New customer onboarding in many industries is as simple as downloading an app, inputting a name and email address, and clicking to accept terms and conditions. Subsequent marketing communication then commences, building engagement, loyalty and hopefully, resultant positive word-of-mouth.

Seeking to replicate this mostly digital experience, banks and credit unions have increased their marketing investment in acquiring and onboarding new customers and members. Despite this investment in differentiating the organization’s brand, however, the onboarding experience is often negatively impacted by a process that includes stacks of paperwork, branch visits, overnight mailings, and redundant data requests. Consumers don’t understand why opening a new account is so difficult.

In a new report entitled, ‘All Aboard: Delivering the Onboarding Experience Customers Demand‘, PwC believes financial institutions that get customer onboarding right must focus on three overarching objectives:

- Improving the customer experience

- Protecting the financial institution through thoughtful compliance

- Enhancing operational efficiency and profitability

Financial institutions that get customer onboarding right can improve customer satisfaction, lower churn, and gain better insights into customer preferences and desires, all while reducing costs and enhancing regulatory compliance.

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

First Impressions Matter

While many banks and credit unions cite regulatory mandates as the main reason for not implementing a streamlined multichannel onboarding process, PwC believes these same requirements provide the business case for onboarding improvements that will enhance the new customer experience. From the outset, consumers want to be asked about their individual needs and be advised about services that meet these needs. This is aligned with ‘know your customer’ (KYC) requirements.

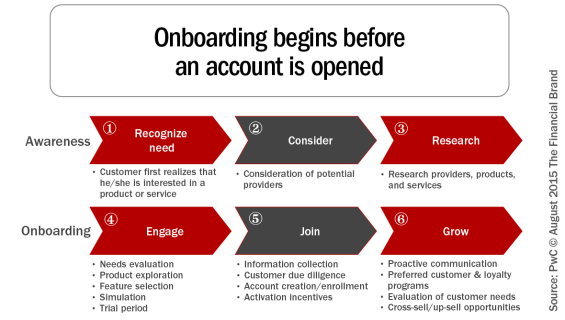

These initial experiences create expectations of what the future holds for established customers. What most organizations don’t realize is that an effective onboarding process begins before the new account is actually opened.

With consumers researching, shopping and, in many cases, opening a new account online or through mobile channels, organizations need to collect insight during the pre-purchase stage of the digital customer journey and provide the tools for the prospective customer to easily open an account. In other words, the onboarding process can begin with no human involvement.

During the first 6-9 months after the account is opened, financial institutions need to proactively communicate, providing interactive tools to educate the customer about ‘go with’ services (online and mobile banking, billpay, direct deposit, etc.). There should also be a continuous process of identifying other products or services that will benefit the customer. If another service is opened, a new onboarding process begins.

Challenges to Effective Onboarding

According to PwC, there are several areas that can pose challenges to financial institutions as they seek to improve their onboarding processes. These include:

- Multichannel Engagement: As organizations attempt to expand beyond traditional marketing communications, using text, video and even social media, it is sometimes difficult to provide a consistent experience across all channels.

- Lack of Coordination: Silos have been the bane of banking organizations for decades, with the lack of coordination between product areas and distribution channels highlighted during onboarding. The ability to view initiatives from the customer’s perspective can be difficult in an organization where product goals reign.

- Antiquated Technology: Successful onboarding needs to be built on a real-time platform that can react immediately to changes in the customer’s behavior, purchase patterns or even their location. The power of contextual marketing is highlighted during an onboarding process.

- Insufficient Analytics: To provide the basis for a test-and-learn onboarding process, not only is a single view of the customer needed, but insight must be provided regarding the customer’s path to purchase. The analysis must also go beyond reports, providing actionable insight that can be used immediately.

- Paper-Based Processes: From new account forms to signature cards, paper-based processes must be digitized to remove friction and simplify the onboarding experience.

Improving the Onboarding Process

PwC recommends that financial institutions perform a strategic review and implement a solution that exceeds the needs of customers, the internal business lines and the regulators. “Before implementing any changes, financial institutions should understand the needs and expectations of their current and potential future customers,” stated the report.

In addition, it is recommended that an internal governance structure be developed to focus on how onboarding can both reduce operational costs as well as improve profitability. This group can also make prioritization decisions regarding technology investments, determine how to meet (or exceed) regulatory requirements and can set the foundation for improving the analysis of results.

Delivering customized onboarding communications based on customer needs requires an institution to first understand what the recipient values and what he/she is willing to pay for. To accomplish this, PwC recommends multiple inputs from voice of the customer analyses that can serve as the foundation for analytics and can help improve customer onboarding.

Benefits of Effective Onboarding

Done correctly, there are multiple benefits of effective onboarding:

- Enhanced Customer/Member Loyalty: Research done by J.D. Power shows that a strong onboarding process results in greater customer satisfaction, improved retention, more referrals and increased sales. Keep in mind that 75% of all cross-selling occurs within the first few months of a customer’s onboarding. Therefore, first impressions are crucial.

- Improved Customer Insight: There is no better time to collect customer insight than during the onboarding process. This not only includes in-branch collection of information across the desk, but digital collection of insight before and after the purchase. Done well, and this collection of insight will result in improved customer engagement and increased sales results across the organization.

- Increased Operational Efficiency: Developing a digital process to replace current paper-based processes (such as authentication, credit decisioning, and KYC) can be leveraged across business units, products, and geographies, improving accuracy and limiting manual processes.

- Risk Mitigation: By creating a single view of the customer early in the onboarding process, an improved audit trail of customer interactions can be maintained, providing enhanced adherence to compliance standards.

Download the Complete Report

The 32-page PwC report entitled, All Aboard: Delivering the Onboarding Experience Customers Demand, is available for download and provides an excellent addendum to the Digital Banking Report, Guide to Multichannel Onboarding in Banking. Beyond reviewing the pre- and post-sale stages of onboarding, the PwC report provides several case study examples, an excellent discussion of the rationale for using onboarding to meet compliance guidelines, and an 8-step framework for improving the onboarding process.