Traditional and non-traditional banking providers are increasingly responding to evolving customer needs and behaviors by creating new solutions at speed and scale. With a challenger mindset, these organizations are continuously rethinking back-office processes to enhance products and services that build engagement and create better experiences.

These efforts are expanding the set of potential financial partners that consumers and businesses consider using, resulting in shifting loyalties and market share.

New research, soon to be released by the Digital Banking Report, shows that while innovation leaders understand the importance of delivering improved experiences and products as quickly as possible, structural challenges continue to impede the speed and scale of innovation. Adding to the challenges of legacy cultures and processes, financial institutions are considering ‘scaling back’ investments in innovation as the industry faces uncertain economic times.

More than ever, those institutions that view the innovation process as a driver of future revenues (as opposed to a cost) will benefit the most as the economy returns to normal growth patterns.

The future of retail banking innovation has the foundation of internal and external data, advanced analytics, digital technologies and new delivery alternatives. Winners will be defined by how well they can rethink back-office operations and whether organizational leaders can embrace change. This also requires a shift from a product orientation to a consumer-centric culture.

Banking Transformed Episode: Innovation, Transformation and the Future of Banking

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

1. Improving Innovation Success

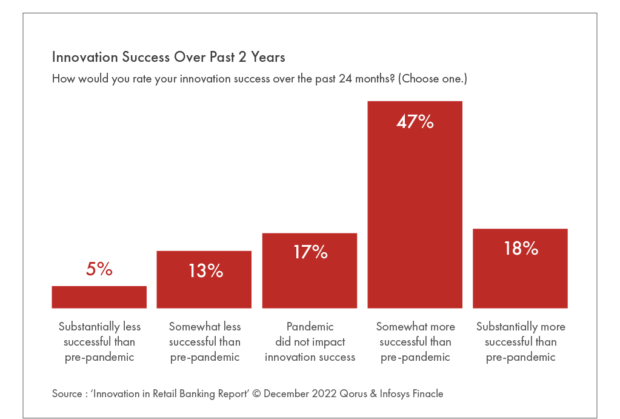

In this year’s research, we found that banks and credit unions globally indicated that they have seen improved results from innovation efforts over the past two years. When we asked financial institutions about their innovation success over the past two years, 65% of organizations stated that their success was greater than in the past. Unfortunately, there are still close to one-fifth of financial institutions that are not having the success they achieved pre-pandemic.

When we reviewed the different components that are the foundation of innovation success, 18% of financial institutions surveyed indicated that they are ‘very successful’ in getting dedicated investments for innovation initiatives, with another 49% stating that they were ‘somewhat successful,’

Interestingly, a third of institutions stated they were either ‘somewhat unsuccessful’ or ‘very unsuccessful’ in getting the needed funding. As seen in the past, the largest and smallest organizations are doing the best at committing dedicated investments to innovation.

Innovation Impact:

Firms that stay focused on innovation will have a definite advantage as the economy returns to normalcy.

It was encouraging to see that 76% of financial institutions were successful in sourcing and evaluating innovation ideas from partner or fintech firms (up from 66%), with over three quarters having success with their overall approach to innovation and 65% having a well defined innovation strategy. 63% of institutions stated having success in measuring the benefits of innovation initiatives.

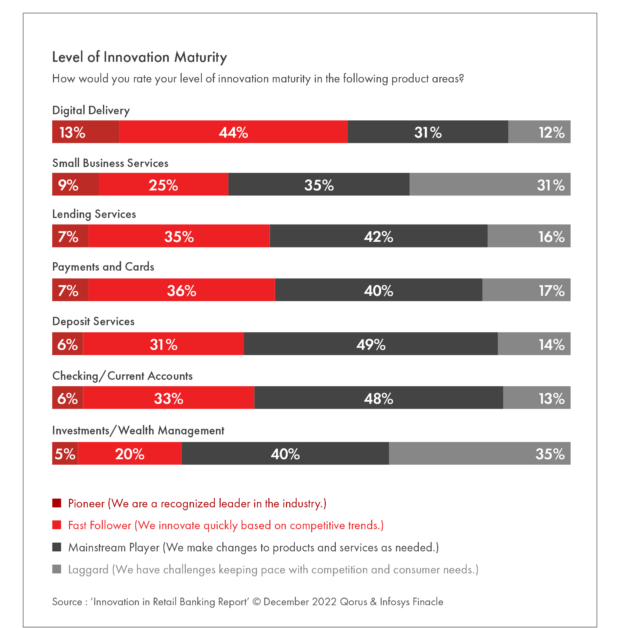

Despite these improvements, the self-assessment of innovation maturity did not change significantly from 2021. In fact, the variance in maturity levels was virtually non-existent across all banking categories. This lack of improvement is especially concerning in foundational categories such as checking accounts, and lending services which are the foundation for customer growth.

2. Increased Collaboration With 3rd Party Providers

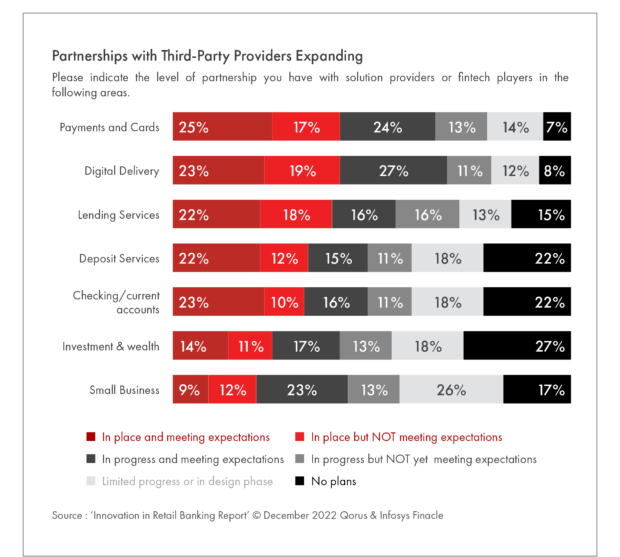

The speed of deployment of innovation solutions is more important than ever as the banking ecosystem is evolving faster each year. The good news is that when we asked financial institutions how they are using third-party providers and fintech firms, many organizations already have partnerships already in place or in progress of implementation. The biggest areas of concern are deposit services and checking accounts, which drive new customer acquisition at most firms.

Third Party Collaboration:

When selecting partners for innovation, it’s important to look for firms that align with your core values and the key focus of your innovation agenda.

In most cases, the rationale for looking elsewhere for support was the desire for more innovative solutions to specific needs (digital account opening, cloud deployment, open banking functionality) and the need for speed and scale of deployment.

Read More: Four Essential Tech Trends Changing Banking in 2022 and Beyond

3. Increased Importance of Digital Engagement

Data, analytics, and new technologies are transforming the art and science of personalized customer experiences, enabling the creation of advanced forms of engagement beyond transactions. Innovation around customer engagement is holistic, predictive, precise, and clearly tied to business outcomes beyond sales.

Winning organizations are building the capabilities, talent, and organizational structure needed for this transition. Those that stick with traditional processes will be forced to play catch-up in the years to come.

Back-Office Modernization:

Innovation requires modernized platforms, simplified applications and democratization of data. That said, outdated technology can't be an excuse for failing to innovate.

The goal is to provide value beyond just products and services, displaying empathy for customer needs that will strengthen the overall relationship, throughout the entire customer journey. The crucial importance of this capability is increasingly understood by banking leaders.

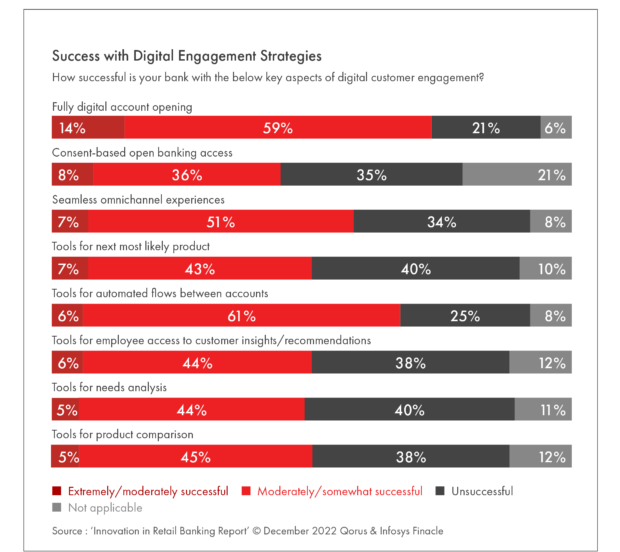

Data from our research reveals that by their own assessment, financial institutions are still falling short of what’s required, but that progress is being made in several areas (digital account opening, tools for automated flows of data, omnichannel experiences, etc.). Innovation must focus on engagement across the entire customer journey and across channels.

Despite challenges around delivering greater customer engagement, financial institutions large and small are testing how to process all forms of customer interactions. The challenge for most organizations is doing the type of engagement required at scale. To deliver this level of engagement, most financial institutions need to invest in updating existing technology and architecture.

In addition, building a strong engagement strategy requires a shift from a traditional product-centric approach to a customer-centric approach that focuses on intelligent customer engagement. Done well, the result will be the ability to capture new growth opportunities by delivering greater value for customers now and in the future. Innovations in this area support a true omnichannel experience.

Read More: How Data and AI is Transforming the Future of Banking

4. Omnichannel Innovations Across the Customer Journey

More consumers than ever rely have moved beyond branches as their primary channel for routine transactions and service. That said, the local branch remains valued for complex transactions, advice and resolving problems. In today’s omnichannel environment, customers expect to be able to choose among self-service, banker-assisted service, or full-service — and the ability to move seamlessly between digital and human interactions.

Financial institutions need to innovate ways to better deliver high-quality customer experience with the flexibility to reliably support all touch points. Democratizing data availability and empowering people with technology are emerging trends — allowing customer support personnel to engage on all channels.

It is more important than ever that banks and credit unions act to avoid losing personal engagement associated with face-to-face contact. Using data and technology equipped to detect and quantify customer needs can help digital and human channels to work in concert, proactively engaging the right banker for the consumer at the right time.

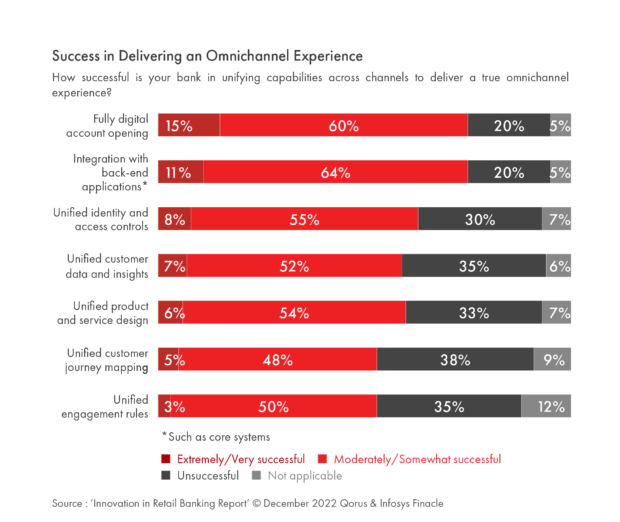

The good news is that many financial institutions surveyed indicated a modest level of success in delivering omnichannel experiences. From new account opening to integration of front and back office applications, banks and credit unions are focused on innovating new ways to communicate and deliver solutions using the channels customers prefer.

There are still gaps, but progress is being made.

5. Major Business Model Shift Occurring

As found in last year’s bank innovation report, financial institutions are increasingly looking to move to more of an open banking business model, re-prioritizing investment strategies and building third-party partnerships that will drive innovation and customer experiences in the future.

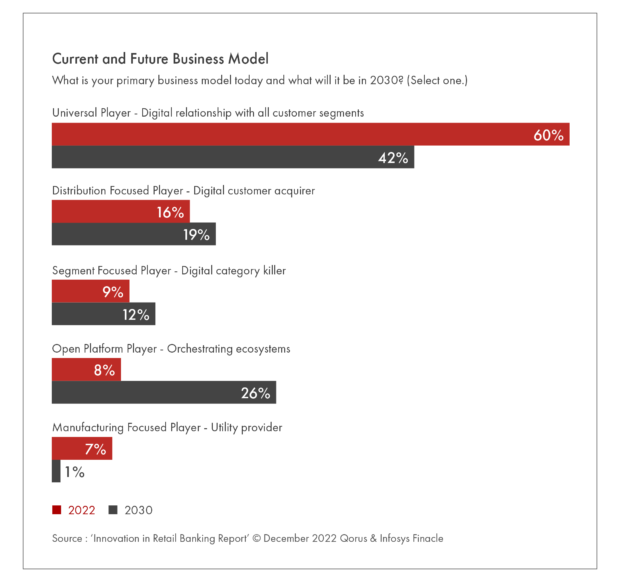

The move away from being a universal player — building digital relationships with all customer segments — is gaining momentum, with the use of application programming interfaces (APIs) now seen as a secure and standardized method to provide consumers more control over how their data is used.

While 60% of organizations considered themselves a ‘universal player’ today, with only 8% saying their business model was being an open banking player, more than 25% of organizations see themselves having an open banking model in 2030. Most of this shift is away from being a universal player, disrupting traditional banking business models forever.

Banks and credit unions are challenged to satisfy consumers with the traditional services they have used for decades, while also delivering the latest offerings that a growing portion of consumers desire. More than ever, consumers are willing to take their business to other financial institutions to find innovative products and services, with more consumers willing to use new financial services partners to get what they want.

A financial institution’s leadership has a direct impact on the ability to create innovation and the success of innovations already undertaken. This includes both the top leadership of an organization as well as those in a lower supervisory position. A culture that encourages new ideas and a challenger mindset is now essential.

Better utilization of data allows banks and credit unions to offer a more personalized and differentiated user experience — and a better UX keeps customers more engaged. Every interaction provides valuable data, which then helps inform how a financial institution can better personalize the experience and drive engagement.

Bottom line, the entire future of innovation in banking hinges on the availability, democratization and deployment of data and solutions.