Real-time personalization and contextual customer experiences are critical to differentiating yourself from competitors. With new technologies and the vast amount of consumer data available, the banking industry has the potential to understand how and when to best engage with customers and to deliver experiences that create satisfaction and loyalty.

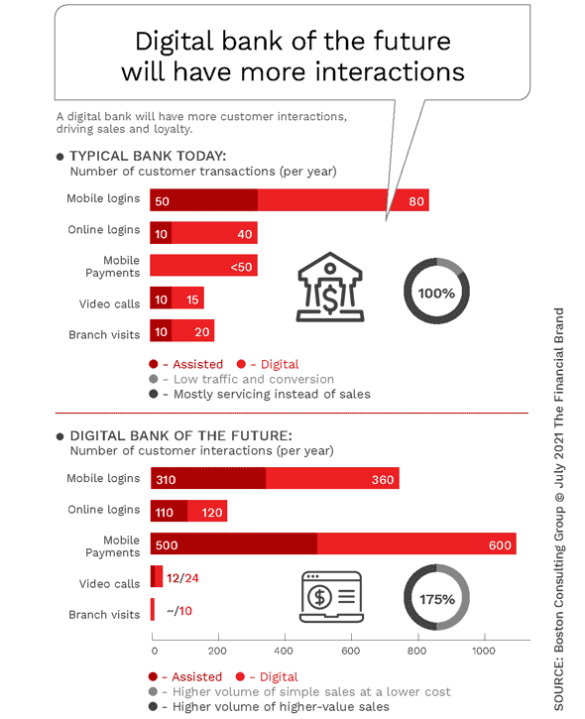

More importantly, as the number of in-branch visits continues to decrease and the number of digital transactions increases exponentially, the importance of making each engagement more personalized will be the key to success. According to the Boston Consulting Group, digital engagement could increase by six-fold (or more) in the near term. Many of these engagements will be assisted by humans or digital support tools, making the level of insight and contextualization even more important.

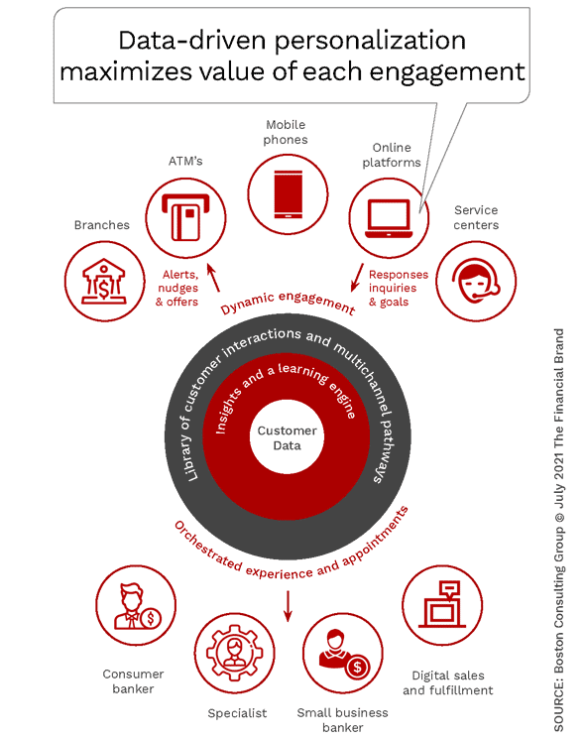

“Personalized customer engagement requires putting customer intelligence at the core of data-driven customer management,” states BCG. “This requires building an overarching database of a customer’s needs, behaviors, and preferences and using this data to fuel analytics and AI algorithms that maximize the value of every interaction between the customer and the bank.”

Key Insight:

As digital interactions increase, the need for personalized engagement increases as well. Loyalty will be based on how often a consumer relies on their financial institution’s digital app for insight and advice.

Despite this opportunity, the vast majority of financial institutions are still falling woefully short of consumer expectations, with personalization maturity lacking across the entire customer journey. The good news is that the industry is well positioned to deliver memorable experiences and unique interactions by leveraging both internal capabilities and external partners.

The key is to structure the collection and use of existing data in a way that can improve the customer experience and drive increased engagement, starting with high-impact use cases that are meaningful to the consumer but not too complex to execute. These ‘quick wins’ can provide the foundation for increased investment and commitment to creating differentiated experiences across all channels.

Read More:

- Now is the Time for Intelligent Digital Banking Experiences

- Digital Transformation Requires More Than Technology Upgrades

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Personalization Needs to Start Before Sale Is Made

Most organizations understand the need to personalize communication with existing customers, yet few realize the power of a personalized website experience to drive engagement before a sale is made. According to Optimizely, “Website personalization is the process of creating customized experiences for visitors to a website. Rather than providing a single, broad experience, website personalization allows companies to present visitors with unique experiences tailored to their needs and desires.” This can include targeted offers, personalized content, product comparison tools and financial education.

Website as a Sales Tool:

The lack of personalized website journeys result in lost sales. Consumers should not need to perform long searches to find what they want.

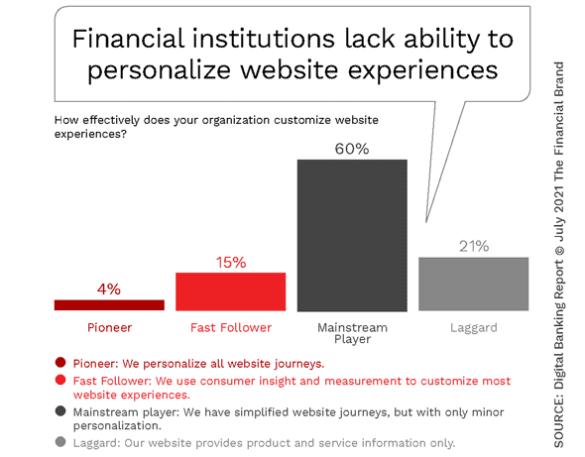

Consumers expect a website experience that replicates the level of personalization they receive from the search firms, news and social media feeds, and big tech providers. In fact, many organizations regularly create custom content to generate contextual engagement at scale. This level of website personalization has been challenging for many financial institutions, however, as shown below.

In our research, less than 20% of financial institutions believe they are either a ‘pioneer’ or ‘fast follower’ when we asked about their website personalization maturity. Eight of ten say have little or no personalization of content.

For banks and credit unions, personalizing a website can be challenging. Most organizations have traditionally used their website as a digital branding billboard and/or product display site. The majority of the work, once a prospect or customer entered the site, was left to the consumer to find what they were looking for. In many cases, the site was not updated with current product information (rates, fees, etc.) and almost never integrated simplified account opening tools.

In our research, the top three challenges include:

- 35% of financial firms stated that, despite having an abundance of data, the ability to organize data for personalized web experiences was their biggest challenge.

- 16% of banking firms found the biggest challenge to be targeting messages to specific website audiences. This limits the potential for insight and content to be accessible to the intended website visitors proactively.

- 14% of the organizations surveyed said that the biggest challenge was that they did not have the skillsets available to deliver personalized web experiences.

In a subsequent follow-up to this question, it was found that each of the challenges below stood in the way of delivering personalized web experiences for more than 75% of banks and credit unions globally. To resolve many of these challenges, organizations must focus on search behavior prior to visiting a website, instant customer identification, understanding customer journeys, and continuous measurement of engagement. When these actions are taken, the power of personalized content at scale will be unleashed.

Read More:

- Beyond Personalization: Three Reasons to Focus on Customer Journeys

- Digital Banking CX Boils Down to One Word: Speed

Personalization at Scale Is Required Across the Customer Journey

Once a customer is acquired, you want to connect with them with relevant offers that meet their specific needs. This must occur immediately as part of the onboarding process and continue throughout the customer journey to create engagement, sales, satisfaction and loyalty.

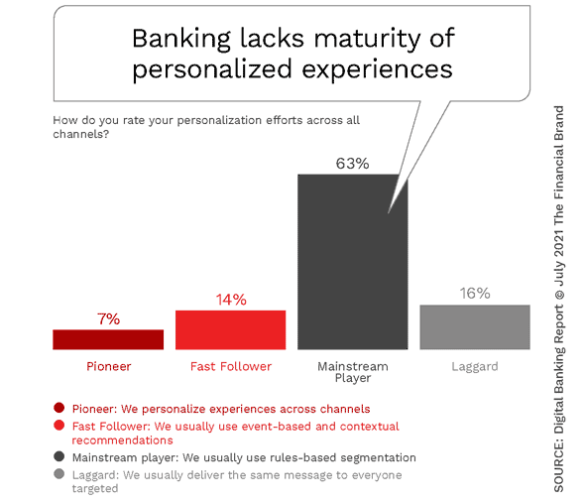

Financial institutions can no long just send personalized communication based on a prior purchase or demographic segment. The customer expects you to provide a tailored message based on much more finite insights, including life stage, recent activity, financial goals, etc. With today’s technology and marketing tools, these messages must be delivered to thousands of customers, across multiple channels at scale and in real-time.

Key Insight:

Fewer than 1 in 5 financial institutions feel they are prepared to deliver personalized experiences at scale.

Done well, personalization at scale not only can generate increased engagement, sales and retention, but also reduce marketing costs through greater efficiency. Unfortunately while over 90% of financial marketing professionals say they understand the need and importance of personalization, only one in five say they are proficient at it. For most banks and credit unions, the maturity level of personalization at scale is still lacking.

Single View of Customer Is Lacking

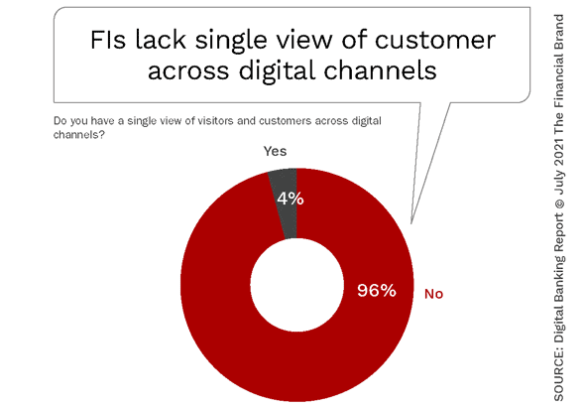

Customers can research financial product alternatives within moments and make purchases within seconds. This means that banks and credit unions must ensure that the right message reaches the right customer, using the right channels at the right time. The only way to achieve this is with a single customer view.

To achieve this view, organizations must collect and connect identity, behavior and attribute data about each individual customer, consolidating this insight into one, universal record that is available at all times for real-time consumer recognition.

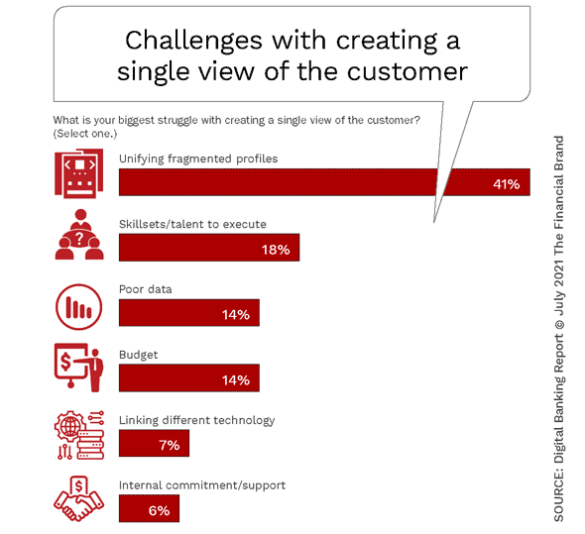

Without a single customer view and real-time insights, banks and credit unions will struggle to deliver the quality experiences that customers are looking for. When we asked whether institutions had a single customer view across channels, an overwhelming majority of organizations do not have this capability today.

The challenges are many, but the most important challenges revolve around the silos that still exist within financial institutions. These silos make the ability to create a single customer view difficult without outside assistance. This is why most financial institutions partner with third party providers to bring disparate data and insights together to drive personalization campaigns.

Third party organizations, with data and personalization technology and acumen, can assist in collating data and creating insights that can drive contextual, real-time marketing communication. They also have the talent available that is so difficult to find in the marketplace today.

Building a Customer Data Platform for Future Success

Building a personalization strategy that increases contextual engagement across both digital and non-digital channels requires accurate, real-time customer insight. To manage this data and insight requires an advanced marketing technology platform that is both scalable and actionable.

To be most effective, there needs to be democratized data platforms that are trusted and available throughout the organization. For instance, increasingly idle branch personnel should be provided daily reports on their customers who have been identified as having a product or service need. This data also must be used for decision making for product development, revenue enhancement and cost containment.

The management of this data should also be cloud-based and accessible through application programming interfaces (APIs) by both internal and external partners. This facilitates agility, higher efficiency, and reduced time to market. The key is to maximize the value of each interaction through personalization and contextual solutions.

Our research found that financial institutions are moving forward, testing an array of personalization tools, including trigger marketing (62%), rules-based recommendations (56%), and traditional segmentation (41%). Of concern is that far fewer banks and credit unions are using more advanced tools, such as AI-based recommendations (13%) and decisioning using advanced technology, such as a customer data platform (12%).

To move forward, financial institutions of all sizes will need to address immediate priorities, including making the opening of new accounts and applying for new loans much easier on a digital platform, while building capabilities that will support growth and retention of relationships in the future. Digital transformation is a process that will never end.

The winners will be those organizations that create exceptional experiences – at scale and in real-time – with every interaction. Value must be provided, and insights must be collected, to avoid ‘silent attrition’ that is occurring as fintech and big tech organizations steal components of the traditional relationship that legacy financial institutions have enjoyed. This can only be achieved with contextual personalization.