Becoming a digital lender is not easy. More than just a new mobile app or converting paper forms to a digital format, competing with fintech providers requires restructuring of legacy back-office processes that are inherently slow. By only focusing on the delivery channel, most financial institutions are avoiding the difficult challenges of streamlining data input, credit adjudication, forms management, customer communication and loan closing.

According to research from McKinsey, there are challenges with legacy IT lending systems, a lack of trust in automated decision making, insufficient cooperation between businesses and risk, IT, and operations functions, limited data access, and scarce digital talent to make an optimal digital lending process a reality. In addition, since there usually is no single “owner” of the credit process with the discretion to drive change at scale, most efforts lack focus and top-down commitment to broad improvements.

The challenge is that introducing advanced digital transformation in lending is not a “project.” With a process as broad as digital lending, a significant number of stakeholders need to align and remain constantly on task over a prolonged period (two to three years). This broad scope has derailed or delayed many digital lending transformation processes.

For the second consecutive year, global research on the state of digital lending was conducted by the Digital Banking Report. In 2018, we found that organizations were just beginning to embrace the need for online and mobile lending solutions. What we found in the 2019 Digital Lending Review, sponsored by Meridianlink, was that while there was significant growth in the number of organizations offering online and mobile lending functionality, most of the offerings are substandard compared to fintech and big tech alternatives. In other words, banks and credit unions are creating digital lending options that are slower and have more friction than the competition.

For the second consecutive year, global research on the state of digital lending was conducted by the Digital Banking Report. In 2018, we found that organizations were just beginning to embrace the need for online and mobile lending solutions. What we found in the 2019 Digital Lending Review, sponsored by Meridianlink, was that while there was significant growth in the number of organizations offering online and mobile lending functionality, most of the offerings are substandard compared to fintech and big tech alternatives. In other words, banks and credit unions are creating digital lending options that are slower and have more friction than the competition.

Banks and credit unions need to take an end-to-end view of the entire customer journey to best move from traditional lending to digital lending. For instance, McKinsey found that most organizations may be best to limit the scope of the first wave of the transformation and focus on an effort that will drive significant value, while still being able to be implemented relatively quickly. With this scope as the foundation, adjustments and improvements should be made on an ongoing basis over time.

It must be remembered that digitization of the lending process doesn’t completely replace interaction with humans. While much of the process can take a self-service approach, many organizations believe that a multichannel, single application route works best.

The key takeaways from the 2019 Digital Lending Review were:

- The majority of consumer loans still require branch involvement.

- Financial institutions are introducing new digital lending solutions.

- Most new digital lending apps from banks and credit unions do not meet consumer expectations.

- The consumer desire for digital lending functionality is grossly understated.

- Organizations are increasing collaboration with fintech providers.

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs.

A Need to Improve the Loan Application Process

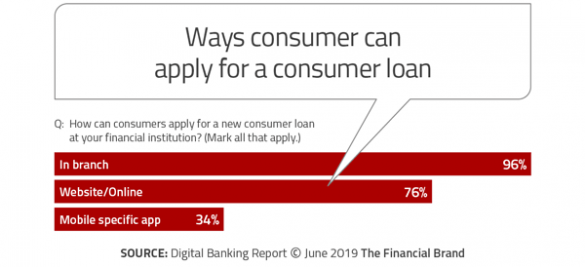

In 2019 Digital Lending Review, our research focused on ‘consumer loans’ as a product class. We also asked some specific questions regarding the digital engagement on other types of loans. As would be expected, virtually every organization surveyed globally had the ability to accept consumer loan applications in a branch office. In addition, 76% of respondents indicated the support of an online/website application process, which is a 5% increase from 2018. As in 2018, the availability of digital account opening was higher for larger banks and credit unions (over $1 billion).

According to our survey, 34% of organizations had a mobile-specific app for consumer loan applications. The ability to apply via a mobile device was significantly higher than in 2018, when the mobile specific application capability was only 26%. The difference between large and smaller organizations was more pronounced for the mobile application capability than was seen with online/website applications.

End-to-End Digital Application Functionality

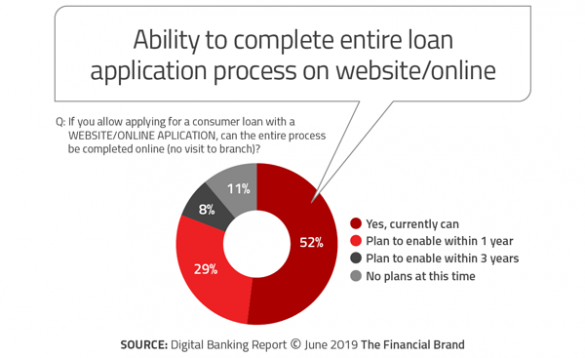

Of those organizations that answered yes to the ability to process online/website and mobile applications, we inquired as to their ability to support a complete end-to-end application process. We found that 52% of organizations were able to complete an online application from end-to-end. It is clear that more organizations than ever are focusing on simplifying the digital lending process since the percentage of organizations that said they could provide end-to-end applications increased by 12% this year.

Similarly, 29% believed they would have this capability in the next year, which was down from the 35% level in 2018, reflecting that more organizations are where they want to be. The percentage of organizations that have no plans to offer web/online lending functionality dropped from 14% in 2018 to only 11% this year.

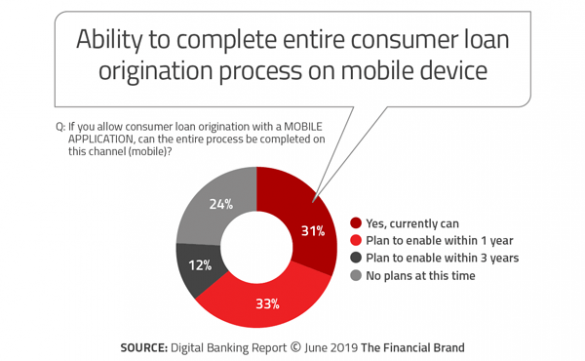

When we asked the same question for mobile capabilities, we found that only 31% of organizations can support an end-to-end application process, which was an increase from 20% in 2018. Another 33% planned to have this capability in the next year compared to 39% last year, again reflecting that more organizations had actually implemented mobile applications. The percentage of organizations with no plans to provide mobile lending application capability remained stable over the past year at 24%.

These results indicate that there is a much stronger movement towards consumer lending digitization, but that the majority of organizations still have not gone beyond digitizing forms for the online/website and mobile channels. In other words, while there is positive movement towards digitization, traditional financial services organizations are still playing a game of catch-up, with market leaders far in the lead.

For Digital Lending, Speed is Essential

The level of digital functionality, customer experience and speed of fulfillment provided by other industries such as travel and retail set a high bar of expectation, which banks must now meet. The desire for immediacy and personalized service is driving more proactive digital strategies in the financial services industry, with the ultimate goal of improving the customer experience.

As banks and credit unions evaluate how to make strides toward achieving this overarching goal, there are several avenues worth exploring, starting with treating financial institutions more like a digital factory. Process quality improvements that are traditionally associated with manufacturing can dramatically advance the service areas of a bank by helping the organization become more efficient while also improving quality, reducing costs and risk, and increasing customer satisfaction.

At the end of the day, customers can no longer comprehend a bank providing a credit decision in one day, let alone one hour or even 10 minutes. In fact, most consumers expect a close to immediate approval time, and a highly streamlined application process that uses insight already on file (or on the mobile device) to pre-fill information.

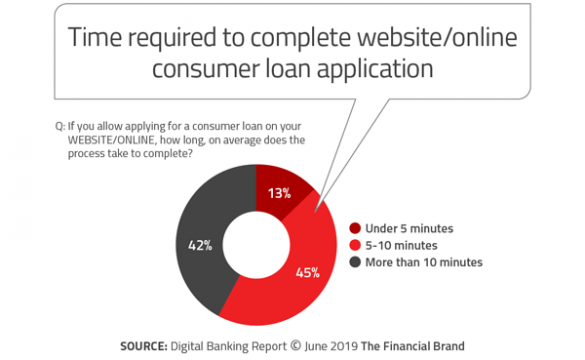

We found that the time it takes to complete an application at the vast majority of financial organizations is still not digitally adept. Our research continues to find that most applications are not reflective of what is possible in a digital world. For website/online applications, 87% of the applications took consumers more than 5 minutes to complete. Somewhat unbelievably, this is 5% higher than our research in 2018. What is of greater concern is that the percentage of institutions that said customer could complete a loan application in less than 5 minutes also dropped from 19% in 2018 to 13% in this year’s report.

From our perspective, this is unacceptable. It illustrates that we are not building digital loan processes, but simply turning old processes into a digital app.

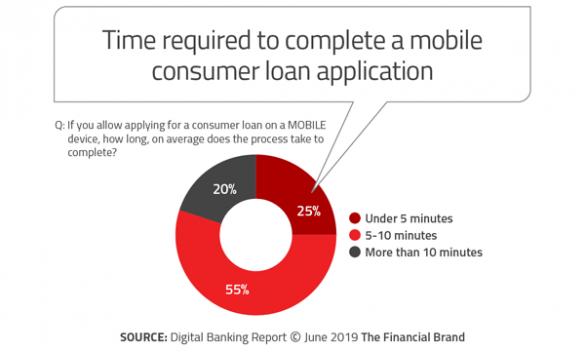

The good news is that the mobile application processes have improved marginally. In 2018, 23% of organizations stated that the consumer could apply in 5 minutes or less. This year, 25% said they could achieve this level of speed. While 52% thought the process would take 5-10 minutes in 2018, 55% said the process would take this long in this year’s research. As an industry, we should be concerned since alternative lenders (with no prior customer relationship) can far exceed these time parameters.

One additional insight that should concern banking executives is that 37% of respondents stated they “did not know” how long a mobile application takes at their organization. We believe that virtually anyone at Rocket Mortgage knows the time it takes to generate a mobile application.

Start Building Digital Lending From the Foundation

Everyone is talking about automation, digitization, robotics, etc. – but not about preparing for automation. Installing new digital banking technology doesn’t help much unless the routine task processes that are being automated are first closely examined and streamlined. Now applying the principles of “industrialization” and efficiency management to white-collar jobs — as blue-collar work was industrialized over 100 years ago.

Without a review and revamping of these underlying processes, any digital lending initiative will fall short of full optimization and, at worst, simply automate already dysfunctional processes.