Who will win the debate over whether the branch is dead or whether it has a future? A new study from Cornerstone Advisors suggests that it doesn’t matter.

The report actually characterizes the long-running scuffle as an irrelevant distraction from much more important questions that go beyond channel-specific concerns.

Few people build their lives around their banking needs. It’s something they check off a list. As banking analyst Ron Shevlin states in the Cornerstone Advisors’ study, “consumers have ‘jobs to be done.’ Those jobs include opening an account, understanding how their financial lives are performing, and resolving problems like fee disputes and potentially fraudulent activity on their accounts.”

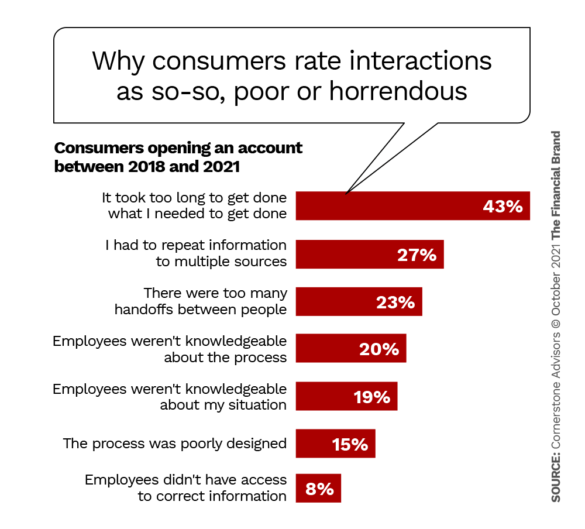

A key conclusion made in the study, conducted in conjunction with Backbase is that both sides of the “branches are dead/branches are not dead” debate miss the point. Channels need to work together in a single process that meets consumer needs. Thinking in terms of one channel or another won’t work anymore.

“The challenge should be framed in terms of human+digital,” the survey report states. Two key points stand out: “1. How can digital technologies enhance the human-assisted or human-intermediated (i.e., person to person) interactions? And 2) How can digital technologies be better utilized when human-assisted interactions are less convenient or less effective?”

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Using a Branch Does Not Equal Loving a Branch

Shevlin, Research Director at Cornerstone, says that perceived preferences for branches versus online and digital channels should be interpreted carefully, because they may not mean what they seem to mean.

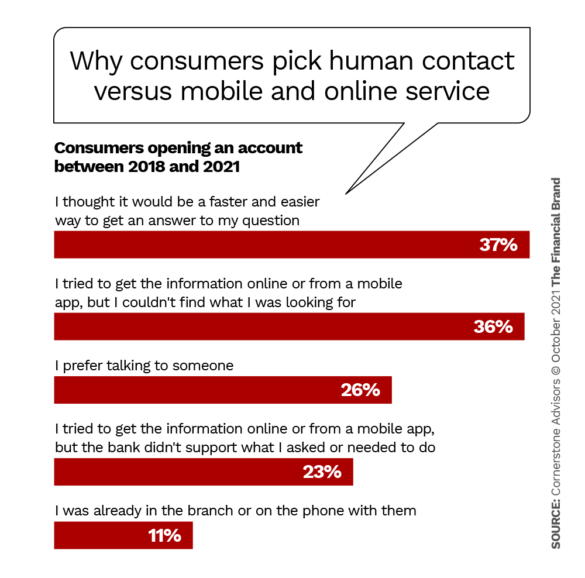

For example: When consumers choose to turn to branch staff to ask questions when they are opening accounts or to revolve problems they are having, it’s not likely that they prefer dealing with people. More likely, their bank or credit union has dropped the ball digitally.

Why did branches ever come about? the report asks rhetorically. For Shevlin, it comes down to one word: convenience. In the study he points out that any discussion of retail banking service needs to be centered on that.

People often turn to live bankers during account opening because they can’t find the answers to their questions digitally. In addition, people often discover that whatever glitch they’ve encountered in trying to open an account digitally isn’t supported in either the online or mobile channels of the financial institution. In either case, though they started digitally, they have no choice but to take the human option.

Inconvenient Truth:

Reaching out to humans in branches sometimes begins with frustration: Attempts to accomplish something electronically have failed, so “let’s try a person.”

The study makes the point that different generations react differently to circumstances and have different comfort levels, even after the pandemic drove so many to digital channels.

“Young consumers live their lives on their smartphones,” the report states. “So, when it comes time to get a banking job done, doing it on a smartphone will be most convenient for them and what they’re most experienced using.”

Why people choose humans over digital channels, by generation

| GEN Z (Ages 21-25) |

MILLENNIAL (Ages 26-40) |

GEN X (Ages 41-55) |

BABY BOOMER (Ages 56-75) |

|

|---|---|---|---|---|

| I couldn’t find what I was looking for online | 40% | 40% | 42% | 19% |

| I thought it would be faster and easier | 39% | 38% | 37% | 33% |

| The bank didn’t support what I needed to do | 24% | 33% | 21% | 6% |

| I prefer talking to someone | 17% | 19% | 27% | 55% |

| I was already in the branch or on the phone with them | 10% | 13% | 12% | 7% |

Source: Cornerstone Advisors

The report continues: “They’re interacting with bank employees, not because they want to, but because they have to. And they’re doing it in branches because that’s the only way banks make their employees easily accessible — not because they want to go to a branch.” [Emphasis added.]

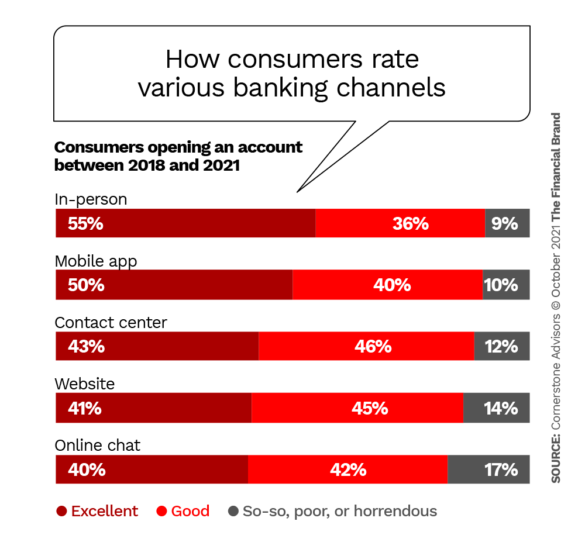

The study found that branches ranked slightly higher than mobile apps but the “why” behind consumers’ use of one or another is a key factor in determining satisfaction. Nearly every reason involves some aspect of convenience.

In the report, Shevlin quotes Vernon Hill, who founded Commerce Bank, which became notable for extensive and ubiquitous branching, as saying that he wasn’t making major investments in digital (in the early 2000s) because “Nobody wants a relationship with a machine.”

To which Shevlin ripostes, “That might be true, but nobody wants a relationship with a brick, either.”

Read More: Branch Staff Unprepared as Offices Become ‘Advisory Centers’

A Human Touch in Banking Doesn’t Have to be In Person

Something that jumps out in the research is the concept of the account manager. About 31% of the consumers sampled said they had one.

Account Managers Matter:

34% of Gen Z consumers and 43% of Millennials have account managers at their primary financial institution. And for many this relationship is important.

Both generations value having an account manager. Consumers overall cited these as the top four subjects they cover with account managers:

- How well my overall financial performance is doing 47% (Millennials 65%, Gen Z 50%)

- What I can do to improve my financial health 36%

- What other products and services could be right for me 33%

- Issues and/or problems I have with the company 32%

Gen Zers and Millennials tend to discuss issues and problems they have with their financial institution more than Gen X and Baby Boomers.

The study suggests there is no reason that these relationships have to be centered on branches. “Having a human account manager doesn’t necessarily mean giving up on digital,” the report states.

As a model, the report refers to Umpqua Bank’s Go-To app, which allows customers to consult with human bankers but through a secure chat environment, rather than face to face.