One of the most prominent themes Covid introduced to the banking world is the concept of the hybrid workplace.

Not all financial institutions are in favor of it, notably Goldman Sachs, which told employees they must return to the office by a certain date. Others believe when carried out correctly, a collaborative mix of in-office and remote employees can make for a very effective system.

The reality is the pandemic reprogrammed people’s habits in many ways — inspiring them to try their hand at cooking, go for walks more regularly or even try out TikTok. More than that, freed from the 9 to 5 routine and the commute, many believe they are in fact more productive working from home.

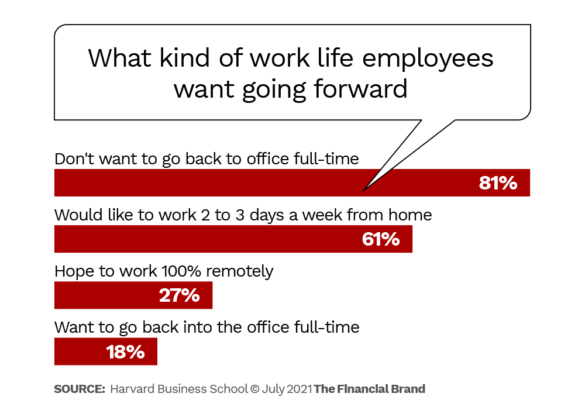

A March 2021 Harvard Business School study found that 81% of all workers don’t want to return to work full time. Three out of every five people say they would enjoy the hybrid office-home lifestyle, over a quarter say they’d like to strictly work remotely and only 18% say they wouldn’t mind returning to work full time.

This could be bad news for the financial institutions with branch networks, technology centers and executive offices to run.

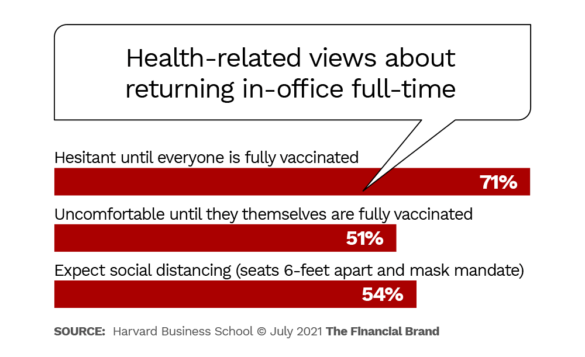

Employee views could change over time, however. A slight majority of workers argue they’re uncomfortable going back into the office until they’re fully vaccinated and almost three quarters say they’re hesitant until the entire workforce is fully vaccinated. Therefore, employees may grow more comfortable returning as more of the population gets vaccinated.

It’s really single adults and those without children who are defending the work-from-home options the most, the HBS survey found. On the other hand, as most schools reopen to in-class teaching, parents and married people generally are more often the ones preferring to return to their pre-Covid work lifestyle.

Food for Thought:

Parents are the ones who most want to come back into the office. With single employees, however, financial institutions will need creative solutions to break them away from the remote-work life.

Nonetheless, there are ways to get employees back in the door. But, it will take understanding what people became used to and make it worth it for them to come back.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

Some Different Approaches

When Covid-19 first surged, financial institutions were classified as “essential businesses.” Every bank and credit union went about organizing their employees with different strategies, which is reflected in how they’re navigating the post-pandemic world. Here are some examples among larger institutions.

A Return To The Office:

Most financial institutions are eager to have their employees reoccupy the empty desks. Yet, the hybrid lifestyle doesn’t work everywhere. While there are some that are comfortable integrating a flexible schedule into their playbook, big players such as Goldman Sachs, Blackstone Group and JPMorgan Chase are demanding their staff return full-time.

Goldman Sachs, for instance, (which told everyone to return by June 14, 2021) generally offers its workers 20 days of care per dependent in a non-pandemic year. Now it’s added an additional ten days. Goldman Sachs’ in-office teams are also being offered free takeaway breakfast and lunch.

Chase and Blackstone are likewise offering incentives to employees. Blackstone is covering the costs of taxis for London and New York workers to come into the office so they can avoid using public transportation. And Chase is using “JPM Park,” an app which allows directors in London to donate headquarters parking spots for lower-level employees who are driving in. Chase employees biking to work can also use company changing rooms.

The Flexible Method:

Other institutions are experimenting with the hybrid approach.

Throughout 2020, American Express depended on the virtual environment, which “worked well” for the company, CEO Stephen J. Squeri said in an email to staff, according to Banking Exchange.

Now, AmEx is going to introduce the hybrid model in a three-week transition period in mid-September. If it is successful, employees likely will work in the office for three days a week with a choice to work two from home.

On the other hand, Switzerland’s UBS Group says it is permanently allowing two-thirds of its employees to continue the hybrid home-office lifestyle, although internal memos warn employees that “hybrid working doesn’t mean that you can work wherever and whenever you want,” Bloomberg reports.

“In the changes you’ve made, have you created a foundation for the future that everybody in the company will find engaging, fair, inspiring, and meaningful?”

— Lynda Gratton, HSM

Standard Chartered enthusiastically champions the hybrid model. The big U.K. bank allowed employees in nine of its markets to apply for “flexi-working arrangements” in early 2021, with additional phases to be extended through mid-2022.

“While we have been thinking through the issues around the future workplace for some time, it’s inevitable that recent events provided a catalyst,” Tanuj Kapilashrami, Group Head of Human Resources at Standard Chartered, said in a statement.

Read More: Will Banking Executives Ever Return to the Office?

It Can’t Be Done Without Technology

Regardless of how financial institutions go about re-inventing and reintroducing their workplaces, technology more than anything is an integral tool. Data marketing company Tech Target recommends incorporating 14 different kinds of technology. The Financial Brand pulled out the top four for banks and credit unions to focus on for the next stage of the post-Covid workforce.

Collaboration tools: If companies didn’t have fluid cloud collaboration tools (e.g. Slack, Asana, Google Docs) available to employees prior to the pandemic, they certainly should consider them now.

However, even though employees are returning (either full- or part-time) to the office, it does not mean those technologies are less important. It’s essential that a hybrid workplace continues to utilize collaboration tools such as cloud storage, document synchronization, file-sharing tools, instant messaging and online whiteboards.

Video conferencing software: In addition to collaboration tools, video conferencing (e.g. Zoom, Webex and Microsoft Teams) enables groups to work efficiently and collectively. People may be in the office two or three days a week, but video conferencing systems can keep them engaged in their home offices as well. Even with all employees in-office, video conferencing can be a useful, especially now that people are more familiar with it.

Performance management tools: TechTarget says even with in-person employee-manager relationships, “employees need clear goals and regular check-ins to ensure they are receiving timely feedback.” This is even more important for remote workers. Managers can easily slip into the ‘out of sight, out of mind’ mentality, and employees won’t know if their performance is meeting expectations.

Tech Target counsels that technology that encourages performance management updates is imperative to hybrid work arrangements.

Office capacity management tools: The Covid-19 pandemic may have influenced social distancing guidelines for good, especially as the Delta variant impacts the United States. Yet, even with winter flu viruses, offices can benefit from tracking their office capacities.

Other technologies Tech Target suggests incorporating include applicant tracking systems, communication platforms, document management, human capital management, employee learning applications, mobile tools, office cleaning automation, onboarding applications, reservation systems and security software.

Read More: 21 Tips to Help Bank Sales Teams Working From Home

Make It Worth It To Return

Although hybrid working could be the wave of the future, even for banks and credit unions trying to get employees back into the office full-time, it’s essential that executive teams take the opportunity to rethink how in-office work is performed.

Lynda Gratton, London Business School Professor and founder of the HSM consultancy, writing in the Harvard Business Review, encourages financial institutions to really think about what the office work life is like and ask questions such as, “Are any team tasks redundant? Can any tasks be automated or reassigned to people outside the team? Can we reimagine a new purpose for our place of work?”

“In the changes you’ve made, have you created a foundation for the future that everybody in the company will find engaging, fair, inspiring, and meaningful?” she prompts.

Gratton advises financial institutions to make the hybrid model enticing, which could even be as simple as reconfiguring office spaces to “encourage cooperation and creativity” while also investing in tools to make working-from-home a collaborative effort as well.