Over the past year, I have had the opportunity to write extensively on the future of banking. Many of these articles and research reports have centered on using advanced analytics to provide an improved customer experience and the importance of changing many of the pillars of the legacy banking organization to better serve the consumer (back office systems, a siloed structure, physical branches, etc.). The majority of these writings were well received, with almost uniform agreement on what is needed for financial institutions to succeed in the future.

As I prepared for a recent presentation, I realized that many of the talking points I was going to use were not too dissimilar to what was discussed within the banking industry in the 1980s. Then I wondered, why is there so much inaction on such important keys to success that so many banking executives agree upon? For that matter, why should the consumer believe we will make banking better for them when we have failed on so many fronts for the last 30 years?

It has been said that when a word is deprived of its dimension of action, the word is changed into idle chatter and into an alienating “blah”. Further, it has been said that words without action will end up costing more in the long run. I believe that this is a lesson that banking needs to learn.

Customer Relationship Management (CRM)

While the terminology and acronym may have changed over the past 30 years, the importance of using customer data to improve the personalization and contextuality of marketing communications, product development and offers, and the overall customer experience has been at the forefront of banking’s “to do list” since the advent of the modern computer. Having access to a treasure trove of data, from basic demographics to account ownership and behaviors, banks and credit unions have more insight into their customers than virtually any other industry.

So why, after decades of discussing the importance of customer relationship management, 1:1 marketing, and the removal of silos can’t most financial institutions know that I have a small business account if I walk into a branch with a question about my personal banking relationship? For that matter, why do insights around my mortgage loan and credit cards also reside in separate silos and not part of an overarching 360 degree view of my relationship? Without this overarching view, consumers are forced to start from scratch each time they want to expand their relationship at most institutions, providing information that already resides on the organization’s database.

Potentially more important, as the banking industry seeks to replicate the digital experience of such consumer-centric organizations such as Uber, Apple, Facebook, Amazon and others, banking is usually unable to leverage the insights on customers for the benefit of these same customers. Where Uber can provide a ‘contextual commerce’ experience, including a digital hotel keys to the hotel I am being driven to, and restaurant suggestions around my destination (along with integrating the payment process), many legacy financial organizations can’t provide more than historical transaction data on a mobile device.

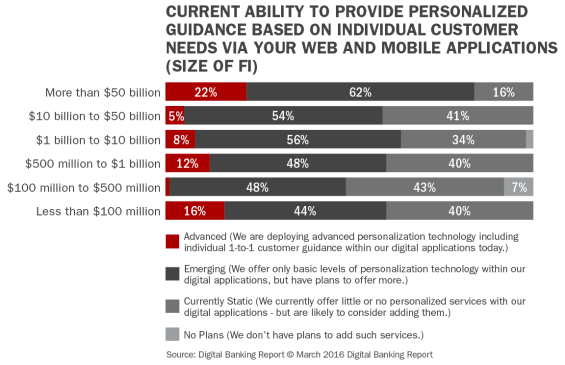

Despite the almost universal agreement that the banking industry needs to improve the use of data to deliver an enhanced consumer experience, and the decreasing cost of technology to deliver on this promise, advanced analytics remains a low priority according the Digital Banking Report. In addition, while banking organizations indicate they want to deliver real-time insights to customers, less than 20% of the industry currently has this capability according to the Digital Banking Report, The Power of Personalization in Banking.

Of more concern is that roughly 40% of all but the very largest financial institutions place themselves in the ‘Static’ self assessment category.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Ease of Engagement

Since I was a management trainee at National City Bank in the late 1970s, the banking industry has tried to make it easier for the consumer to conduct banking. From the advent of the drive-up teller, credit and debit card, ATM and direct deposit, to more recent developments like mobile banking and remote deposit capture, the industry has leveraged technology to simplify engagement. The problem is, much of this advancement has been focused on taking costs out of the banking process as opposed to focusing on improving the consumer experience.

In the annual 2016 Retail Banking Trends and Predictions, published by the Digital Banking Report, ‘removing friction from the customer journey’ was the second most mentioned trend/prediction by close to 100 financial services industry leaders surveyed. Despite being a primary focus since the beginning of my banking career, why do we still require the consumer to visit a branch to open a new account at most institutions? Why do most mobile banking applications appear to replicate online banking as opposed to being designed like the most popular non-financial mobile applications, with a mobile-first intuitive design and minimal steps to process completion?

The potential cost of not making it easier to conduct banking is the loss of the customer. How long will a consumer who shops for their new banking account using their computer or mobile phone settle for leaving their device to act on their purchase decision? They don’t need to leave the Amazon app to visit a store or purchase a movie, or leave Apple.com to buy music. Maybe the perceived tolerance of this ‘broken process’ is because only 20% of the major banks currently offer a mobile-first account opening process.

The consumer is making their voice heard, however. According to the 2016 U.S. Retail Banking Customer Satisfaction Study published by J.D. Power, the biggest banks have the best customer satisfaction scores for the first time ever, with the potential to steal business from smaller organizations. The advantage in customer satisfaction was attributed almost entirely to the investment by the larger banks on digital delivery that is focused on an improved customer experience.

![Big_banks_take_the_lead_in_satisfaction_for_the_first_time[1]](https://thefinancialbrand.com/wp-content/uploads/2016/02/Big_banks_take_the_lead_in_satisfaction_for_the_first_time1-565x366.png)

Ease of engagement is only the first step as we move forward. According to Accenture, the consumer has indicated they would like a seamless banking experience and an almost invisible part of their daily life. This is a tremendous opportunity for those financial institutions who stop talking about the future of banking … and start delivering this level of engagement. Especially as we enter an era of the Internet of Things.

Relationship Expansion

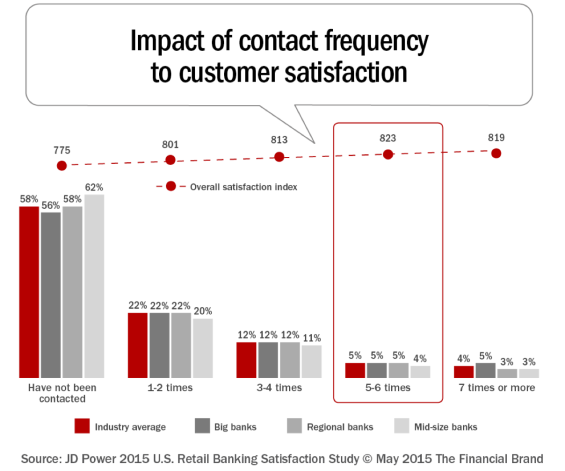

There is probably no objective that has stood the test of time more than the concept of cross-selling. As an industry, banking has always known the importance of garnering ‘share of wallet’ to decrease attrition, increase revenues and improve loyalty. So, why is the new customer onboarding process non-existent at some organizations and underdeveloped at most others? And in a great example of “actions speak louder than words,” despite being near the top of every State of Financial Marketing survey over the past 6 years, less than 10% of financial institutions connect with the new customer using multiple communication channels more than 3 times during the first 180 days of the relationship (5-7 contacts has been found to be the optimal contact level according to JD Power).

Beyond the basics of new account onboarding, very few organizations leverage online or mobile channels to deliver contextual real-time offers based on personalized needs identification.

The difference between the beginning of my banking career and today is that, back in the 80s and 90s, we had the opportunity to meet and understand customer needs better (and offer the right solutions) on a weekly basis when the customer visited the branch. With the vast majority of consumers visiting a physical facility much less often (or not at all), the need to deliver relevant offers via digital channels is no longer just an option … it is a necessity.

The required technology already exists to deliver these offers based on timing as well as location (as Uber and other organizations do today). The consumer is expecting this level of engagement.

Financial Advice

The banking industry has always coveted the position as a “trusted financial advisor.” Over the past 40 years, the status of a bank and credit union in this role has changed dramatically, as financial service offerings have become more complex, new competitors have entered the marketplace and the prestige of banking as a career choice for financial advisors has waned. Add the dynamics of the financial crisis and the reduction in visits to a physical branch into the mix, and there is no wonder that 79% of consumers view their banking relationship as transactional or commoditized rather than advice-driven.

This is certainly not good news for an industry that relies on securing a greater share of wallet to make an overall relationship profitable. Especially when interchange and other forms of transaction fees have come under fire. In addition, the ability to provide personalized financial solutions and advice is becoming one of the more powerful capabilities of digital start-ups. It is clear that simply adding licensed agents at physical branches will not be enough to turn the tables.

The vast majority of legacy financial institutions say they want to partner with consumers as they make their financial choices. While these organizations have vast amounts of insight that could be the foundation for this partnership, most insight provided today amounts to nothing more than a “rear-view mirror” view of what has already occurred. Today’s consumer wants a “financial GPS” view of what they need to look out for (financially) in the future. And they want this delivered digitally … in real time.

Again, there is a vast void between what banking says they want to be in the future and what they are prepared to deliver.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Actions Speak Louder Than Words

It is time to put our money where our collective mouths are.

While the vast majority of banking relationships have proven to be highly resilient to changes in the marketplace, with minimal churn, this could be a matter of lethargy on the part of the consumer. As we enter a period of increased digital engagement, switching of accounts (and relationships) may occur with zero advanced notice. The signs of this potential are all around the industry, as satisfaction and convenience are both being defined more by digital capabilities.

So, while this is definitely not the first time this list of “must-do’s” has appeared, it may be the most important. It also represents the most basic requirements to satisfy an increasingly demanding consumer.

1. Customer Relationship management (CRM): Develop an advanced analytics strategy that includes customer insights from across the organization (all silos). Use this insight to drive all customer communication and to provide a more robust online banking and mobile banking solution. Deliver this 360 degree perspective to all internal customer-facing entities as well.

2. Ease of Engagement: Build a digital account opening solution that is optimized for mobile devices and does not require a new customer to enter a branch during the process. This solution must include digital identity verification, mobile funding and information pre-fill for ease of relationship expansion and the digitization of any paperwork that is currently required.

3. Relationship Expansion: Create a multichannel, multitouch onboarding process that helps a new customer make the most out of their new account with your organization. Make sure the contact strategy has a sequence and cadence that optimizes both sales and customer satisfaction. For more on how to accomplish this, refer to the Guide to Multichannel Onboarding Digital Banking Report. Secondarily, but no less important, leverage advanced analytics to deliver financial solutions to customers digitally and in real-time based on contextual insights.

4. Financial Advice: Increase the use of digital alerts and notifications beyond simple messaging around financial events that have already occurred (overdrafts, NSFs, etc.) to include ‘advanced warnings’ of potential issues. As with most deliverables for the digital consumer, providing proactive advice will require a much greater advanced analytics commitment.

It is not a matter of educating the banking industry about what is needed to succeed in the future. Virtually all research studies over the past few years indicate bank and credit union executives know what is required in the future. It is now a matter of committing to the investment of time and money requisite of a successful digital bank.