The plan to introduce a new digital wallet by the same banking industry consortium that runs the Zelle person-to-person payment service has been greeted by a curious mix of reactions since word about it leaked — perhaps on purpose — in late January.

One of the most unusual aspects of the plan is that the seven big banks behind the effort are, atypically, trying to be the disruptors — newcomers trying to break into an established club, like the fintechs of a decade or so ago were doing.

Their wallet could be a big deal. But will it be?

Some scoff that going up against other digital wallets from the likes of PayPal is a huge ambition without any reasonable expectation of success. Others see cracks that could be exploited.

But a few perceive a far loftier ambition, which would elevate this initiative from just a “me-too” move to something momentous. They suggest what might be afoot is a long game that involves creating payment rails separate from those used by credit cards today.

The Digital Solution for Prepaid, Incentive and Reward Cards

Join experts from CPI for an informative webinar to learn where digital cards are today and what they will look like in the future.

Read More about The Digital Solution for Prepaid, Incentive and Reward Cards

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

The Court of Opinion: Pro, Con and Undecided

There’s been a shortage of facts since the initial report about the proposed digital wallet, but no shortage of opinion.

• On the negative side, there’s been scorn over how late to the digital wallet party the big banks are.

Some predict that the effort, called “Wallet” for now and initially designed to be used in ecommerce, will flop or, at best, be an also-ran. After all, earlier attempts at launching a digital wallet by the U.S. banking industry — major payments companies Visa and Mastercard included — have fizzled.

Still, Zelle was a late arrival in person-to-person payments, but made big strides.

• On the positive side are suggestions that the banks have an advantage because of the data trove Zelle built up. This could give the new digital wallet a competitive edge.

Beyond that, some boosters say that the big banks’ promotion of a new wallet for credit and debit card transactions would be just a first act. A successful launch could see the digital wallet segue into additional services, notably an industry-driven pay-by-bank effort.

Early Warning Services, the consortium behind Zelle, would be responsible for Wallet, and it is owned by seven of the largest banks in the country. So access to a large base of potential users is a given. But potential is the key word there.

• In between are those who suggest that success or failure will depend entirely on the approach taken and the “use cases” that the bank consortium focuses on to get the digital wallet rolling.

In addition, a major question is whether the banks want to stage a frontal assault on the big tech and fintech-owned digital wallets that dominate the U.S. market — PayPal, Venmo, Apple Pay, Google Pay, Samsung Pay and more. They could have in mind a sortie around these established players, possibly with some specialized applications.

Each of the digital wallets from these nonbanks has a competitive plus of its own. All have a reputation for agile and speedy product development as well, which may mean a short shelf life for any banking industry innovations in the digital wallet space, consultants and analysts point out.

PayPal, a payments leader for years, keeps adding new functionality to its digital wallet. Apple Pay has a large potential base for its wallet among iPhone users, who all have the app regardless of whether they opt to use it. Google has the Android operating system that runs a variety of phones. And so on.

Banks, for their part, still run a big piece of the legacy consumer payments business, though they don’t own any physical phone or operating system real estate.

During a podcast discussion, Ron Shevlin, chief research officer at Cornerstone Advisors, noted that he had changed the headline on his blog post about the big banks’ digital wallet effort three times. It’s now “Bank of America’s and Chase’s Digital Wallet Is DOA (Doomed on Announcement).” Originally the parenthetical was “Delusional on Announcement” and then “Doubtful on Announcement,” until Shevlin’s viewpoint settled.

What the Digital Wallet Landscape Looks Like Today

The big banks’ early moves — which we’ll review in a moment — come at a point when the consumer payments business is in flux with the launch of FedNow in the near future and much more going on.

Digital wallet usage is climbing as well.

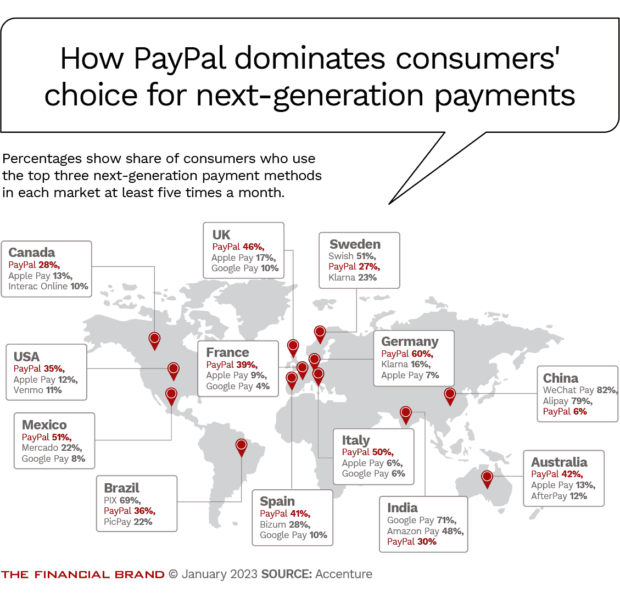

“The preference for digital wallets is increasing exponentially, with over half of consumers surveyed globally regularly using this form of payment,” says Sulabh Agarwal, global payments lead at Accenture. “Digital wallets offer the customer convenience, speed and simplicity, while providing banks with deeper insights into their behaviors and needs.”

Payments is a means to an end, with the goal being to “own the customer relationship and build value on the back of it,” Agarwal says. “Owning the relationship is a key battleground for banks, and crucial in driving growth and relevance.”

Dan Schulman, PayPal’s president and chief executive officer, said in early February 2023 that digital wallets continue to capture a growing share of consumer spending.

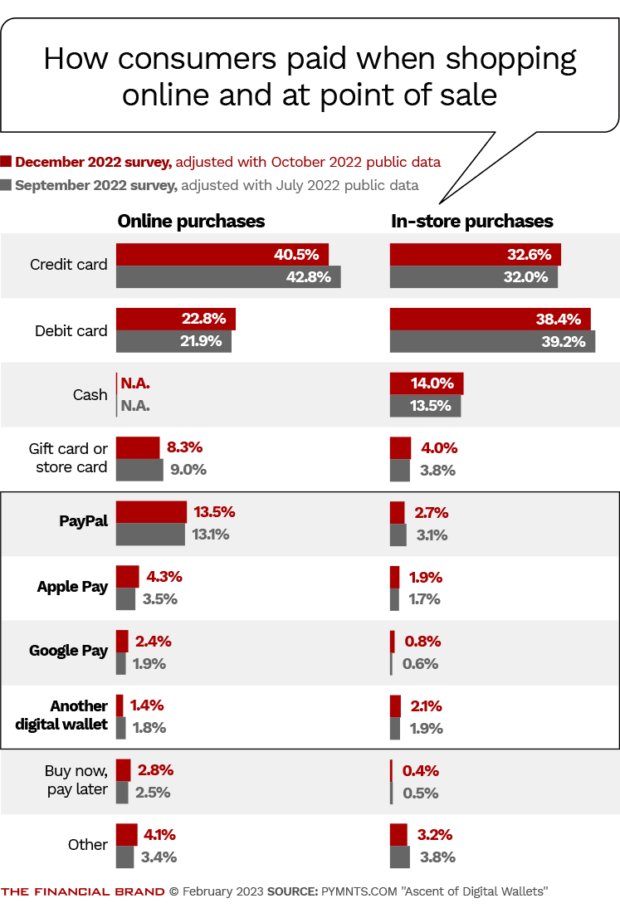

Speaking on PayPal’s fourth-quarter earnings call, Schulman said more growth is possible, especially since purchases using manual entry of credit card data still account for a 30% share of ecommerce spending today.

“There’s a lot of share to be taken from that by digital wallets,” he said. (Schulman has announced plans to retire at the end of 2023, though he plans to remain on PayPal’s board.)

Another potential source of growth for digital wallets is the portion of consumers who don’t trust merchants with their payment data — but who crave better checkout experiences.

Wally Mlynarski, head of product-merchant services at Bank of America, referenced this during a PYMNTS.com podcast in February 2023. He cited PYMNTS research indicating that 55% of U.S. consumers don’t store their payment information with merchants. (In fact, a recently introduced leading-edge credit card feature offered by JPMorgan Chase is designed to help consumers determine which merchants have retained their payment details and let them revoke access easily.)

But Mlynarski also noted the heavy competition for space in the checkout experience. Besides the visual clutter it creates, there is the challenge of limited real estate. “Merchants can’t implement every single wallet,” said the BofA executive. “It’s too much of a cost burden.”

To provide value that wins merchants over, payment companies need to offer low-cost integration, and then deliver on consumer volume, he said. “You have to have consumers transacting with you. If you only have five out of every hundred consumers using your wallet, it may not be enough to drive that willingness to integrate and drive that solution set.”

Richard Crone, the founder and CEO of Crone Consulting, agrees that merchants are key. “All new payment types start with merchant acceptance,” he says. “If you don’t have merchants accepting, you’re not going to gain any traction.”

This is why Amazon’s 2021 decision to begin accepting Venmo transactions was such a big deal. Crone thinks Venmo’s coup — Amazon has approximately 40% of all U.S. ecommerce sales — is part of what got the banks moving.

“The owners of Zelle can’t ignore the opportunity of expanding their network with retailers and others supporting shopping,” says Heidi Liebenguth, managing partner and research director at Crone Consulting.

As Shevlin sees it, the big banks are going to struggle to disrupt the digital payments leaders. “PayPal is clearly the 800-pound gorilla in this space,” he says, adding that changing digital behavior is notoriously difficult.

Read More:

- Zelle’s Growing Popularity Benefits Banks in Surprising Ways

- Digital Wallets Could Cost Banks Billions in Lost Payments Income

- ‘Bank of Twitter’: Is Elon Musk Spitballing Or Could It Really Work?

Early Warning Services’ Coy Reveal Is Typical in Payments

There’s been very little detail about the proposed digital wallet from Early Warning Services itself. (The company originated in the 1990s as a cooperative means of providing anti-fraud and related services. It took over the forerunner to the Zelle person-to-person payment service in 2016 and rebranded it the following year.)

Early Warning published a blog post titled “Introducing a Wallet Your Customers Can Trust” in January, a day after The Wall Street Journal published an exclusive about the plan, without identifying any sources beyond one mention of the company.

The Early Warning blog post included a link to the article, which could be seen as a strong hint about where the information originated. In the payments business, this type of reveal is common with major developments. Whatever the intent is — maybe to send up trial balloons? — more begins this way than through official announcements.

Early Warning has granted no media interviews specifically about the digital wallet — The Financial Brand made multiple requests — though it promises more news “soon.”

But during an interview about Zelle’s growth trends, Early Warning CEO Al Ko told The Financial Brand that Wallet is intended to be a solution for all banks and credit unions.

Early Warning anticipates expanding the service to additional institutions in 2024, Ko said, noting that the expansion would be done in stages, but that no specific timeline has been set. He also said inquiries are already coming in from institutions that are interested.

Early Warning’s meager website page about the proposed digital wallet stated that it would be at a merchant industry event in mid-February, where “executives will be available to discuss how Wallet can impact the merchant’s bottom line, specifically increasing sales and reducing costs.” (This publication requested copies of sales literature being distributed at the conference, only to be told none was being used. A media representative for the conference said the event was closed to the press.)

The conference appearance, coming as it does without much detail about the digital wallet, reflects the urgency to get merchants interested. Payments experts indicate that it can take years to get new payments efforts up to scale.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

What Little We Know About the Proposed Digital Wallet

Here’s a review of what is known at this point:

• The basics: In the second half of 2023, Early Warning Services, will roll out a digital wallet on behalf of the seven banks that own the business — Bank of America, Capital One, JPMorgan Chase, PNC, Truist, U.S. Bancorp and Wells Fargo. The wallet will make it unnecessary to manually enter data and will produce a tokenized number for the merchant’s use.

• Who’s in charge: Early Warning announced that James Anderson, a former Mastercard executive and payments veteran, would lead the effort from new offices in New York City. (Early Warning is based in Arizona.) Though some speculate that the effort is very new, Anderson’s LinkedIn page states that he’s been aboard since August 2022. The same page indicates Anderson holds 10 payments-oriented patents. Other hires have announced on LinkedIn that they are joining the EWS digital wallet team.

• The point of it all: In the consortium’s blog, Anderson states: “We hear from consumers that they want to utilize online payments from their trusted financial institutions. Early Warning is working closely with financial institutions to build a wallet that provides consumers a secure and easy way to pay. The wallet will also aim to deliver better business outcomes for merchants — including higher transaction approval rates and more completed sales.”

The company also says a simplified checkout process should reduce cart abandonment, the bane of the ecommerce seller.

Issuers whose cards are loaded in existing digital wallets by consumers still receive the interchange income they would get if the cards were swiped. However, being part of the digital wallet purchase is seen as having less control over the transaction and the customer relationship.

The stakes: Early Warning says the banks involved in the initial effort will bring 150 million Visa and Mastercard credit and debit card relationships to the table as part of the launch, “with plans to add other card networks in the future.”

The official announcement makes no mention of allowing financial institutions that are not in the initial group of seven to be part of Wallet. (They can take part in Early Warning’s Zelle service, though many complain about the costs of giving customers this access.)

Read More:

- 5 Payments Trends to Watch in 2023

- ‘Pay By Bank’ Trend Is Next Front In Merchants vs. Banks Payments War

- Chase’s Playbook to Beat PayPal and Square in Digital Payments

How Would This New Digital Wallet Get Traction?

What’s not clear is how those 150 million accounts would become part of the new wallet. And this underscores a challenge: While merchant acceptance and a place among the many logos are critical, there’s a serious chicken/egg dilemma. Consumers want merchant acceptance, merchants want signed-up consumers.

“Those seven banks may collectively have 150 million customers using their debit and credit cards at a variety of merchants on and offline — but so what, big deal,” Karen Webster, CEO at PYMNTS.com, wrote in a blog post about the proposed digital wallet. “Those customers must be persuaded to create an account — or activate one, depending upon how it is introduced — and then use Bank Wallet most of the time they shop online instead of the online payments options they use today at checkout.”

Added Webster: “There’s even more to overcome because consumers are already using those bank cards with other wallets today, so that those cards aren’t themselves a competitive advantage.” She argued that Early Warning Services must come up with a wallet that provides an experience that is “exponentially better.”

When 'Latest' Isn't Necessarily Too Late:

Of course, being late to the game isn't necessarily insurmountable — if you bring something measurably better. If that weren't true, we'd all still be using passbooks and scrambling to get to the bank by 3 p.m. on Fridays lest we have no cash for the weekend.

The question some commentators have is whether banks, having owned so much of the payments business, but having lagged nonbanks like PayPal, can come up with something better.

“Too little, way too late,” observes Jim Marous, co-publisher of The Financial Brand and host of the Banking Transformed podcast. “Financial institutions may participate, but it is the consumer who drives scalability.”

Marous adds that “playing ‘catch-up’ does not make for a good press release, but that is what is happening. Their main target is their existing customer bases. The challenge is that the heaviest users of mobile payments and mobile wallets already have their payments partners selected.”

How could the big banks make their offering attractive enough to bust up the status quo? While Early Warning talks about trust in banks, many consumers have grown comfortable trusting a nonbank like Amazon with their credentials and PayPal decades ago blazed a trail for confident use of credit cards on websites.

Marous thinks some inroads could be made by increasing security and integrating rewards into the new wallet. “But such components continuously get enhanced,” he says, “so I doubt if the new digital wallet will have anything in these areas that can’t be replicated.”

He’s skeptical about the big banks investing the continuous effort he sees as necessary for success. Even if the launch is successful, he says, will the follow-up be strong? “How long will it take for the big banks to introduce ‘Big Bank Wallet 2.0’?” Marous asks.

In his blog and his podcast, Cornerstone’s Ron Shevlin has questioned a tone he reads into the few details from Early Warning that the banks have a “winner take all attitude.”

“I don’t think that’s how consumers use digital wallets and other digital payment tools,” says Shevlin. “I think to a large extent their usage is driven by convenience.”

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

Is There a Much Longer Game Afoot Based on Zelle?

Crone sees the big banks’ digital wallet as the beginning of a bigger payments push and not just an effort to go head to head with other digital wallets. As part of a bigger push, he thinks the end game could be creating an entity out of Early Warning Services that could be sold by the big-bank owners. A cooperative venture in payments going public has precedent. Years ago what is now the public company Mastercard, for example, was a banking cooperative that benefited from united branding, product development, shared payment rails, security, marketing and more.

But that’s down the road. Right now Crone thinks the plus that few are talking about is the user directory that Zelle has by virtue of the way it operates. Consumers must provide their cell phone number as well as an email address in order to enroll in Zelle.

“Zelle is a certificating authority,” Crone explains. “It uses the cell phone number and email address to initiate transactions. Those payment credentials are embedded in Zelle’s database.” He says the validation and storing of that information is valuable because it is a way of communicating with modern consumers. This is data that banks and credit unions often lack for many of their customers, he says.

Crone suggests that if Early Warning can gain merchant acceptance for its wallet, the big banks could in time meld the functionality of Zelle, which connects to users’ checking accounts for P2P transactions, to the point of sale for purchases from merchants. This would facilitate a bank-driven pay-by-bank network, potentially with tremendous ubiquity. Other payment functions could be added on. In time, he says, this could evolve into payment rails separate from those of Visa, Mastercard, American Express and Discover. This could be part of how the 150 million credit and debit card holders become part of the digital wallet structure, according to Crone.

This is a high-level description of a complex argument, but the conclusion is that Early Warning could be aiming for something beyond a “me-too” move.

“There’s a lot of heavy lifting to be done,” says Crone. But he says that if venture capitalists get involved at some point, that is a plus. For them, he says, “hard is good,” because the harder a challenge, the more unique a business model can be.

In spite of negative publicity ginned up on Capitol Hill and elsewhere about Zelle, Crone thinks that the brand, enabling P2P payments on a growing scale, has considerable cachet.

In her blog post, Webster acknowledges the possibility of the pay-by-bank effort that Crone predicts. But the PYMNTS.com CEO says persuading consumers to adopt a new way to pay will take years and will require the convenience and protections that cards provide today.

“Assuming that enough consumers establish a bank digital wallet — and enough merchants accept it to make using it a better deal for them than the existing alternatives — moving consumers to a pay-by-bank option is another big lift,” Webster writes.