Pittsburgh-based First National Bank is venerable in banking years. But this old dog is learning some new tricks in the face of digital evolution.

The bank opened in 1864 and is one of the few pre-20th Century banks still in existence. Despite having its roots in the industrial revolution, FNB, now with $39 billion in assets, is generating most of its revenue from digital banking. The Financial Brand spoke with Vincent Delie, Jr. — CEO of F.N.B. Corp. and First National Bank — to learn more.

To give an idea of the degree to which FNB has transformed, 61% of the bank’s mortgage applications now originate on digital channels. Remarkably, that migration has taken place in six months — the bank launched its digital mortgage experience product in May 2021. In addition, Delie says that, from the first quarter of 2020 to 2021, the bank saw drastic increases in mobile banking usage, as much as 40%. Additionally, First National reported a 29% increase in online banking and a 60% year-over-year increase in use of the Zelle P2P app it launched in 2017 (it says it was one of the first banks to add Zelle to its tech stack).

Fast Track:

Over half of FNB’s mortgage applications come from its digital origination product, which the bank launched just six months ago.

Read More: Zelle Stretches Far Past P2P Payments to ‘Digital Cash’ Role

FNB’s Latest Product

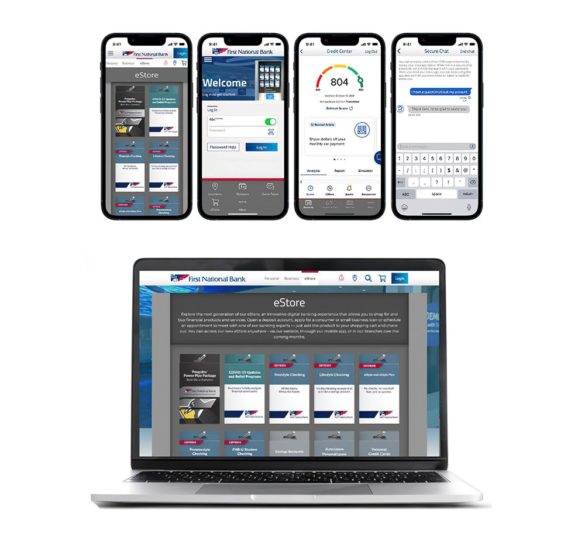

First National Bank’s digital banking strategies have been coordinated for the recent launch of its new mobile eStore. This app recreates a sort of digital convenience store, allowing customers to look at and purchase financial services like a gift card display. Delie says that this is especially beneficial for customers looking to finance a home.

“In fact, for home mortgage products, customers can even choose the mortgage representative they want to work with during the homebuying process, further integrating innovation with personal service,” Delie states.

“We added a number of features that are common in other retail environments but unique in the banking industry.”

— Vincent Delie, FNB Corp

While the eStore used to live exclusively on FNB’s website — averaging 2,000 deposit applications per month — customers who prefer to bank through the mobile app can now also use the service. The idea is that people should be able to use First National much like they would a neobank, if that’s how they prefer to bank.

“The key features enable consumers to shop for products, open deposit accounts, apply for loans and learn through our financial education resources,” Delie explains. “In addition, the tool streamlines the onboarding process, makes it easier to apply for products and services and enables customers to talk to experts.”

Read More: How Banks Can Change ‘Innovation’ from Buzzword to Differentiator

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Lessons From Retail Moguls

FNB’s new offering is unique in that it mimics experiences found in retail ecosystems like Amazon, Target.com, Walmart.com and other online retail stores — an idea which Delie says was intriguing to his team. The strategies these companies created have become commonplace in other industries, but he found that banking was missing out on the trend completely.

“To make our website more intuitive and user-friendly, we added a number of features that are common in other retail environments but unique in the banking industry, including a shopping cart and checkout process, product filtering and account selection tools,” Delie explains.

Additionally, the bank’s technology teams embedded artificial intelligence software into its website and app so the bank’s online systems could “make product recommendations that are tailored to the individual user.” FNB Corp formulated its data science team and hired its Director of Data Science Adrianne Bernini in 2019 to run the bank’s data management team and build out its artificial intelligence systems. It is all part of FNB’s “Clicks-to-Bricks” campaign, which is the bank’s strategy to interweave its physical and digital channels.

Catering to Different Segments

The eStore came about after extensive interviews with customers. Delie and his teams learned that there were three types of customers that First National would have to cater to.

For instance, for the customer who knows what kinds of products they need, and wants it quickly, they would be better off using the eStore, while the people who prefer to do more research could benefit more from the bank’s consumer insights page on its website — called the “Knowledge Center” — as well as its “Help Me Decide” feature, which allows customers to compare banking products. Still, others are planning for larger life events, for whom First National created its “Goal Advisor” to help customers looking to achieve certain goals.

Not One Solution:

Financial institutions can’t assume all customers need the same digital product. FNB looks at three different types of customers when figuring out who needs what.

But, Hold On to the Branches

Yet, the bank is trying to keep from excluding people who still prefer the feel of a bank branch. So although it is making digital strides, FNB still plans to retain most of their East Coast branch footprint. Additionally, First National Bank acquired Baltimore-based Howard Bank in July 2021, which will add 13 branches to FNB’s footprint, bringing the bank’s total network to 330. Furthermore, in 2022, the bank will roll out the eStore in the bank’s ATMs and ITMs to create congruity between the bank’s physical and digital environments.

The long-term goal that Delie sees for the eStore is that it will become a consolidated space for all of FNB’s lending and deposit products in the hopes that customers can easily submit multiple applications across different banking products without resubmitting their personal information time and time again.

This strategy is an innovative approach to a common problem in the banking industry, which is that separate systems make it difficult for specialists in an institution to communicate with one another. If someone fills out an application for a checking account, it’s likely they’ll be filling out the same information for a mortgage, or a personal loan.