According to a whitepaper from Oracle and Efma, banking organizations are making some progress towards harnessing consumer insight to enhance the customer experience and to boost overall profitability, but there is still a long way to go. Although consumers prefer a personalized approach, most financial institutions seem to understand their expectations, but can’t meet these expectations as they’re faced by various challenges. For instance, most are unable to offer products or solutions in real time.

In addition, most banks and credit unions don’t have a full view of their customers or members across the organization. This results in lost opportunities to engage or provide proactive advice and well as increasing the cost to serve for the institution. Finally, few organizations are collecting insight from outside sources – such as social media – to gain a 360-degree view of consumers.

While it is universally agreed that insight and customer data is an increasingly important potential differentiator against competition, this is only true if the right insight is collected and used for the benefit of the consumer. In other words, unless the data can be used to “know the customer”, “look out for the customer” and “reward the customer”, the insight is of limited value.

Oracle and Efma conducted a survey of senior executives from 60 financial institutions globally. The study explored how the industry is using data to build more personalized experiences and applying data for more profitable pricing strategies.

Collection and Use of Insight Falls Short of Potential

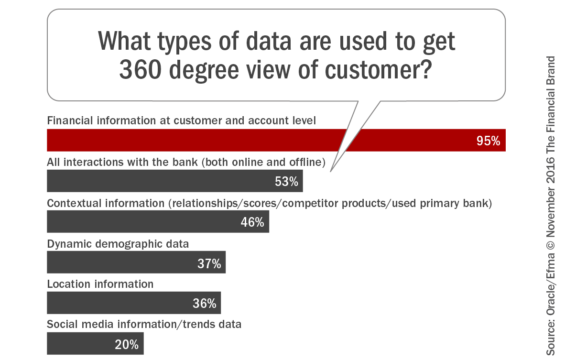

According to the Efma/Oracle research, the majority of organizations only leverage insight around customer accounts held, balances and interactions/transactions. In these cases, there is often still an inability to see understand the level of customer engagement across the organization, falling short of the preferred 360-degree view desired.

The collection of contextual insight, locational information and unstructured social media data is far less likely to be done by the organizations surveyed. While the research found some testing being done with this data, it was far from universal.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

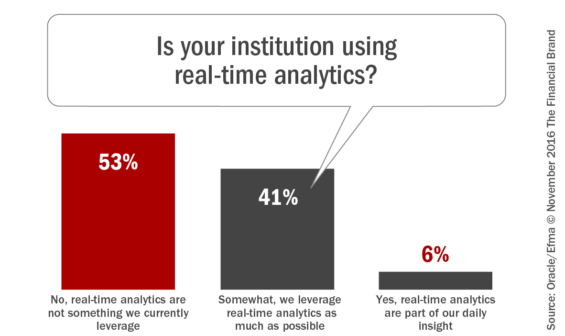

Over half of the organizations surveyed were not using real-time analytics at all, with only 6% of banks using real-time analytics on a daily basis. According to the white paper, “One significant reason {for not using real-time analytics] is that this approach can potentially conflict with the privacy of client information, which is also a growing concern for banks.”

For the 47% of organizations that are using real-time analytics to some extent, the application of data for ‘Next Best Offers’ was done by 59% of the organizations. The reason for this was because ‘Next Best Offers’ are a more straightforward way for a bank to use real-time analytics. It is also a more reactive approach, that involves looking at real-time customer behavior and then developing rule-based offers. Other primary uses of real-time analytics was for customer retention (50%) and monitoring customer traffic acros channels (47%).

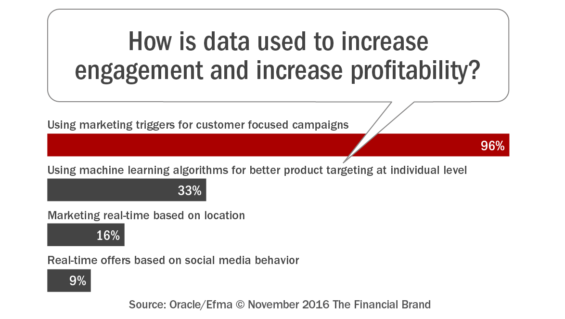

When asked, “How are you leveraging data/information to better engage customers and increase profitability?”, the overwhelming majority of organizations want to use insight to deliver the right offer, to the right customer, at the right time. They believe this enhances the customer experience while also reducing costs of delivery.

While virtually all banks surveyed indicated they are using data for targeted marketing campaigns, none of the respondents from the US indicated that they use real-time location information or social media activities for marketing. This was also the case for all of the largest banks with assets of over US$300 billion. In fact, only 6% of the organizations surveyed indicated that they used social media insight for understanding their customers or engagement.

According to the white paper, “Few banks are taking [analytics] forward to the next level to ensure that their customers are being engaged throughout the campaign. Data is valuable, but if banks fail to use all of the different elements available, this can ultimately lead to lost customers.”

Improving the Depth and Use of Big Data

While the banking industry has a vast amount of data at their disposal, that doesn’t necessarily equate to valuable insight when trying to develop offers and increase engagement and loyalty. There’s a much wider (and potentially more valuable) pool of information from which organizations. This includes both structured and unstructured data that comes from sources such as social media, digital (mobile) engagement, locational insight and other online activities.

When it comes to the use of big data, many banks are still in the planning stages. “There is perhaps a reluctance to forge ahead due partly to perceived costs and also due to the difficulty of knowing which data to use and how to use it effectively,” says the whitepaper. This gap between the amount of data and its usage is growing which the research shows is a cause of concern.

The key is to identify the data which will be most useful to an organization and then finding ways of using it most effectively to boost customer engagement and to enhance the customer experience – which will lead to greater profitability.

Despite knowing the importance of leveraging “big data”, 49% of the organizations indicated that they were only in the planning stages. A similar percentage (43%) said that they had started the journey, but are still in mostly uncharted territory. Only 8% of those organizations surveyed said that they used big data technologies and insights on a daily basis. When the survey asked about what types of big data banks were using, a majority (60%) of the respondents are augmenting their existing data with more structured data. A questions could be asked whether ‘easy’ data is the ‘best’ data for marketing communication, advice and solution decisioning.

Leveraging Data for Improved Pricing

Using big data for marketing is just one of the many ways customer insight can improve the customer experience as well as the organization’s profitability. Data can assist in reducing friction in the back office and can assist in risk and fraud determination. In addition, customer data can be applied towards the development of improved pricing and produst development models. “Banks are rapidly recognizing the need to differentiate in terms of the customer experience required, and pricing based on the relationship (rather than just risk-based pricing) is a very important aspect of this,” states the whitepaper.

Most banks surveyed (79%) still use a product-centric approach. There has been a move towards other strategies, however, with risk-based pricing being the most prominently used method. A large percentage of organizations also indicated that they use relationship-based pricing,

The Future of Understanding the Consumer

While the availability of data within the banking industry was always considered a strong benefit, most organizations are not currently using the available data optimally and may not be using the right data at all. To remain competitive in the “Age of the Individual”, banks and credit unions must improve both the collection and use of data to provide a more proactive and contextual customer experience.

“Information is the lifeblood of financial institutions,” said the whitepaper. “Banks are in the privileged position of having access to a huge volume of data relating to their customers. How this is used can make a big difference to the customer experience – and ultimately to the profitability of the bank. The right information, analyzed in the right way, can ensure that the bank can provide the right offer at the right time – along with a seamless service at a lower cost. And that has to be good for everyone involved.”

Further Reading

Readers of The Financial Brand can download the Efma/Oracle whitepaper on using data to understand consumers, improve pricing and increase profitability on the Oracle website.

You can find additional insight in the The Power of Personalization in Banking report, sponsored by Personetics, provides unprecedented insight into the minds of consumers and the activities of financial institutions around personalization and contextual engagement. The report includes the results of a survey or 1,000 consumers as well as a survey of more than 300 financial services organizations. The report includes 64 pages of analysis and 60 charts.