An analysis of online conversations about financial institutions shows that passion for credit unions is waning slightly, but not enough to cause concern. In fact, credit unions are mostly maintaining ground they gained during the Great Recession, when consumers expressed more trust consumers in them than banks.

Using Crimson Hexagon, a tool that collects public posts from digital channels across the web, the IQ Agency has studied online conversations from 2008 through 2015 to identify trends in the way that people discuss banks and credit unions.

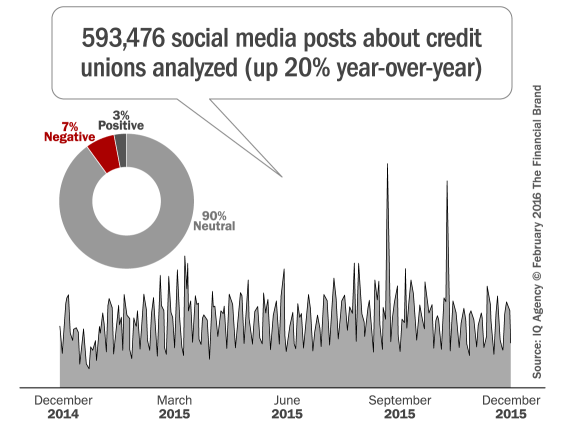

Toward the end of the Great Recession, the overall volume of credit union-related conversations increased year-over-year by more than 200%, but this pace has slowed significantly. Each of the past two years have shown only a 20% increase year-over-year in credit union conversation volume, the passion for credit unions is holding steady.

In 2010 there was a total of 252,000 mentions of credit unions online with 9% of those mentions being negative. Just a year later in 2011, total volume of mentions had increased to just under 500,000 with negative sentiment dropping a point. Interestingly though, as the economy stabilized, total volume dropped 14% and negative sentiment returned to 9%. And that is basically where the numbers stayed in 2013 and 2014.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs.

2015, however, was very different. The total volume of conversations was up to almost 600,000, and negative sentiment was at its lowest point at 7%. While all things point to an overall good year, it seems that the passion for credit unions might be waning somewhat. Of the nearly 600,000 credit union conversations, just 3% of those were positive, down sharply from previous years, with the vast majority being neutral.

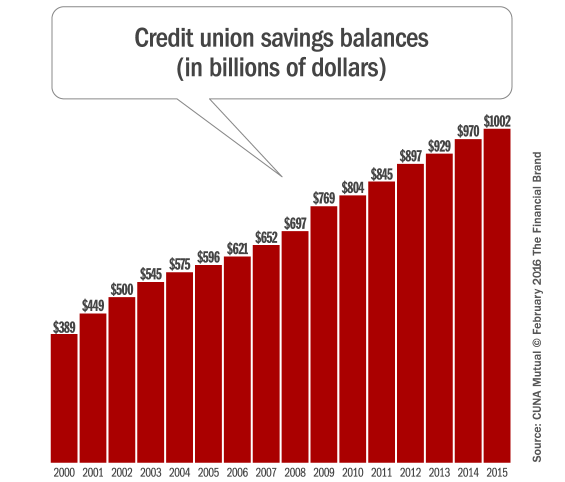

It’s interesting to layer behavioral and deposit data on top of these trends. Since 2000, there has been a steady increase in deposits at credit unions across the country. While the spike in mentions seen in 2011 does coincide with the most dramatic increase in deposits, generally online advocacy for credit unions does not directly translate into an correlative increase in deposits. This suggests that credit unions struggle to capitalize on consumer interest.

Credit unions should invest in ways to translate online conversations into more members and more accounts by emphasizing the features and benefits consumers crave. Specifically, consumers are looking at the following considerations when choosing between a bank and credit union.

1. Convenience. They want to access, move, and manage their money at any time of the day with the same level of user experience that they’ve come to expect from other industries like retail.

2. Service. Credit Unions excel in service, but it is important to differentiate today as businesses increasingly shift to competing more on service than product.

3. Technology. Consumers, especially Millennials, expect a great mobile and desktop experience. Invest in a website that can compete with larger banks and mobile apps that delight users who are accessing it daily.