What if banks stopped caring about crafting the perfect customer experience?

What if, instead, some banks focused on delivering banking services such as checks, bank accounts or automated clearing house infrastructure through an open application programming interface (API) — and let someone else worry about customer interaction?

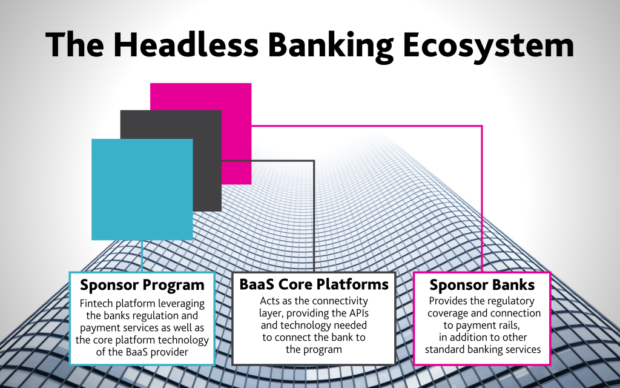

Headless or sponsored banking — service-focused banks without branches, apps, or any sort of customer-facing user interface — is a budding trend in banking-as-a-service that is poised to help redefine the way smaller, community banks go to market and generate revenue. At least on paper.

How? These banks allow financial institutions to focus on technology and infrastructure without investing time and resources into costly user-facing experiences, Simon Taylor, head of strategy and content at Sardine.ai writes in a LinkedIn post. But technology limitations and regulatory mandates could limit the rate at which headless banking is adopted.

What’s the Fuss About Headless Banking?

Column in the U.S., Solaris Bank in Europe, Griffin Bank in the United Kingdom and Pave Bank in Singapore all serve as examples of headless banks, Taylor says. All four possess banking licenses.

The rise in financial institutions offering headless banking services signals a paradigm shift where consumers no longer directly engage with traditional financial institutions for their everyday banking needs, says Cornerstone Advisors Senior Consultant Elizabeth Gujral.

In fact, headless banking separates itself from wider embedded banking and other forms of BaaS in a few key areas, says Gujral.

“Unlike BaaS or embedded banking, where fintech firms like Chime serve as alternatives to banks and do not hide that fact, headless banking transcends the conventional banking structure altogether,” she says. “Behind familiar fintech brands like Chime or MoneyLion lie traditional banks issuing cards and holding deposits, such as The Bancorp or Pathward, a fact often obscured to consumers unless they read the fine print.”

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

More specifically, headless banks like Column combine two key components of the tripartite banking model — technology, infrastructure and a banking license — to “fundamentally redefine” the banking ecosystem, says Agustin Rubini, director analyst at Gartner’s Banking and Investment Services Global Research.

That’s an important distinction to make between embedded finance companies or digital banks like Chime and more traditional headless institutions like Column, Rubini says.

What’s The Difference Between Headless Banking and Digital Banking?

Digital banks offer a user-facing experience and partner with licensed banks to hold deposits and issue cards. Headless banks, on the other hand, combine the technology infrastructure and banking license to enable other organizations to offer financial products without directly interacting with customers.

“Chime, managing customer interactions and technology, lacks its own banking license and relies on partnerships with licensed banks,” he says. “In contrast, Column provides both the technological infrastructure and the banking license to other organizations but does not handle direct customer interactions. This model enables Column to empower a broad range of financial products without maintaining a traditional customer-facing role.”

Dig deeper into BaaS:

- How FinWise Bank Plans to Survive the Storm in BaaS

- 8 Themes That Will Power a Fintech Comeback in 2024

Headless Banking is, In Fact, a Familiar Model

While headless banks like Column, founded in 2022, are relatively new to BaaS, the headless banking model has been around for decades, says Jonah Crane, partner at Klaros Group.

Case in point: prepaid cards and white-label credit cards.

“Each of those is really offered in the same way that banking-as-a-service works,” Crane says. “You have a brand that says ‘I want to issue a card of some sort’ and so they partner up with the bank. Then the money is loaded on that card and it can be accessed via the card,” wherever it sits in the bank.

“Most banks have not built their technology on this modern tech stack, which is APIs.”

— Ryan Christiansen, Stena Center for Financial Technology

On the flipside, tech giant Apple serves as a key example of a company that leverages headless banking services, Cornerstone Advisor’s Gujral says.

Apple is “not positioning itself as a bank but as a technology giant integrated into the fabric of daily life for many consumers,” Gujral says.

Yet, many folks can’t identify that Goldman Sachs issues the Apple Card, for example.

“I have a bunch of friends with an Apple Card, but if I ask them what bank actually issued that card, half of them don’t know,” says Gujral.

Understanding the Technology Lynchpin

Not every financial institution can just flip a switch and immediately offer headless banking services.

Headless banking relies on robust APIs to allow partners to access back-end data structures and business logic, says Ryan Christiansen, executive director of Stena Center for Financial Technology at the University of Utah.

“Take the Column example,” Christiansen says. “This is a very innovative bank in that its entire tech stack is built around just having these APIs. Most banks have not built their technology on this modern tech stack, which is APIs.”

Chart by Jeff Forkan

For business credit card and expense management platform Brex, which partners with Column, a reliable API system has been a priority from day one. “However you want to frame it, any money movement is ultimately just a message system,” Brex Head of Global Financial Products Erica Dorfman says, noting that best-in-class APIs allow Brex “to build with” its partners.

That’s not necessarily the case from some “older architectures,” she says.

Regulators Unfriendly to BaaS

Regulators have been turning up the heat on sponsored banks and BaaS firms as a whole, which also slows down, or impedes altogether, potential entrants, Stena Center’s Christiansen says.

“It’s a full Category 5 storm in the regulatory space,” he says. “There’s consent orders being handed out to these sponsor banks on a very routine basis right now. Regulators have decided that there’s not enough oversight of their fintech clients.”

Sponsored banks, for example, are still required to abide by “very strict” KYC guidelines when new accounts are opened, even if a fintech partner is the one handling the account opening, Christansen says.

Learn more about KYC guidelines:

- Is Your Aging ‘Know Your Customer’ Program a Risk Timebomb?

- How Banks Can Reduce Fraud and Improve KYC Compliance

Regulators may also have a hard time assessing sponsor bank risks as headless banking services scale, Sardine’s Taylor says. “Community banks appear to be less risky than they are when they start out in embedded banking or BaaS. They’re on a 3-year exam cycle from their major agencies, and their business looks more or less the same year over year.”

Once banks start allowing third parties to distribute their banking services, additional risks build up, Taylor says, which are unfamiliar to both the bank and regulators. “The way out of this Catch-22 is automation from day one: Real-time oversight and thoughtfulness about the risk policies required before getting deeper into BaaS.”

Profits Abound

Despite the required technology investment and unfavorable regulatory environment, headless banking has potential to generate legitimate revenue — evidenced by earnings results of sponsor banks like The Bancorp, which works with Chime and other BaaS partners, Gartner’s Rubini said.

“Bancorp reported a substantial 31% revenue growth in Q4 2023, impressive even excluding the recent interest rate rises,” Rubini says. “Their early adoption of embedded finance technologies has allowed them to leverage deposits from these services to fund specialized lending programs, highlighting the symbiotic relationship between fintechs and smaller, agile banks.”

Looking ahead, he expects banking and fintech to further converge, “driven by the digital-first business models that facilitate embedded finance” despite regulatory headwinds and technology limitations that could hamper its growth.

“The alternative is the slow death of community banks as a species.”

— Simon Taylor, sardine.ai

“Companies like Shopify exemplify this trend, having shifted a substantial portion of their revenue to financial services, thus underscoring the profound impact of embedded finance on traditional business models,” Rubini says.

“As the industry continues to evolve, we see a movement towards a more integrated banking model where fewer platforms provide a comprehensive suite of financial services, driven by technology firms that package various banking services into a single, user-friendly platform,” he says.

Headless banking may even help smaller, community banks stay afloat by focusing on what they do best — banking, rather than customer experience, Sardine’s Taylor adds. “A well-run embedded banking program is the best way for community banks to be economically viable in the long run. The alternative is the slow death of community banks as a species.”

Joey Pizzolato is an award-winning writer and editor based in New York, specializing in consumer finance. His work has been published in DSNews, The MReport, Auto Finance News, and Bank Automation News, among others. He is a two-time recipient of an Azbee Award for Enterprise News and Investigative Reporting.