Banking isn’t just for banks anymore — and that’s not a problem for those financial institutions that have embarked on a banking as a service (BaaS) strategy. BaaS continues to blur the lines between what is — and what isn’t — a bank.

Although there are many variations, in a BaaS model, regulated institutions provide their charter to non-regulated companies that want to offer financial services without needing to acquire a banking license of their own.

The most notable examples are by now familiar to anyone paying attention to fintechs and neobanks: Chime partnering with The Bancorp Bank and Stride Bank; Acorns partnering with Lincoln Savings Bank; Venmo also partnering with The Bancorp Bank, and many more.

Less often discussed, but increasingly important are the BaaS technology providers that work with both the financial institution and the fintech. These ‘middlemen” help to manage the BaaS operations, notes Kate Drew, Director of Research for CCG Consulting. Key players include Galileo, Marqeta, Q2 and Synctera.

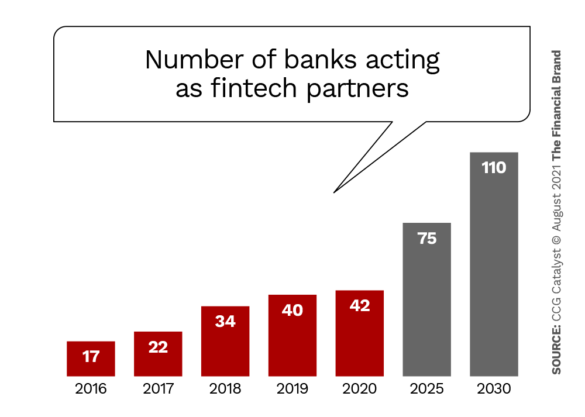

“BaaS” is a new name for an old concept: “white-labeling.” Banks and credit unions have white labelled their credit card products for years, but what is changing is the breadth and depth of these partnerships — and the volume. In a detailed report, CCG Consulting predicts that the number of financial institutions partnering with nonbanks will more than double by 2030.

( Read More: Community Bank Builds Future on ‘Banking as a Service’ & Google Plex )

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

BaaS Versus Open Banking

Don’t confuse BaaS with open banking. While open banking also connects financial institutions with nonbanks using APIs, it’s a totally different model than BaaS. In an open banking model, third parties access data from a financial institution (when the customer has given permission to do so) and loads it into their own applications, like a personal financial management (PFM) tool aggregating from multiple sources. The flow of data is one-way.

In a BaaS model, nonbanks integrate banking services into their own products, like a fintech’s home buying app offering a mortgage or a neobank offering a debit card. Data is shared back and forth between the financial institution and the nonbank.

Offsetting Diminishing Returns

BaaS is hot for several reasons. First, banks’ earnings growth has stalled. The problem, notes 11FS, is that the traditional banking business model offers diminishing returns. Net interest margins are squeezed by perpetually low interest rates, competitors with lower overhead costs and product commoditization.

Regulatory and compliance costs continue to rise, and many banks and credit unions have invested heavily in high-cost branch distribution channels when today’s customer preferences are shifting in of favor digital delivery channels.

Since a BaaS model can be a low-margin yet high-volume business structure, it can grow a regulated institution’s bottom line. There are many variations in the model so it’s difficult to generalize, but revenue often comes from debit card swipe fees, program management fees, revenue sharing arrangements, and of course the benefit of additional deposits. BaaS is an opportunity for financial institutions to reach more customers at a lower cost, notes Oliver Wyman.

Shifting Sands:

36% of financial institution executives say they are increasing use of multi-partner arrangements, heralding a new model for banking.

( Read More: The Evolution of Banking: 2021 and Beyond )

Second, the global disruption of Covid-19 caused numerous changes in business models — including how banks and credit unions think about partnerships. According to Accenture, almost a quarter (24%) of banking executives are experimenting with multi-party systems and 36% are scaling up multi-partner systems as a result of the pandemic. The vast majority (91%) agree that multi-party systems will enable their institutions to forge a more resilient, adaptable foundation and create new value with partners.

According to a report by Transcard and Pymts.com, 80% of global financial institution executives believe that banks will profit from embracing platform business models. By 2030, Transcard estimates the size of the embedded finance market will reach $3.6 trillion.

A Match Made in Heaven?

There are plenty of benefits for financial institutions in a BaaS model besides whatever fee arrangement are set up: The most compelling is that the bank’s partner does the hunting and gathering of customers, something that fintechs and other technology-first companies do very well. Banks and credit unions can focus on operations and compliance, and the partners focus on customer acquisition and experience.

The regulated institutions, however, are still on the hook for compliance and managing risk.

Difficult Decision:

Traditional institutions fear losing control of customer relationships by embracing BaaS, but ultimately they may lose them anyway.

Banks and credit unions need to figure out where they should lead the customer interaction and experience, and where they should take a back seat and become a product or service provider to a third party. The struggle is real as incumbents worry that distributing products through partners will erode their customer relationships. While that is a legitimate fear, traditional institutions may not have a choice as their competitors implement BaaS.

Not Trying to Be a Bank

BaaS doesn’t just offer bank wannabees an easier path into providing banking services but enables nonbanks to attract customers — especially young people, gig workers, those in lower socioeconomic brackets and immigrants — that have a cultural aversion to banks. Far from hiding the fact that they aren’t actually banks, they celebrate it.

Chime’s website landing page makes this fact crystal clear, stating that “Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank or Stride Bank, N.A.”

Some, like Goldman Sachs and BBVA, are working diligently to digitize their existing operations and have launched their own BaaS platforms. Goldman Sachs created its new cloud-based platform Transaction Banking (TxB) to meet its own treasury needs, but soon realized that they could share this system with their corporate treasury clients to embed banking services into their own products.

BBVA’s Open Platform (now called PNC Open Platform) offers a variety of APIs centered on both consumers and businesses to move money, open accounts, and issue cards. One BBVA platform client is Catch, a personal benefits platform helping freelancers and hourly workers who don’t receive benefits to calculate how much they should save out of each paycheck to pay taxes, take a vacation, save for retirement, and pay for health insurance. Catch needed a bank to pull those funds from each customer’s account, hold the funds, and assist with KYC requirements.

Not all fintechs see the need to follow the BaaS playbook. Social Finance (SoFi), a digital personal finance company, is acquiring Golden Pacific Bank as their way to obtain a national bank charter. Payments giant Square obtained an industrial bank charter, while Varo Bank went through a grueling, multi-year process to obtain a full OCC charter, one of the few neobanks to attempt it.

Read More: How Fintechs Buy, Rent and Fight Their Way Into Bank Charters

What to Do Next

Oliver Wyman suggests that banks approach BaaS by answering four key questions:

1. What is our overall strategy? Decide whether you going to become a distributor or a producer of financial products. If you become a producer, are you willing to allow a nonbank to put its brand on your product? That requires some strategic soul-searching. Are you willing to give up your customer-facing relationships?

If you decide not to enter BaaS, how will you protect your existing business model and revenue lines from the threats of competing BaaS offers?

2. How much revenue will we gain? BaaS is changing banking business models, but the big questions is: Can you make money at this? The early entrants have seen higher than average ROA and ROE results, but that may not be for all. Will you consider adding subscription services such as identity theft monitoring to boost revenues? Can you leverage the more granular customer data you’ll gain?

11fs reports that a change in mindset could transform the way financial institutions make money. Instead of competing on digitization and customer experience, they could monetize playing the role of enabling new market entrants.

3. Who should we target? Determine which markets offer the biggest opportunity. Is there an industry type or brand that makes sense to target? Consider how you set up your operating model to service these target distributors?

4. What technology should we use? You can choose to use your existing legacy technology stack or build a new “greenfield” BaaS platform. With legacy infrastructure, acquiring a customer can cost between $100 to $200, Oliver Wyman estimates. That cost drops to between $5 and $35 per customers with a new BaaS technology stack.