Humans love milestones, and the start of a new decade makes a particularly good perch from which to take a look at what’s further ahead than next quarter’s deposit and loan growth numbers. Several of the most respected banking analysts and researchers obliged with “decade ahead” reflections. The Financial Brand pored over their reports and extracted common themes of particular importance to retail banking.

A Deloitte report opens with a sweeping prediction: “A new wave of disruption more forceful and more pervasive than what we have seen in recent years will likely unfold in the next decade.” Ouch. Before you reach for an antacid, the consulting firm also believes the same forces will create new opportunities “perhaps greater in scale than ever before.”

Overall, the changes stemming from technological, economic, geopolitical, demographic and environmental forces will not only change how banking is done, Deloitte states, but could force financial institutions to rethink their role in society, and “increasingly cater to a greater good, placing themselves at the forefront of tackling large socioeconomic issues, such as climate change or social equity.”

In terms of how banking is conducted, the industry must become more “open, transparent, real-time, intelligent, tailored, secure, seamless and deeply integrated into consumers’ lives,” the report states. Also, in the next few years, more banks and credit unions will partner with others in the financial ecosystem to become de facto platforms, offering services that will extend beyond banking.

That said, Deloitte firmly believes that traditional financial institutions’ core role as financial intermediaries matching demand for capital with supply will likely not change. Further, banks and credit unions will remain “trusted custodians of customers’ assets,” which could expand to include digital identities. In doing all this, the report notes, the industry possesses great strengths in managing risk and complex financial matters in a highly regulated market.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Insights Will Be a Banking Differentiator

In its annual outlook survey of community banking institutions, CSI found that the largest proportion of respondents (41%) identified “Launching new products and services” as the tactic they would use in the year ahead to build market share.

That reflects the belief among many traditional institutions that the usual lineup of retail products offered by banks and credit unions does little or nothing to differentiate one institution from another, according to Sundeep Kapur, a marketing and digital banking consultant and head of Digital Credence.

“Offering advice should be a differentiating factor for banks as it becomes contextual and real time.”

— Deloitte

New products will focus on consumers’ financial well being, and will closely connect lending, payments and wealth management services, Deloitte predicts. Even basic products will move in this direction, as evidenced by Wells Fargo’s plans to roll out a checkless/no overdraft account and a checking account that limits overdrafts to one per month.

Beyond that, the whole area of financial advice is seen as a great opportunity for banks and credit unions. “Offering advice should be a differentiating factor for banks as it becomes contextual and real time,” Deloitte states. Banks and credit unions should rethink and innovate their pricing models accordingly.

To be able to successfully deploy an insights strategy, most traditional institutions still have a lot of work to do. Not only do they need the right people with the right skills and training, but they will need the right systems and data to support them.

The Promise (and Risk) of Technology and Data

The foremost disruptive element in the decade ahead will be the same one that disrupted the decade just past: technology. But now, it won’t be applications like mobile banking, but “the fusion of current technologies, such as machine learning and blockchain, and emerging ones such as quantum computing,” as Deloitte puts it. This will create not only opportunities and scale but bring new risks

One such risk is that traditional institutions won’t address, or address quickly enough, the lack of legacy system modernization, which the consulting firm calls “a huge impediment to transformation.”

Modernization of bank and credit union core technology platforms has been much discussed, but little changed. The logjam may finally be breaking up, however. A separate report from EY, covered by The Financial Brand describes three new approaches to technology modernization that enable much quicker time-to-market.

By 2022, nearly half (48%) of banks’ IT spend will be for new technology investment, according to Celent data cited in the Deloitte report.

Read More:

- Financial Institutions Taking Innovation Shortcuts with Fintech Deals

- The Biggest Technology Trends That Will Disrupt Banking

One of the biggest areas for investment over the next decade will be artificial intelligence (AI), machine learning and other data-related applications that go well beyond risk, fraud, and compliance applications. Unlocking AI’s potential will enable banks and credit unions to finally move from product centric to customer-first organizations.

The data will not only come from within the financial institution from outside sources as consumers’ digital footprints continue to grow. This can greatly increase the ability of banks and credit unions to provide customer insights and contextual offerings, but complicates data management and raises privacy concerns.

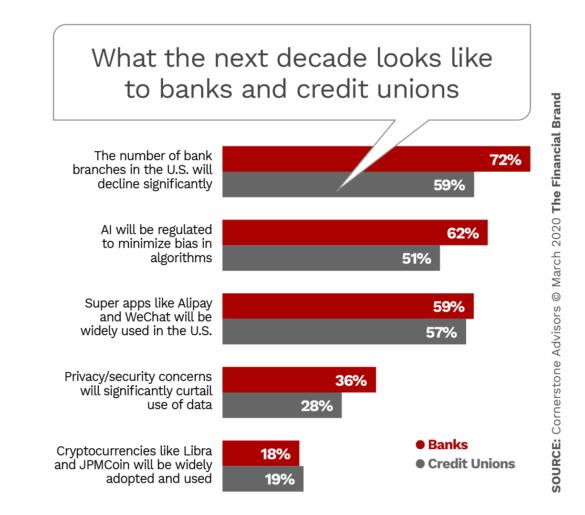

Executives at both banks and credit unions predict privacy and security issues that could curtail use of data in the next decade, according to Cornerstone Advisors. In particular, these leaders expect use AI to be regulated to prevent bias.

Financial institutions need to take the lead in devising solutions and controls that strike a balance between meeting consumer expectations for a free flow of data and protecting their privacy. As Deloitte points out, privacy policies within banking currently are all pretty much alike. “Banks should rethink privacy as a value exchange that mutually benefits consumers and companies without compromising trust, their reputation, or regulatory compliance.”

Read More:

Talent Pool Needs More Attention

The technology advancements that have kept — and will continue to keep — the banking industry in a state of flux are rendering employees’ legacy competencies and traditional training methods, obsolete, according to Capgemini. Key skills now center around using machine learning and AI to derive customer insights and improve the customer experience. The consultancy sees increased use of virtual classrooms, video and podcasts as the way to train employees. An improved talent development focus will be critical for financial institutions to compete with fintechs and the GAFA giants (Google, Apple, Facebook, Amazon).

The human side of digital transformation has received much less attention than the technology side, Deloitte observes. It’s largely a leadership issue. Four out of five financial institutions believe their organization is not effective or only somewhat effective in developing leaders who can keep up with the rapid pace of change in the work required now and in the decade ahead, according to the report. It identifies five key leader competencies.

Attributes of tomorrow’s banking leaders

- Aptitude for balancing business knowledge with tech fluency

- Ability to manage complexity

- Strong interpersonal skills

- Expertise in facilitating change with an inspiring, forward-looking vision

- Ability to empower a diverse and inclusive workforce across co-located and virtual environments

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Growth and Challenges from Open Banking and Ecosystems

In terms of laws and regulations, open banking so far has occurred outside the U.S. and none of the sources checked predicted when that might change. Most, however, emphasized the growing recognition of a more open, collaborative approach to banking.

“Expect the best banks to accept that vertically integrated banking is dead and to try and use shared data to claim the advisory high ground.”

— Alan McIntyre, Accenture

“Expect the best banks to accept that vertically integrated banking is dead and to try and use shared data to claim the advisory high ground, intermediating the offers of other financial and non-financial firms for the benefit of their customers, while also protecting their personal data,” states Alan McIntyre, Accenture’s Banking Lead. By “vertically integrated,” he means the approach long used in banking whereby financial institutions offer products and services primarily of their own and maintain full control of the value chain.

As Capgemini notes, “Customers expect their primary financial services provider to offer solutions for all their financial needs — proactively. A shared marketplace will empower banks to provide solutions across a portfolio of products and services.” The firm adds that financial institutions now acknowledge the need to collaborate with various partners to stay relevant and compete with big techs and fintechs.

Capgemini predicts that “open banking” will evolve into a “future-state ecosystem … that includes incumbents and non-traditional players.” Banks and credit unions that embrace such an evolution will benefit in four ways:

- Hyper-personalization: Access to numerous datapoints allows personalization of products for individuals versus a population segment.

- Portfolio expansion: Providing innovative offerings from fintechs on banking platforms will expand the range of products.

- Customer penetration: Participating in a shared marketplace will help banks and credit unions reach a new segment — the under-penetrated customer base.

- Process efficiencies: Fintech solutions can significantly boost banks’ operational capabilities, helping incumbents become leaner and more cost-effective.

While the upside potential of an “ecosystem” approach to banking is large, there are also downsides. Greater transparency benefits consumers, who may increasingly expect it, but “wrecks the economics” of the traditional vertical banking industry, according to McIntyre. He also notes that as more data is shared, the risk of data breaches rises.

Moving Toward the Purpose-Driven Bank

In its report, “Banking in the Age of Instinct,” Genpact states that financial institutions “must shift from authoritative and functional to supportive and emotional,” because societies will demand that enterprises take an active and ethics-driven role within communities.

Most financial institutions are already highly active in their communities, but the Genpact report predicts that banks and credit unions will need to make investments and lending decisions based less on immediate ROI and more on encouraging consumers and businesses to grow, innovate and achieve life goals, particularly in under- or unbanked segments.

Accenture’s McIntyre states that financial institutions, through credit intermediation, can play a vital role in supporting sustainability by investing in renewable energy and either withdrawing or raising the price of capital to less ethically sound sectors. However, he adds a note of skepticism: “We’ll see whether ‘doing well by doing good’ is just good advertising copy or whether it begins to change … the banking industry.” And also whether shareholders reward such efforts with higher valuations.

Climate change in particular presents financial institutions with a singular challenge. As Deloitte’s report notes, most banks and credit unions are already committed to improving the environment and reducing their carbon footprint, but such initiatives typically fall under corporate social responsibility.

The firm suggests that in the decade ahead institutions should consider a more robust and analytical framework along the lines of a “climate risk management.” The report states that customers will increasingly be looking to financial institutions for guidance in this area.