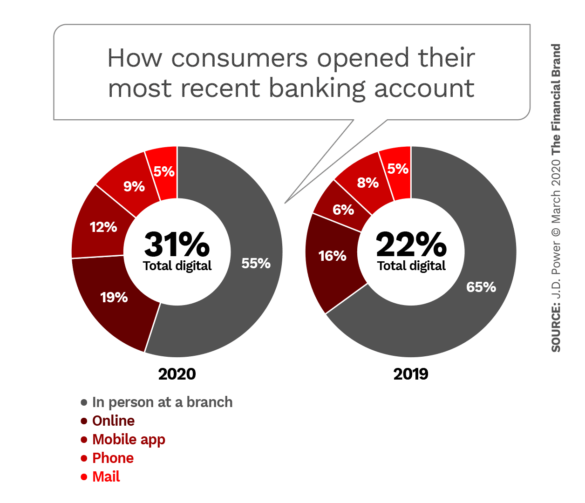

Tucked into a larger report from J.D. Power on bank advice satisfaction was a little-noticed, but revealing finding: Digital new-account openings rose nine percentage points from 22% in 2019 to 31% in 2020. Conversely, in-branch account openings fell by ten percentage points to 55%. The report was released in January 2020, and at the time, J.D. Power predicted that less than half of all new bank accounts would be opened in a branch within two years.

Now, of course, in-branch activity is severely restricted with every American urged to stay at home except for taking care of essential needs. Banking is one such need, but with a large and growing number of financial institutions limiting branch access through outright closure, appointment-only service or drive-up only, the half of consumers who open bank accounts in a branch now have to find another way, or just wait if they can.

Digital channels, phones and mail are now the main banking options for everything except safe deposits, coins and possibly notarization. The same should hold true for account opening. By necessity — if not preference — retail and business customers will need to open accounts digitally as long as the coronavirus pandemic lasts.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Racing to Get Up to Speed

The degree to which banks and credit unions can accommodate that need varies by which data you look at. In early 2019, among a sample of 160 banks and credit unions, 30% had in-app mobile account opening in production, with another 23% planning to offer it, according to Celent. Banks over $50 billion were most likely to offer mobile digital account opening, at 55%, compared with 25% for banks below $1 billion and 30% for credit unions.

A survey by Thynk Digital of nearly 500 bank and credit union executives in 2019 found that 53% said that consumers could open an account with their institution online, without coming into a branch. That number may have been optimistic, however, as only 26% of the nearly 10,000 consumers polled for that research said they had actually opened accounts online — and half of them had to go to a branch to finish the process. Even allowing for subjective interpretations of terms, there is clearly a large gap.

Banking executives have been getting the message. Nearly seven out of ten bank respondents say that creating a digital onboarding (including account opening) capability is an active project, of which 35% consider it a top priority, according to a survey by OneSpan North America.

Now with the demands of the coronavirus situation, it’s easy to imagine that number being close to 100%. As Bob Meara, senior banking analyst with Celent, observes, “Large banks were the first to stand up viable digital customer acquisition and onboarding capability. Now, the rest of the industry is racing to catch up.”

Account Opening and Onboarding Resources for Banks & Credit Unions

- “Digital Banking Customer Engagement” Digital Banking Report (71 pages)

- “Five Mistakes to Avoid in Digital Account Opening” Cornerstone Advisors (16 pages)

- “Digital Account Opening in Small-Business Banking: Keys to Evaluating Vendors” Javelin (16 pages)

- “Top Online Account Opening Vendors of 2019” CU 2.0

- “AI: Transforming the Digital Account-Opening and Onboarding Experience” Aite/Q2 (22 pages)

- “Now Tech: Digital Banking Platforms, Q4 2019” Forrester (overview of 35 platforms)

- “Best Practices in Retail Banking Customer Acquisition” Celent (37 pages)

The Good News: Satisfaction Is Up

Just months before the coronavirus pandemic exploded, consumer satisfaction with the bank account-opening process increased across the board in J.D. Power’s research, although it was up more for branch openings than digital. In the firm’s proprietary 100-point index, branch-based account opening improved by 16 points, while digital account opening improved by 11 points.

It’s ironic that branch account opening was getting better just prior to having branch access sharply curtailed due to the coronavirus. While the pandemic could speed branch (and bank) consolidation, few are expecting in-person banking to disappear, so the improvement in branch account-opening experience is still good news.

Paul McAdam, J.D. Power’s Senior Director, Banking, told The Financial Brand that the strong in-branch satisfaction scores were largely driven by Baby Boomer and older (Pre-Boomer) consumers. The majority of PreBoomers (84%) and Boomers (78%) open accounts in person, according to the survey.

An interesting side-note in the data was that Gen Z, the youngest adults in the survey, opened a new bank account more often in a branch than did Millennials (55% to 42%). McAdam wasn’t surprised by that, observing that even though Gen Z is very tech savvy, many of them would have been opening their very first banking account. They were looking for some human guidance to understand the products.

The two factors that drove most of the improvement in account-opening satisfaction overall were: “Ease of opening an account” and “Reasonableness of time spent opening an account.” This was true for both in-branch and digital account opening.

“Account opening is the first moment of truth. Consumers want validation that they’ve made a good decision.”

— Paul McAdam, J.D. Power

Digital did have one notable negative relating to fees. 28% of consumers who opened checking account digitally were surprised by fees versus 13% who opened a checking account in-branch. For all types of new accounts, including loans, the difference was similar: 33% digital versus 14% in-person surprised by fees. That data suggests that there is work to be done in making digital account opening truly informative and transparent.

McAdam calls account opening “the first moment of truth,” particularly for new customers. “There is some uncertainty at that point,” he states, “which is why it’s so important to make a good first impression. Consumers want validation that they’ve made a good decision.”

He adds that the account-opening process is a great opportunity “to help your customer become a better customer” — i.e. learn how to use your services better. In the process they also become better-informed consumers.

As confirmation of this, McAdam says the research found significant increases in digital account opening satisfaction when an institution’s website or app “prompts the consumer with questions to help select the right product” and “offers a way to compare features and fees of multiple products.”

Some Specific Suggestions for Digital Account Opening

Celent’s report, “Best Practices in Retail Banking Customer Acquisition,” contains numerous suggestions for banks and credit unions ramping up — or looking to improve — their digital account opening and onboarding capabilities.

Here are three specific suggestions from the report, written by Bob Meara:

Invite a dialog. Many consumers using digital to open an account will likely wish to be left alone, but for those who may have questions along the way, a simple invitation to chat may help move them along. This could take many forms: live text chat, click-to-call, video chat, or even digital appointment booking. The time to do this, the report states, is while the application is open, not after it has been abandoned.

Be sure to align marketing and customer acquisition. If a campaign advertises a promotional rate, the application should directly link to the promoted product, rather than forcing consumers to navigate a product comparison page. This doesn’t require artificial intelligence, the report notes. It simply requires a “configurable user experience design specific to each campaign or promotion code.”

Make it REALLY easy to resume. A very apropos suggestion during the pandemic, when multitudes of consumers, going online from home, are subject to interruptions from children, spouses, pets and work at any time. When this happens, it is imperative that customers can easily pick up where they left off, particularly if doing so involves assisted service in a contact center.