Direct banks experienced overall declines in customer satisfaction levels in 2024 versus 2023 in checking and savings accounts, according to the newest J.D. Power Direct Banking Satisfaction Study.

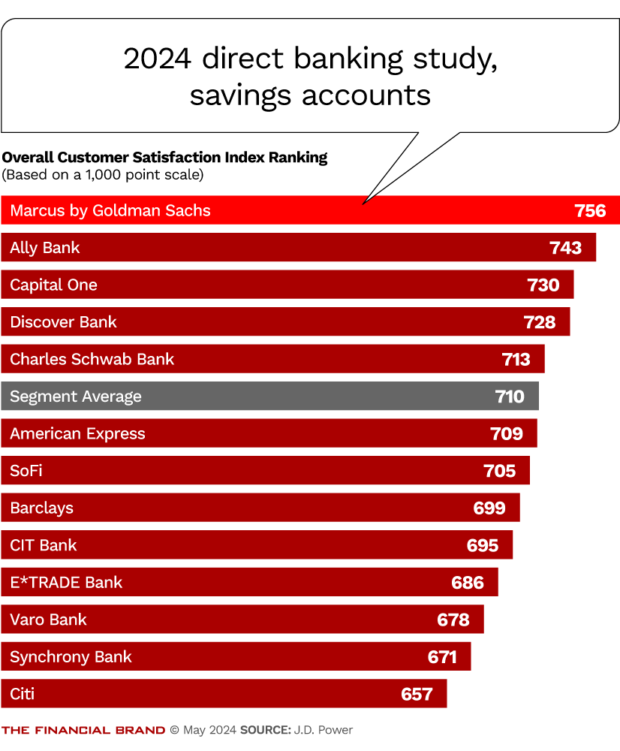

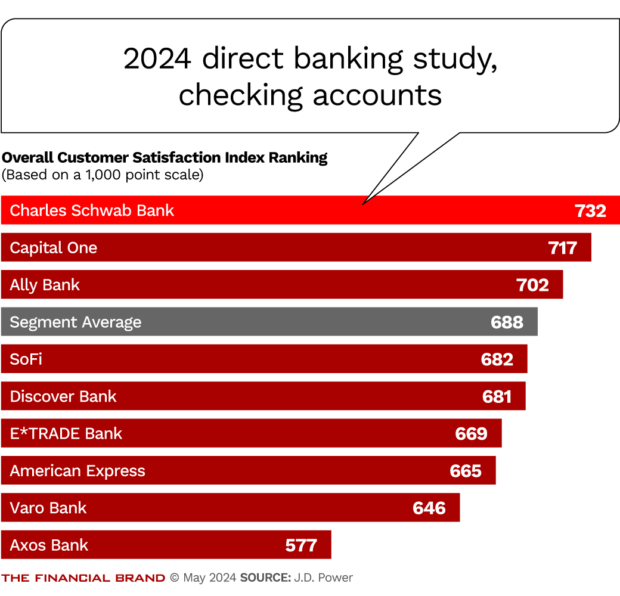

Direct banks scored 688 for checking, down 27 points versus the previous study, and scored 710, down 8 points, for savings. All J.D. Power studies are based on a 1,000-point scale.

The 27 point fall “is a large, significant decline — they definitely lost some ground,” according to Paul McAdam, senior director of banking and payments intelligence at J.D. Power, in an interview with The Financial Brand.

Granted, some direct institutions that have mastered online account opening earned higher ratings than the rest. And direct banks as a category still outdid other groups of providers for overall customer satisfaction in both checking accounts and savings accounts.

The company’s direct banking study covers institutions that do business digitally and which have a banking charter. (Institutions like Chime that don’t have charters are covered by J.D. Power research among neobanks, not in the direct banking study.) The company also compared the direct banks to midsize banks, regional banks and national banks, and the group outperformed all of them.

These trends played out against a backdrop of increased consumer interest in direct banks, according to McAdam, thanks to higher interest rates, lower fees and 24/7 access to account information. The study notes that checking accounts opened with direct banks were up seven percentage points; savings accounts were up six points.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs.

What Pulled Down Direct Bank Satisfaction Ratings?

McAdams says that the ratings came in lower than they had in the previous study for two main reasons: weaker customer service and slower problem resolution.

“Fewer customers actually had problems. But if customers needed support of any kind, and particularly if they had a problem, it just went downhill,” says McAdam. He said the company ran special analyses to be sure that problems with a handful of consumers weren’t pulling down overall numbers.

McAdam says the report underscores that direct banks must keep their eye on customer service fundamentals. One example he cited was how problems involving consumers’ direct banking account debit cards took two days longer for the institutions to address than in 2022. (Among causes of the problem may be a rising level of debit card fraud events, says McAdam.)

Read more:

- To Fight Waning Consumer Loyalty, Here’s How to Shift Focus

- Consumers’ Finances Are Stressed — And Its Getting Worse, Fast

Navigating direct bank mobile apps is also causing problems for consumers. Overall, J.D. Power researchers feel that direct banking mobile apps and websites need a refresh. Among sources of dissatisfaction — even among consumers who have not had problems with accounts — are digital interfaces that lack visual appeal. Other sources of dissatisfaction include the narrow range of services available and lack of clarity in digital channels.

On the flip side, institutions that had well-oiled online onboarding typically have higher satisfaction levels, according to McAdam. He says that the more customers can do online without any human intervention, the more satisfied the customers are. Online onboarding helped push Marcus to the top of the savings direct bank list and Capital One to high spots in both rankings.

It’s Not Always About Digital Shortfalls

The study also found that institutions that saw their customer satisfaction ratings fall sometimes had people, not technology, to blame when ratings went down.

Human support for digital channels were often the culprits, including issues with “knowledge of the support” and “courtesy of support.”

Notably, many of the unhappy customers were newcomers to direct banking brands.

“Customers who used phone or online chat reported declining satisfaction with rep helpfulness and knowledge,” the report says. “Satisfaction with new account opening decline, and fewer new customers felt completely prepared to start using their new account.”