While there is debate over who first said, “The definition of insanity is doing the same thing over and over again, but expecting different results,” there is little debate that financial marketing is currently experiencing this phenomenon. This is because, as the financial services marketplace changes faster than ever, many financial marketers seem to be using strategies and tactics from the 1970’s or 1980’s.

The 2016 State of Financial Marketing Report, sponsored by Deluxe, has found that while bank and credit union marketers know the challenges and opportunities of today’s marketplace, there continues to be a product (rather than consumer) focus and the movement to digital communications is occurring at a snail’s pace.

In addition, there is not a commitment to advanced analytics by most firms and measurement of marketing ROI is close to non-existent. And while most institutions believe they are lacking financial and/or human resources, there is evidence that current budgets are poorly allocated and the right people may not be in place to succeed in the future.

Bottom line, the 2016 State of Financial Marketing Report finds that banks and credit unions are not changing their priorities, strategies and budgets fast enough to respond to an increasingly demanding digital consumer.

Five Banking Challenges

The best way to understand the state of retail banking is to look at the top 5 marketing challenges that were mentioned by respondents to this year’s study.

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

1. Measurement of Results

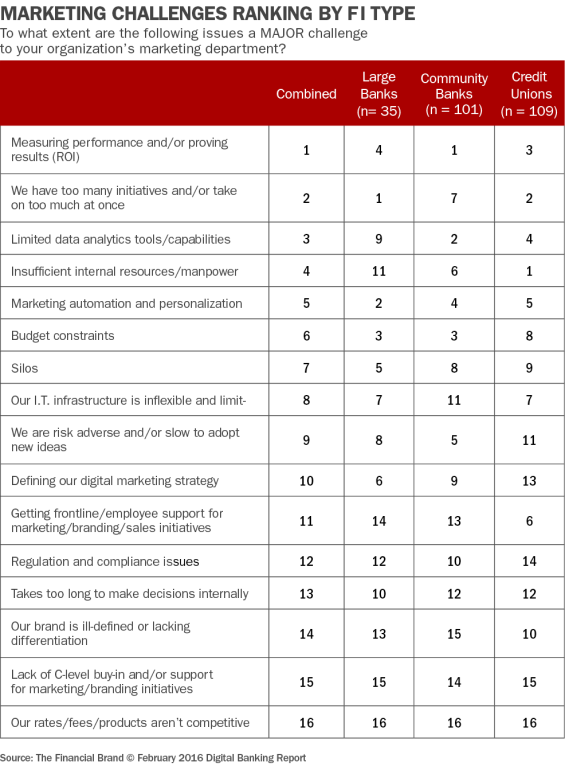

When all of the results were tabulated, the ability to measure the ROI of marketing initiatives was the number one challenge mentioned (in the top 5 for all sized organizations). The impact of this challenge was reflected in the survey results regarding the way the C-suite views marketing and in the frustration marketers have with being able to understand the results of their efforts.

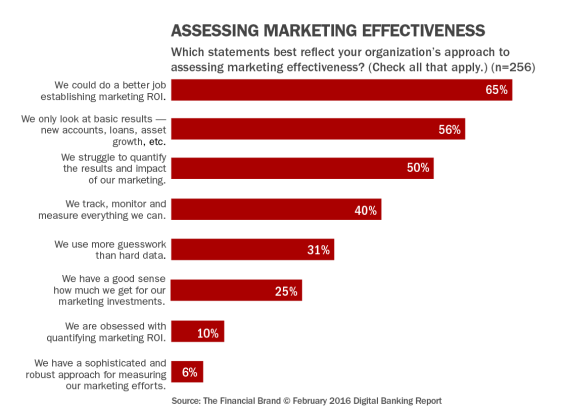

Two-thirds of financial institutions completing the survey said, “We could do a better job establishing a marketing ROI,” with 56% mentioning that only basic results are reviewed and 50% saying there is a struggle with quantifying the results and impact of marketing. Frighteningly, 31% said they use guesswork more than hard data, while only 10% said “We are obsessed with quantifying marketing ROI.” There was virtually no variation by type or size of financial institution.

While there was an indication that budgets will increase for the improvement of measuring results, other responses in the survey, including strategy prioritization, staffing and the tools that firms will use to measure marketing success tell a vastly different story. In fact, virtually all of the measurement tools mentioned were available 40 years ago and are based on accounting reports.

(Note: The 2016 State of Financial Marketing Report provides an analysis of the perceived effectiveness of social media and branding efforts as well as a review of the approach and tools organizations currently use to measure marketing effectiveness)

2. Lack of Focus/More Business as Usual

With the exception of the community bank segment, financial services executives believe, “We have too many initiatives and/or take on too much at once.” This can result in a lack of focus and potentially a lack of capacity to measure results. In our experience, when too much is on the plate of a marketer, analysis suffers. A recent phenominon contributing to this challenge could be the added burden of compliance being added to the marketing mix. In most organizations, getting any program approved by compliance adds time and effort to the process.

A result of ‘feeling overwhelmed’ in marketing also results in a status quo mentality. This year’s survey (like last year’s) showed that, despite ongoing conversations regarding moving from a product silo marketing perspective to a consumer-focused marketing model, most organizations still budget and build strategies around the same products year after year. This consistency in emphasis over time is an indication that only slight adjustments are made to prior year’s plans as opposed to conducting deep consumer needs analysis.

While not reflective in the roll-up of all survey results, we did see a significant increase in marketing focus around mobile banking and mobile payment solutions by the largest organizations (over US$10 billion). This is consistent with other research that shows a higher commitment to digital banking by big banks than by smaller institutions.

(Note: The 2016 State of Financial Marketing Report provides a ranking of products by level of marketing emphasis including rankings by institution type and asset size. There is also a trend report showing changes in emphasis over the past 4 years)

3. Limited Data Analytics

The largest banks appear to be doing a better job in this area compared to their smaller counterparts, but nobody is out of the big data woods. In other industry studies, it has been found that there is still an issue with multichannel attribution and customer journey measurements, usually having a negative impact on measuring the impact of digital channels.

Despite this being one of the top challenges mentioned, only the largest regional and national banks (over US$10 billion) ranked improving data and analytics capabilities in their top three priorities (47%), compared to community banks and credit unions (only 8% of these organizations placed data and analytics in their top 3 priorities). In addition, only 36% of organizations were planning to increase their data analytics budgets by more than 10% in 2016, reflecting a surprising lack of commitment to alleviating this challenge.

(Note: The 2016 State of Financial Marketing Report provides an analysis of marketing priorities by organization type and size as well as a trend analysis of marketing priorities for the past four years. The report also provides an analysis of budget allocated to 13 marketing channels and tactics)

4. Marketing Automation and Personalization

The ability to take advantage of the benefits of marketing automation and personalization is a top 5 challenge for all sized organizations according to this year’s financial marketing survey. Despite the challenge, as with the challenge of managing results, this ranks surprisingly low compared to other priorities.

This represents a customer experience “perfect storm,” as consumers are demanding that partners in their daily lives know them, look out for them and reward them as individuals, yet most banks and credit unions are not budgeting or committing to this requirement. According to this year’s survey, the challenge is especially acute for community banks, that appear to lack the resources and are not prioritizing for the reality of needing to become a digital bank.

Consumer expectations are being set by other industries and the bar is getting higher every day.

5. Lack of Budget and Human Resources

Rounding out the top five overarching challenges in financial services marketing mentioned by all sizes and types of financial organizations is the lack of budget and/or manpower to get the job done. Unfortunately, catching up to an ever demanding consumer gets harder and harder if resources are not properly allocated.

The results of this year’s survey provides evidence that many banks and credit unions have not made significant changes to their marketing strategies to adequately address the changing consumer and competitive landscape. When we look at trends over the past four years, most institutions seem to make only small adjustments to goals, strategies and tactics hoping for an evolutionary result.

The question needs to be asked whether more budget and people are needed or whether budgets and people need to be reallocated for the digital future. The models and strategies in place today at the majority of financial institutions are not going to generate the acquisition, share of wallet or loyalty goals that financial marketers say they aspire to.

When we asked bank and credit union executives about how much they allocate to various communication channels, interesting disparities were evident. For instance, while the vast majority of financial institutions have reduced their offline marketing budgets, there are still 42% of institutions that allocate 50% or more of their budget to offline channels (16% of respondents allocated 70% of more of their budget to offline channels).

Similarly, while online communication budgets are increasing, 82% of banking organizations allocate 30% or less of their budget to online channels. It also appears that there is still only a minor commitment to mobile channel marketing, since nine in ten organizations allocate 20% or less of their budgets to mobile (70% allocate 10% or less).

(Note: The 2016 State of Financial Marketing Report provides an extremely deep dive into financial marketing budget allocations, including total marketing budget changes over time and by size of institution, marketing budgets as a percentage of assets, marketing budgets by strategic goal and channel, and anticipated change in marketing budget by channel and tactic)

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

A Call to Action

The 2016 State of Financial Marketing Report found that most marketers are acutely aware of what needs to be accomplished, but have not made the required changes to their marketing organization or their priorities to succeed. Instead of making relative modest adjustments to marketing plans, most organizations need to start from scratch and rebuild their marketing plan to mirror organizations in other industries.

Alleviating the insanity in financial services marketing is not impossible. It requires changes in priorities, strategies, budget allocation and even personnel. It is time for a paradigm shift from the financial marketing strategies used by the last generation of bankers and credit union executives.

Purchase The Report

The 2016 State of Financial Marketing Report, sponsored by Deluxe, provides the most comprehensive guide of bank and credit union marketing trends and spending. The report is based on a survey of close to 300 financial services marketers and includes 62 pages of analysis and 40 charts.