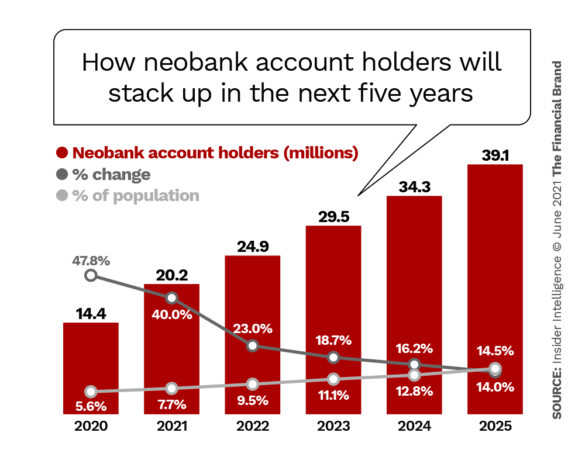

Neobanks, which were just a hypothetical threat ten years ago, now have the banking industry’s full attention. Insider Intelligence estimates in its first digital-bank forecast report challenger banks will claim at least 20.2 million account holders by the end of 2021 — double the number it was two years ago.

“The pandemic has been a unique growth accelerant for neobanks,” Insider Intelligence Senior Forecasting Analyst Oscar Bruce told The Financial Brand. He speculates the financial industry can only expect further growth of the neobank trend, even as everything returns to normal. Even though neobank users are still just a small nugget of the population, it is predicted to double yet again in just another four years.

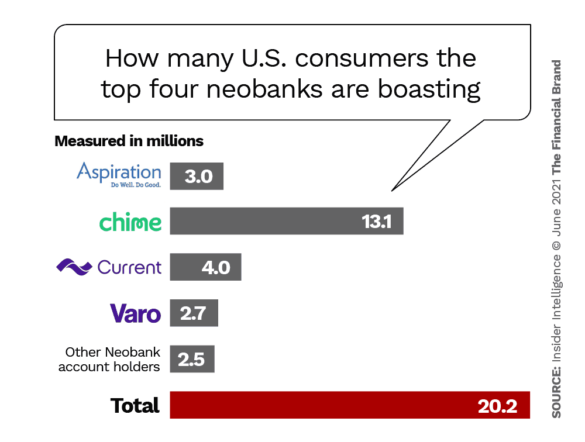

Insider’s inaugural report ranks the best-performing challenger banks, putting Chime at the top of the leaderboard with a projected 13.1 million U.S. account holders by the end of 2021, Current in second with four million and Aspiration in third with three million. Varo Bank — in fourth place — is estimated to come close to Aspiration with 2.7 million consumers.

Chime has been the top dog for a few years now in America, so the fact that it is still in first doesn’t come as a surprise to people keeping track of neobanks. However, the biggest news is that Current may be switching places with Aspiration.

Just a year ago, in 2020, Current claimed only a little over two million customers, but it will likely be double that by the end of this year. The growth can likely be credited to the neobank’s 2019 announcement it would offer checking accounts beginning that year, according to the Insider Intelligence report.

Here are descriptions of the top three neobanks, along with notes from Bruce about what is keeping them ahead of the game and the strategies to keep an eye on.

Read More:

- Introducing the World’s First Interactive Directory of Digital-Only Neobanks

- Buy Your Own All-Digital Neobank From a Portfolio of Prepackaged Brands

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Chime

Chime has been at the front of the pack for a number of years, competing for space since 2013 when Chris Britt and Ryan King launched the neobank in San Francisco. Since then, the company has raised $1.5 billion worth of funding and garnered 12 million customers as of early February 2021. Insider Intelligence bets the neobank will be up to 13.1 million by the end of the same year, a 31% year-over-year increase.

The report also says it expects Chime to reach 22.7 million customers by 2025, “increasing its lead over competitors through the end of the forecast period.”

“Chime has attracted hundreds of thousands of new users each month over the past year, largely because of its responsiveness to customer needs,” Bruce said in the report. “Last year, it gave users access to their stimulus checks up to five days before they were scheduled to be released.”

Chime also led the movement to eliminate overdraft fees, a trend gaining traction in banking more widely almost two years after the challenger first proposed the idea.

In addition to releasing stimulus checks early, Bruce points out that Chime introduced in 2020 its Credit Builder program and its “Pay Friends” P2P payment plan. “Chime continues to keep up with new players and will remain at the top through 2025,” Bruce concludes.

Learn More: Why Should Banking Providers Offer Credit Builder Loans?

Current

Current, while it sits in third place now, has been making sweeping moves in the financial industry to earn consumer trust. At the end of April, it lined up another $220 million in a series D investment round, bringing its total valuation to $2.2 billion.

“Current has done a great job of articulating how its products help users improve their financial standing,” Bruce explains, adding the neobank’s “emphasis on accessibility and affordability has resonated in this time of crisis.”

And indeed it has. While it is still millions of accounts behind Chime, Current is projected to nearly double the number of consumers it had from pre-Covid levels.

Bruce states that Current has done a few things well, including offering free checking accounts and no overdraft fees, debit card rewards and early processing of paycheck direct deposits.

With an average customer age of 27, Current is winning over the youngest of the Millennials and the oldest of Gen Z, Bruce continues, “about half of whom have never had a bank account before.”

Aspiration

Aspiration, in second place, is estimated to slip into third place behind Current by the end of this year. Insider Intelligence, however, estimates the neobank is on track to top three million account holders by the end of 2021 and will likely double that by the end of 2025.

Although Aspiration — which focuses on sustainable strategies — is projected to fall from its second-place ranking by the end of this year, there has been plenty of news coming out of its press room.

For instance, the company announced in late April it would be rolling out a new credit card, differentiated by being “carbon offset.” Aspiration advertises that, just by joining the waitlist for the card, it will plant five trees on behalf of consumers.

On top of that, Aspiration promises for every purchase, it will plant an additional tree. On the neobank’s mobile app, people can track their progress and every month they reach “carbon zero” — which the company defines as 60 trees planted for monthly spending — consumers get up to 1% cashback on all the purchases.

Read More: Is Eco-Friendly ‘Green Banking’ a Sustainable Strategy?