While fintechs are making waves today, there has been a long-term natural rivalry that has led to complaints about unfair advantages. The traditional U.S. retail “banking” market continues to be comprised largely of banks and credit unions, notwithstanding the growing influence of fintechs. Both banks and credit unions offer similar products for their core consumer and bank small business customers and credit union members who operate businesses. Commercial banks can offer more product capabilities.

In recent years there has been a tendency to lump banks and credit unions together. Through the years, I’ve built distribution strategies for both banks and credit unions of all different sizes, and I’ve come to recognize several core differences between these institution types. Let’s explore them.

How Bank and Credit Union Branch Strategies Differ

For the last several years, some pundits have been predicting the end of branches as digital channels grow in importance. In article after article, you find authors discussing for the acceleration in branch closures.

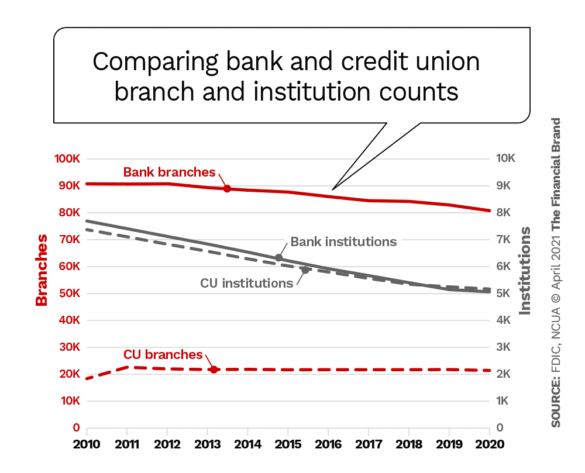

The reality is much different. There are currently about the same number of banks as credit unions (roughly 5,000). The total number of credit unions declined by 29% in last ten years, slightly slower than banks (31% decline).

While bank branch counts declined by 7% over those years, credit union branch counts were basically flat, only seeing a small decline (3%) in 2020 during the Covid-19 lockdown. With all the talk about branch closures, total branches are down only 9% since yearend 2012.

The Contrarian View:

What will the long-term impact of Covid-19 be? Likely a short-term increase in branch closures before returning to pre-Covid-19 trends — which means an increase in new branch openings as well.

While there are basically an equal number of credit unions and commercial banks in the U.S., there are four times as many bank branches as credit union branches, according to FDIC and NCUA figures. That’s 79% for banks and 21% for credit unions.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

In fact, the average credit union has just five branches versus 20 for banks. About 20% of banks have only a single location, but 45% of credit unions operate just a single site.

Scale matters in retail site selection. Having a larger branch network in a market creates a level of convenience that people still desire. Most consumer studies still report “convenient branches and ATMs” or “branches and ATMs near where I live and work” as top reasons for selecting where to bank. Credit unions’ smaller branch networks put them at a disadvantage for attracting customers.

Because of the smaller average size of branch networks, each additional decision to open a new branch takes on even more importance. No matter your scale, it’s important to make informed decisions.

Read More: Research Predicts All U.S. Bank Branches Could Be Shuttered by 2034

How Branch Network Size Affects the Deposit Base

This “scale disadvantage” may be one reason why the average credit union branch’s deposit base is approximately 28% smaller than the average retail bank branch’s deposit base. In aggregate, credit unions represent just over one-in-five branches but just under one-in-six deposits. The average bank branch is $97 million dollars and the average credit union branch is $69 million. (Note: In this analysis, individual bank branch deposits are capped at $500 million to minimize impact of corporate deposits.)

A $28 million deposit base difference drives meaningful differences to the bottom line. According to NCUA, the average net interest margin for credit unions today is 2.82%. At such spreads, a $28 million deposit base difference translates into a $790,000 annual difference in branch revenue. A $69 million branch is already profitable, so an incremental boost of $28 million almost completely drops to the bottom line.

FDIC reports on net interest margins for all banks and for the community bank subset. Community banks offer a good comparison to credit unions. While the average credit union NIM (Net Interest Margin) is 2.82%, community banks’ NIM is 50 basis points higher at 3.32% in the latest reporting at this writing. Many factors could be driving this difference: product mix, pricing, regulatory requirements, cost structure, etc.

Let’s look at loan-to-deposit ratios. The national rate for credit unions is 60% according to NCUA, while banks are at 73%, according to NCUA. Leveraging liabilities into revenue-driving assets seems to be one gap between credit unions and banks. This could be one reason NIMs vary.

Bottom Line: Banks Are More Efficient

Is it a matter of demand? Is it a regulatory difference? Is it risk aversion? Is it business model differences? Regardless, all these differences produce a different financial outcome, which can be measured with the efficiency ratio.

.

The efficiency ratio measures the cost to produce a dollar of revenue and is calculated with the following formula: non-interest expense/net interest income + non-interest income – loan loss reserves.

For banks, the average efficiency ratio is 74%, while credit unions average 81%. (Remember, lower is better.) I work a great deal with credit unions to craft new distribution strategies to drive cost-effective growth, and we always start with an exploration of cost-savings opportunities. I see many credit unions with efficiency ratios in the high 80%s or even the low 90%s.

Does the desire for a better customer experience drive credit unions to overstaff branches? As a non-profit, is expense control not as high a priority?

Read More: 5 Competitive Lessons Credit Unions Can Teach Banks

Regulatory Differences Still Distinguish Many Players

Numerous similarities exist between banks and credit unions, such as their business of providing services to savers and borrowers. But some key differences may contribute to the different outcomes.

A credit union is a non-profit, membership-owned cooperative organization where members share some common bond. While credit unions are given more regulatory leeway than their bank counterparts, and are exempt from federal taxation, they do face regulations. As specified in the Federal Credit Union Act of 1934, they are formed for the purpose of promoting thrift among their members and providing them with a low-cost source of credit.

Conversely, a bank is a for-profit institution owned by equity holders who may not necessarily be customers (depositors or borrowers). Although it must also obtain a state or federal charter, a bank does not have similar membership and commercial lending restrictions that credit unions generally do. (The banking lobby will point out that there have membership liberalizations in recent decades and likewise the member business loan rules have been widened.)

Key Question: Who’s Got the Regulatory Advantage?

Currently banks fall under Community Reinvestment Act regulations, credit unions aren’t. Does the restriction on credit union business lending amounts contribute to the lower LTD ratio and NIM?

Two Sub-Industries Coming Closer Together

Banks and credit unions are both designed to serve consumers and businesses. Historically, credit unions had a reputation for better member service, but recent surveys suggest that advantage may be waning. Banks, on the other hand, tend to offer more branch choices and may be more convenient.

In my opinion, there are more similarities than differences nowadays. While many credit unions started with a member base tied to one company or industry, more often today they have community charters allowing anyone within some defined geography to join for a very small deposit.

Key Insight:

Basically, credit unions are trying to be more like community banks offering more convenience, and community banks are trying to be more like credit unions in terms of service.

The biggest difference between these two financial service provider types is the tax status. Does that advantage lead credit unions to be a little lax in expense control or a less focused on revenue growth?

Perhaps. But for the clients I’ve worked with in the last several years, there is now a more focused effort on those financial factors as they try to battle both traditional and new forms of competition.

Steps Towards Improving Profitability, Whether You’re A Bank or Credit Union

Unless you’re a digital-first institution, your branch and ATM networks are probably your largest expenses next to staffing. The retail financial services business is much like a manufacturing plant with high fixed start-up costs. Once the foundational expenses are covered, building incremental scale is less expensive.

However, unlike a manufacturer who sells a “product” where they hope to attract customers to come back and buy more, retail financial services providers essentially sell a “subscription.” People pay a recurring fee for access to services, and providers focus on retaining accounts and attracting new ones.

To improve your long-term financial health in retail financial services, you must have scale. The ability to reach and attract more customers or members is dramatically improved by having a larger network. But you need to drive growth intelligently.

Each new branch decision represents a big investment of both capital and expenses, as you are making a long-term commitment to that new site. Often, you are better off building a second or third branch within an existing market to create a convenient “network.” With today’s analytical tools it is now possible to define an “optimal” network for every market and every budget.

If your firm lacks digital capabilities, you operate at a disadvantage to your competition. Offering good online and mobile capabilities are now table stakes. If you don’t offer them today, that’s a good starting point for new investment.

But keep in mind that most customers still want the physical branch experience, even those digital-first customers. They consider it “insurance” in case they have an issue.