The impact of the pandemic on the banking industry was immediate. The shift to digital transactions not only changed the industry, but every industry globally, as consumers accepted the need to make purchases and payments using digital devices, with embedded experiences and one-touch engagement.

These changes tested the payments maturity of every financial institution. Most banks and credit unions were unprepared for expectations of the consumer and merchants who wanted payments that were simple, fast, safe and embedded. The combination of customer expectations, back-office operations, technology-driven opportunities, and the increase in non-traditional competitors, quickly exposed much of the industry to the realization that their payments infrastructure was not prepared for the future.

Financial institutions of all sizes must make their payments infrastructure more agile and respondent to the opportunities and threats today and in the future. What was once a planning effort for an unknown time in the distance is a requirement today.

While supporting payments is far from the only priority financial institutions must address as part of their digital transformation journey, clearly organizations must achieve a higher level of payments maturity and efficiency, while supporting innovation that will meet customer expectations and increase business value. A payments transformation strategy must include a greater commitment to data, advanced analytics, modernized infrastructure, risk and fraud mitigation. Retraining and re-skilling people will be imperative to stay competitive.

Few organizations will build these payments capabilities internally, so the importance of partnering with future-ready solution providers will be necessary to keep pace with marketplace changes as it relates to modernized technology, digital talent, updated processes and the application of data insights.

Few organizations will build these payments capabilities internally, so the importance of partnering with future-ready solution providers will be necessary to keep pace with marketplace changes as it relates to modernized technology, digital talent, updated processes and the application of data insights.

A new white paper, published by the Digital Banking Report and sponsored by IBM, provides a perspective on where the payments industry is today – and where it needs to be in the future. These insights provide the basis for debate and shifts in business strategies across the industry in 2021, helping organizations proceed aggressively in the pursuit of improved decision making and customer experiences.

Read More:

- The Future of Payments is Fast, Seamless, Safe and Embedded

- 7 Major Payment Trends that Will Shake Up Banking in the Year Ahead

- 7 Essentials of Digital Transformation Success

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Payments Infrastructure Maturity

The payments infrastructure in a bank is often 30-40 years old. Operational risks, paucity of resources for support, limited organizational agility, lower transaction fees and rising costs are forcing changes in the support of payments and for all banking services.

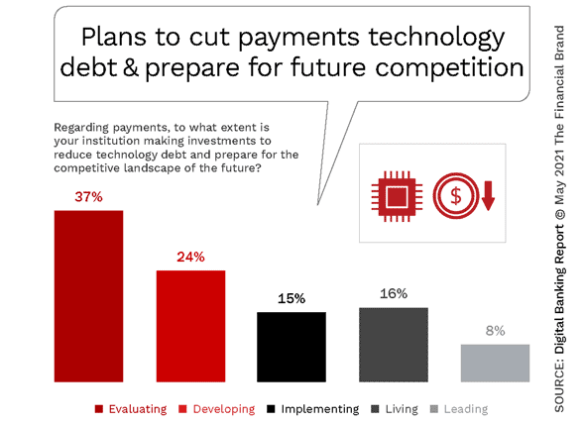

In a global survey, we asked financial institutions the extent to which their institution is making investments to reduce technology “debt” and prepare for the competitive landscape of the future.

“Most organizations appear to be reviewing capabilities and building payments solutions, but very few categorize themselves as being adept at supporting the back office capabilities required to be a payments leader.”

— Mike Cook, Global Payments Leader, IBM

We found that 24% of organizations were either “Living”or “Leading” with regard to updating their infrastructure, with 15% of organizations in the “Implementing” phase and almost a quarter of banks and credit unions stating they were “Developing” improved back offices.

What is concerning is that almost four in ten organizations stated they were in the “Evaluating” stage of infrastructure maturity. The organizations at the lower stages of payments infrastructure maturity were mostly from the lower asset categories, where funding of major infrastructure improvements is not currently prioritized. Alternatively, the organizations with the highest levels of payments infrastructure maturity were in the highest asset categories.

It is clear that many organizations will not be able to update their back-office infrastructure adequately by themselves. The best potential for an agile and flexible infrastructure upgrade will be through partnering with a solution provider that can update key components quickly and at a lower cost than a “build” strategy.

Payments Competitive Maturity

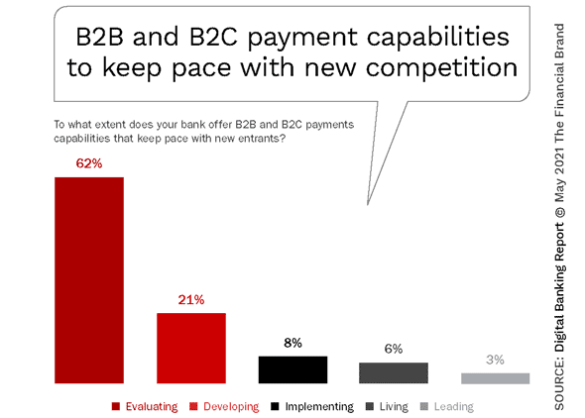

The impact of fintech, paytech and big tech providers of payment services has skyrocketed in recent years. Players like Venmo, PayPal, Square and others have escalated the consumer awareness of “what is possible” by providing better interfaces, delivery certainty, improved pricing and ease of use. We asked financial institutions globally to what extent their bank or credit union offers B2B & B2C payments capabilities that keep pace with alternative digital payments leaders.

Correlated with the ability to invest in the infrastructure required to be future-ready in payments, financial institutions do not consider themselves prepared to compete with paytech, big tech or fintech leaders in the payment space. We found that the competitive maturity skewing to the developmental phases of digital payments transformation.

Payments Technology Maturity

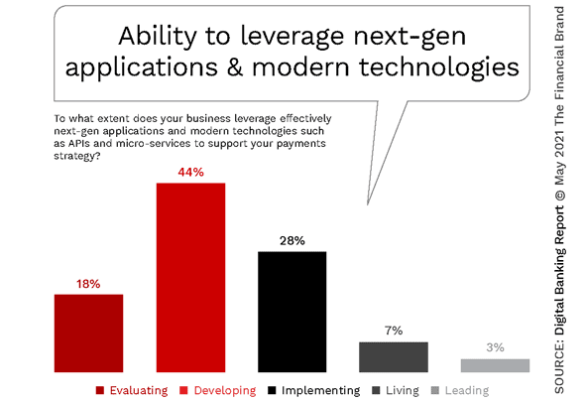

More than ever, technology maturity in the payments process has become a foundational requirement that can support APIs and open banking opportunities that reach beyond traditional financial services.

When we asked organizations about their technological maturity to support APIs, micro-services and other next-gen applications, we found that, while not many organizations were in the advanced stages of maturity, there were significantly more organizations focusing efforts to improve the response to innovative opportunities in the future. More than seven in ten banks and credit unions globally were either already developing or implementing next-gen applications and modern technology.

Interestingly, while the more mature organizations tended to be the largest banks and credit unions, the smallest financial institutions were over-represented in the implementing and developing stage, while mid-asset regional financial institutions were under-represented. This finding aligns with what the Digital Banking Report has found in digital transformation maturity overall.

Risk and Fraud Maturity

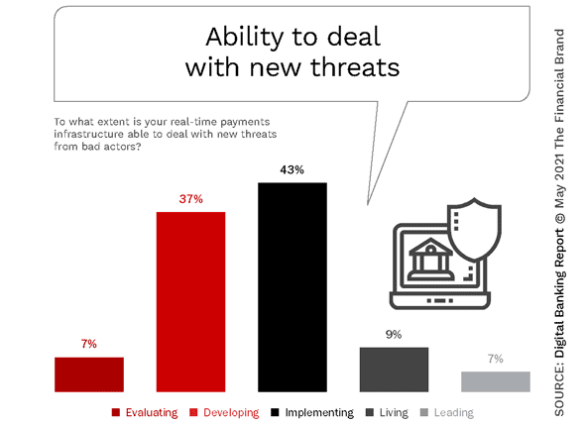

The payments marketplace is operating faster and more seamlessly than ever as more consumers embrace contactless payments, card-not-present transactions, and alternative P2P payment options. As the quest to speed up payments across digital channels becomes a differentiator, the potential for fraud increases. This impacts the bottom line of organizations at all levels of the payments ecosystem and creates a balancing dilemma between speed and safety.

One of the ways to respond to the increased risk of fraudsters and the inherent financial ramifications is to build a real-time payments architecture that is equipped to respond in real-time. In addition, the infrastructure must be able to integrate insight from all available data – both historical and real-time – that can identify the difference between legitimate and illegitimate transactions in a nanosecond.

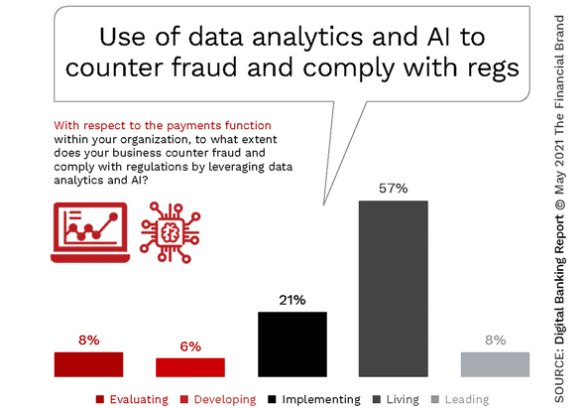

The use of data and advanced analytics for fraud prevention (and to comply with regulatory requirements) must be dynamic, real-time, self-improving, easy to update and scalable.

Our research found both an awareness of the increased threat of fraud (that is associated with real-time payments) and a strong desire to move forward to reduce payments risk and increase compliance capabilities. Unfortunately, as we found with other components of payments maturity, the ability to respond to the needs related to risk, fraud and compliance is not keeping pace with the heightened awareness of need. The good news is that the maturity level for payments fraud prevention was the highest of all components of payments maturity.

As found in other research conducted by the Digital Banking Report, financial institutions are doing a relatively good job leveraging data, advanced analytics and AI to minimize fraud and respond to regulatory needs. In our research, 65% of organizations believed they were either “Living” or “Leading” in the use of data.

The Need For Future-Ready Leadership

Digital payments transformation requires more than just updating technology or building new digital payments applications. Failure to align the efforts, values and behaviors of leadership and employees can create friction and risks within an organization.

Alternatively, when leadership embraces the changes that are needed, and supports a comprehensive and collaborative effort to advance payments modernization, all efforts to “become digital” will have a greater chance of success. Part of any payments transformation effort is having the communication and actions support the efforts at the top of the organization. It also requires support and buy-in by those at other levels of the organization, including the same middle management that has been doing things the same way for decades.

In addition to making the goals of the payments modernization clear (and how the process will positively impact corporate objectives and strategies) top management and boards must focus on communicating the cultural aspects that will help efforts succeed, including transparency, accountability and a willingness to experiment — and even fail.

Despite the uncertainty about the future, the time to act is now. Those institutions that do so will emerge more prepared to compete in a ever-changing payments ecosystem, with a stronger value proposition, greater efficiency, and higher profitability.