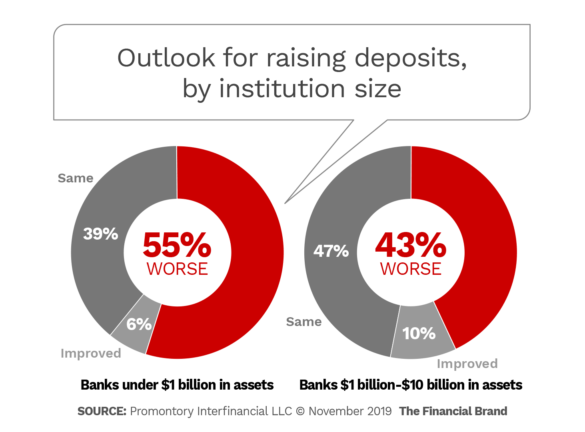

The outlook for deposit gathering in the year ahead looks tougher to just over half (53%) of financial institutions surveyed, with 41% expecting competitive pressure to hold steady and only a handful (6%) anticipating some easing, according to a new survey. This comes during an unusual but lengthening period of extremely low deposit rates and the continued evolution of competition as the internet and other marketing channels change the playing field.

The survey, by Promontory Interfinancial Network, also found at the end of the third quarter 2019 that smaller institutions expect to feel greater competitive pressure in the period ahead. 55% of banks under $1 billion in assets expect deposit-gathering competition to be stronger, while among larger banks of $1 billion to $10 billion, 43% expect increased competition. Overall costs of funding, including deposits and other sources, are expected to be lower next year according to 51% of the sample, with 29% expecting costs to remain steady and 21% anticipating an increase.

The Promontory research found that tech giants like Apple and Google are the greatest overall competitive concern for the surveyed banks, with the nation’s largest banks seen as the next biggest threat. Fintechs that compete with banks rank third, and internet banks — one cited was Goldman Sach’s Marcus — rank fourth. Just over the horizon are mobile-only banks. Three out of five banks surveyed expect all-mobile institutions to build an increasing market share among Millennial and post-Millennial depositors. Size played a role in the answers here too, with 61% of larger community banks expecting major competition from mobile-only banks while only 46% of smaller community banks expect that.

The continuing low-rate environment, kept so by continuing tension in Washington between the White House and the Federal Reserve, has impacted significantly the way institutions compete for deposits. Greg McBride, Senior Vice President and Chief Financial Analyst at Bankrate.com, says the second half of 2019 has seen lowering of deposit rates and falling demand for certificates of deposit.

McBride explains that the current rate picture hardly makes it worth a consumer’s while to lock up deposits for any length of time — there’s no premium for the resulting lack of liquidity. On the other hand, with rates potentially falling lower still, banks and credit unions typically don’t want to lock in CD rates.

With no one having a reason to make a commitment, savings accounts and money market deposit accounts are what most consumers seek. Those accounts are also what most institutions want to open when they can’t obtain low-cost or no-cost transaction accounts, the most liquid deposits of all. Where institutions promote forms of “reward checking” accounts — such as community financial institutions that promote higher-rate checking if a consumer meets a certain level of qualifying transactions — McBride points out that such programs typically cap out. Often, he says, the higher the yield on qualifying deposits, the lower the cap on those funds. Deposit levels exceeding the caps earn much less.

With rates so low, and institutions striving to maximize returns, the challenge of deposit gathering has made it worth institutions’ while to seek other ways of differentiating themselves than bidding up rates.

“Winning deposits is a key priority for many banks and credit unions, and competition is fierce in the battle to find cheap deposit and keep funding costs down,” writes Alyson Clarke, Principal Analyst at Forrester in a report. “But attracting deposits isn’t only about interest rates. There are many tactics and strategies that firms need to use to grow their market share.”

Clarke outlined a series of these measures in a report that began with the premise that institutions need to gather deposits without always just buying them with higher rates. The following points are gathered from materials provided by Forrester; BAI, Comperemedia, a Mintel company; and individual firms and nonprofits.

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

1. Help Consumers Save and You Help Yourself as Well

Survey after survey about American’s financial habits stress how many could not meet a household financial emergency with ready funds, in spite of a record economic expansion.

“Savings is America’s Achilles heel,” says Bankrate’s McBride. “And that’s not likely to change in the next ten years.” According to Financial Health Network’s 2019 U.S. Financial Health Pulse, 12% of consumers surveyed have less than a week’s worth of living expenses saved — a 1.4 point increase over 2018.

Yet there is a desire to save more. BAI’s Banking Outlook survey asked consumers spanning four generations how their primary financial institution could help them manage their money. The #2 aid desired among both Gen Z and Millennials was providing automated savings and investment tools. (Faster payments and quick transfers was #1 for both generations.)

A variety of fintech players have been promoting features that help consumers save or invest, according to Comperemedia research. Chime, for example, rounds up purchases on its Visa card and deposits the extra money into a Chime savings account. The report adds that Acorns has begun pushing to transform itself from a “round-up” app into a full-fledged banking alternative. Traditional institutions have also been trying this tactic, such as Fifth Third’s Dobot and Huntington Bank’s Heads Up.

Forrester’s Clarke believes that the best efforts involve a bit of cheerleading to encourage consumers to keep going when they are using a savings-assistance product. One of the most generous is Citizens Bank’s “GoalTrack Savings,” which Clarke says not only gives kudos, but rewards consumers with monetary savings bonuses.

Read More:

- How Banks and Credit Unions Can Grow Deposits with AI

- 6 Fresh Ideas to Build Deposits When Other Banks Turn Up The Heat

- How Financial Institutions Can Thrive in the Age of Digital Disruption

2. Make Opening Deposit Accounts an Effortless Experience

Clarke believes that banks and credit unions have to catch up with consumers’ expectations in a hurry.

“People increasingly expect fast or even instant responses — Amazon Prime can deliver most things to your door within 24 hours, and Uber can usually deliver your ride within minutes,” she writes. “Even in banking, having to wait for an approval decision or an account number is becoming a thing of the past. Digital ID verification and electronic signatures are speeding up deposit account opening through digital touchpoints. Whether applying online, via mobile, over the phone, or in person at a branch, prospects should be able to open a deposit account in minutes, not days.”

As the Forrester chart below shows, banks and credit unions have a home-field advantage based strongly on convenience. However, desktop and mobile accessibility to other institutions’ offerings could in time overcome the inertia and familiarity implied in the chart.

BAI’s research found that consumer’s comfort level with and preference for online account opening has changed significantly over the course of just one year. In 2018 34% of BAI’s sample had ever opened a deposit account online, and in 2019 that number had risen to 43%. And while 59% of consumers said in 2018 that they’d prefer to open an account online, that increased to 65% in the most recent sample.

In spite of this trend, 47% of financial institutions surveyed by BAI don’t allow consumers to open their first account online. High as that is, the tally represents a six-point improvement over the year-earlier research.

While Clarke presses institutions to add features that speed up applications — beginning with making them digital and paperless — she also reminds them not to forget the human factor.

“Whether deposit account prospects are still researching or ready to buy, they should be able to get human assistance when and where they need it,” says Clarke. “Besides meeting a customer need, some banks report that offering human help significantly increases conversions.” She says online-only Ally Bank makes its call center available 24 hours a day for online shoppers’ questions. The site indicates the wait time consumers can expect if they queue up.

Communicating convenience is critical. In fall 2019 Marcus, the Goldman Sachs online bank, went on the attack against the country’s largest banks with a publicity campaign pointing out that consumers could earn more in a month in Marcus online savings versus a year in savings accounts offered by the big banks.

Yet this wasn’t only a rate play. In a blog to consumers, Dustin Cohn, Head of Brand and Marketing Communications for Marcus, noted that the bank’s own research found that nearly one in three consumers who had considered opening an online saving account hadn’t because they thought it would be too difficult.

“But the reality?” wrote Cohn. “It takes just minutes to open a Marcus Online Savings Account.”

Read More: Is Your Online Account Opening Process Driving People Crazy?

3. Sell Consumers on Your Institution’s Value Proposition

If your institution wants to raid competitors for deposits, what’s in it for the consumer?

“Prospects need a good reason to open a deposit account with a bank,” writes Clarke. “That reason should be clear right away.” The Forrester report gives four points to bring out to consumers:

- Show the benefits of banking with the firm, such as service quality. Ally Bank has been running a campaign stressing its favorable customer service ratings.

- Show consumers how much interest they can earn, making it easy to compute this online.

- Help consumers understand fees — and if they are waived.

- Explain why depositing money with your institution makes it safe.

Comperemedia’s report, by Eric Fahey, Director of Content and Analytics, illustrates how value propositions can be reduced to marketing shorthand, such as this selection of slogans used by fintechs:

- Chime: “We’re Changing the Way People Feel About Banking.”

- Simple: “Save easily. Bank beautifully. Simple Banking.”

- Dave: “Banking for Humans.”

- Digit: “Save Money and Pay Off Debt, All Without Thinking About It.”

4. Apply Data Analytics to Better Target Deposit Marketing

Forrester encourages marketers to seek every potential advantage in promoting deposits to prospects. Looking for pluses over competitors is important once data analysis has helped the institution identify a market.

“Maybe you have a physical presence in a market with strong deposit growth and the bank that is currently winning deposits does not or is closing down branches,” says Clarke. “Even if you’re not offering the highest rate, maybe you offer convenience, trust, and ease in managing the account — which drive many deposit decisions.”

Another critical use of data analysis, according to Forrester, is using it to obtain insights into why a particular consumer is interested in savings. This can help guide which types of accounts are promoted to them — a step toward personalization.

5. Once You’ve Gained a Depositor, Hold Onto Them.

With the exception of people obtaining banking services for the first time, one financial institution’s gain typically is another one’s loss. Having pried a consumer from their original institution, efforts must be made to retain them so they don’t just walk to another provider.

“We find that customers who rate their financial services firms high on customer advocacy are more likely to consider those firms for future purchases,” according to Clarke, “while firms whose customers rate them lowest for customer advocacy have the fewest customers who would buy from them again.”

And loyalty begets loyalty. Clarke believes strongly in rewarding depositors who refer their friends.

“This is a great way to target Millennials, as well as their friends and families,” says Clarke, “since the referral fee can be less than the cost of acquisition through other means.” She cites Monzo, which pays for referrals and which credited 80% of its 2018 growth to word of mouth.