials, per the Deloitte research, was a combination of several related factors: climate change, protecting the environment and natural disasters. The concerns mentioned next most often were “Income distribution/inequality of wealth” and “Unemployment.”

Mintel’s Millennial research found similar results.

Financial institutions must work to “curate a brand image that is both genuine and socially conscious,” the Mintel report states.

2. Intrusiveness. Millennials (and members of other generations) are beginning to exert more control of their data, according to Deloitte.

About a third of Millennials told the consulting firm that they’ve stopped or lessened a business relationship because of the amount of personal data the company requests. A quarter have done the same because of the way a company tracks their online buying/shopping behavior.

These findings reinforce that financial institutions have to walk a careful line between offering personalized experiences and not being too intrusive.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

7 Marketing Tactics and Ideas for Engaging Millennials

One point stressed by many researchers: Beware of applying generalizations to all Millennials. There are commonalities, but Millennials are more diverse than any other generation in terms of income, education, marital status and race. Brookings points out that minorities comprise 44% of the Millennial population compared with 35% of older age groups.

Here are specific marketing strategies and tactics that banks and credit unions can consider in their efforts to further reach and engage with Millennial consumers.

1. Help them budget. More than three out of five Millennials fail to follow a monthly budget, Mintel reports. This represents a golden opportunity to use AI-powered tools to provide personalized budget recommendations that help cultivate financial health.

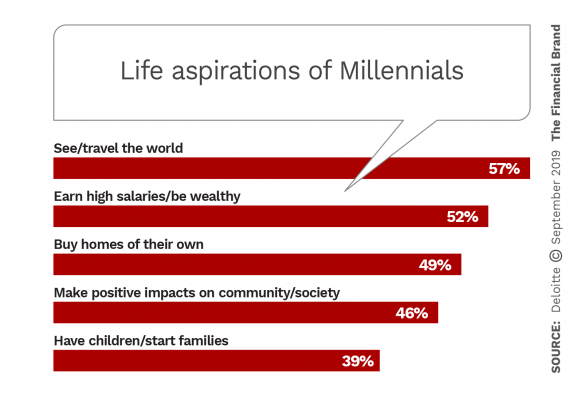

2. Consider Millennials’ aspirations. Based on its latest Millennial research, Deloitte observes that having children and buying homes and other “traditional signals of adulthood” do not top the list of Millennials’ priorities. Travel is the first choice. However, “Making a positive impact” is also highly ranked and suggests that some of the interest in travel may be cause-related.

3. Use influencers to tap the “sharing economy”. Millennials in general are “hyperaware” of what their peers are doing because of the way content gets shared online, states Andrew Martin, CEO of the marketing firm Metia Group, in a blog on EContent. This has led to the “FOMO” (fear of missing out) phenomenon. Martin advises B2C marketers to embrace an influencer strategy. This can be a low-budget affair in which you tap “nano-influencers” rather than celebrities. Millennials are drawn to people they can relate to.

4. Use “Stories” to achieve immediacy. As digital natives, Millennials consume vast amounts of data each day, says Alison McGlone, director of brand marketing at Nerdwallet, in a MarketingProfs blog. That in turn leads to a short attention span. Financial marketers can tap into that by using Instagram Stories, a mix of video, slides and text on a given topic. These stories are up for only 24 hours, then disappear. This appeals to younger audiences who crave authentic, immediate experiences, McGlone states.

5. Design programs around real-life events. Millennials are often described as digital natives, states Ulli Appelbaum, Chief Strategy Officer of FTT Brand Consulting, but the key to their hearts and wallets is through real-life events that they can experience firsthand and then share digitally. Successful Millennial marketers tie into existing events or one they create for a campaign, Appelbaum states. They also go out of their way to amplify the experience as opposed to just showing a presence through passive sponsorship.

6. Don’t sell to them, make them part of the community. Millennials are “relentless rejecters of traditional advertising, which they both filter and ignore,” says marketing consultant and author Barry Feldman. On the other hand, they’re receptive to authenticity and customer experiences that are rewarding. That’s why Feldman maintains that Millennials don’t like to be marketed to on social media. They want to be supported. He recommends that marketers use a combination of listening, engagement, community and content.

7. Don’t lecture them about responsibility. Sure, the Millennial generation as a whole has serious financial issues, but marketers should emphasize compassion, Mintel urges in its Marketing to Millennials report.

“Millennials are tired of lectures about financial responsibility,” the report states. “Avocado toast is not solely responsible for their economic situation.” Student loans and other debt often prevent younger adults from setting aside money for emergencies or retirement. Offer solutions to deal with student loans, and provide digital apps that can help them save smaller amounts.