Financial marketers are in enviable and unenviable positions simultaneously. On the plus side, marketing is more important than ever, helping banks and credit unions connect with consumers who engage increasingly digitally. On the down side, with continued pressure on financial institution earnings likely in the aftermath of the pandemic, marketing budgets for many will be squeezed. That won’t just impact campaigns. It will inhibit the installation of enhanced digital marketing capabilities — both the technology and the skill sets needed to use it — just as the need for it is greater than ever. New marketing technology can bring efficiency, which helps with budgets, but you can’t just snap your fingers to get there. It requires investment in software and talent.

Doing more — a lot more — with less, in other words. Welcome to the next normal.

A rough road, however, is less difficult if at least you know where it is leading. Where this particular road is leading is enhanced competitiveness and opportunities for growth.

“While the pandemic poses a financial and organizational challenge to many financial institutions and their marketing efforts, it has also created a unique backdrop for opportunity unlike any in our memory,” writes Jim Marous, Owner/Publisher of The Digital Banking Report and Co-Publisher of The Financial Brand, in his latest “State of Financial Marketing” research report.

In this article we present some of the most important bank marketing challenges/opportunities, drawn from the DBR survey of financial marketers, sponsored by Deluxe, and from other research and expert commentary. We’ve broken it into manageable chunks and avoided excessive detail. It’s a roadmap, not an owner’s manual.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Marketing Budget Squeeze

Bank and credit union marketers know the drill about budgets. In downturns, it’s the rare institution that doesn’t cut back its marketing, even though studies show it’s highly beneficial to maintain or even increase marketing spend.

The pandemic and the recession it spawned changed the outlook for marketing budgets in a matter of weeks. In a survey conducted by Salesforce just before the pandemic began in the U.S., “budget constraints” were not listed among the top five challenges marketers faced. By contrast a later survey by Marketing Week and Econsultancy found that “Uncertainty about budgets, planning and events” was the number one challenge cited by 69% of the respondents. Further, 63% of U.S. marketers said marketing budget commitments have been delayed or are under review.

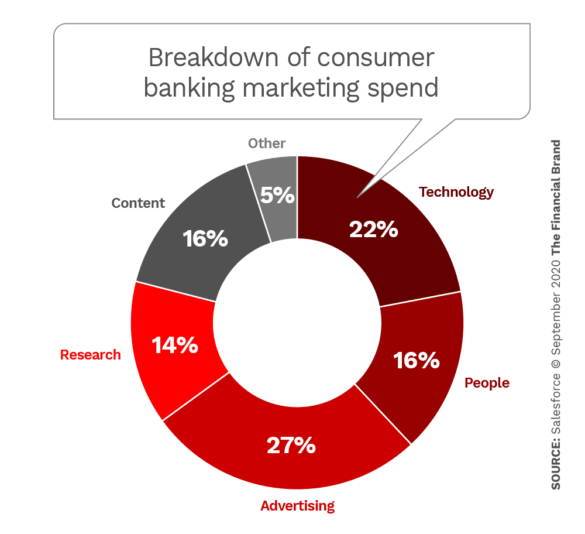

As a benchmark, here’s how Salesforce broke out the pre-COVID B2C marketing budget allocations.

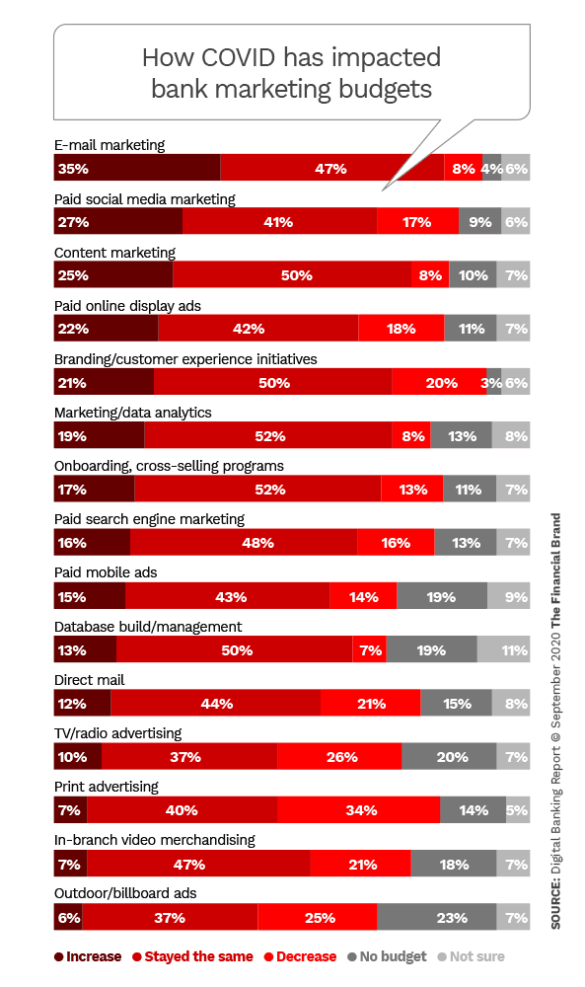

The DBR survey, conducted in July 2020, asked bank and credit union marketers to detail where budget changes had occurred. As the chart below shows, the biggest hits, not surprisingly, were to outdoor advertising, print advertising, broadcast and in-branch marketing. The biggest budget increases came in email marketing, social media and content marketing.

As noted earlier, increased use of marketing technology could create efficiencies that will stretch limited budgets.

“By leveraging process automation tools and technology, financial marketers can build a straight-through and agile marketing process,” maintains Chandramouli Venkatesan, Market Development Executive in Capgemini’s Financial Services and Capital Markets practice. That plus finding the right balance of internal and external resources will bring economies of scale and lower the cost of marketing operations, he says.

As Marous points out, “research has found that brands that have adopted artificial intelligence (AI) for marketing strategy have seen a 37% reduction in costs along with a 39% increase in revenue. This is because correct targeting creates less waste.”

For the majority of financial institutions, however, such tech implementation is not immediately likely.

Read More: Digital Marketing Strategies for Community Financial Institutions

Analytics and AI: The Challenge of Putting Data to Use

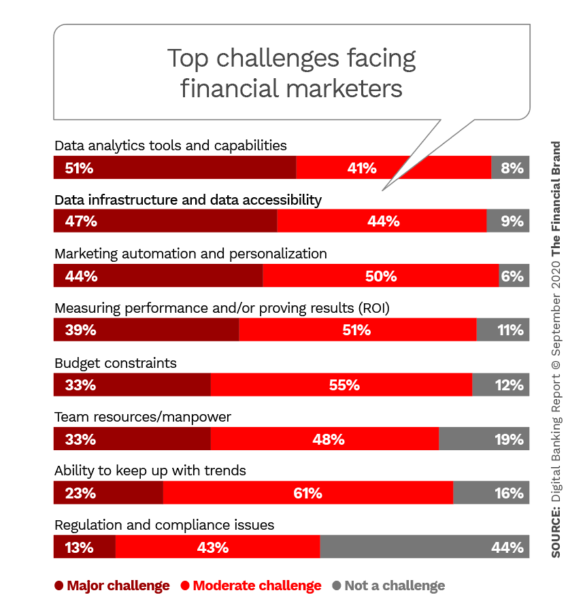

Bank and credit union marketers ranked “Data analytics tools and capabilities” as the biggest challenge they face, far bigger than budget constraints, according to the DBR survey. While AI is not specifically listed in the chart below, a separate question uncovered the striking fact that 75% of all banks and credit unions say they are “not adept” at using AI to determine next best action/offer for customers or prospects.

There is a sharp difference in AI capabilities by size of institution. Only 29% of the largest banks (over $50 billion) mention “data analytics” as a “major challenge” compared with more than 50% of institutions of $1 billion or less in assets that consider this to be a major challenge.

“Mid-size banks are witnessing an increasing demand from consumers for experiences similar to those offered by big techs and neobanks,” says Venkatesan. The Capgemini exec suggests AI and machine learning tools can be used effectively in marketing in these areas:

- Personalization and customer behavioral targeting

- Segmentation

- Marketing attributions

- Marketing operations

- Forecasting and return on marketing investment (ROMI)

- Content, digital asset management

- Cognitive search

Salesforce, in its 2020 State of Marketing report, notes that “Marketers have long recognized the importance of data in understanding and engaging customers as individuals. But as customers’ circumstances and needs evolve rapidly, building a clear understanding of them is nothing short of essential.” However, the report notes that just 37% of marketers are satisfied with the quality of consumer data they have and 34% with their data integration efforts.

For financial institution marketers, Salesforce reports that the median number of customer data sources used in 2020 is ten. That is projected to increase to 15 in 2021. The five most popular sources (ranked by all marketers) were:

- Transactional data

- Declared interest/preferences

- Known digital identities

- Offline identities

- Anonymized digital identities

“We see the new privacy laws and rules as an opportunity for banks to create an even deeper customer focus.”

— Chandramouli Venkatesan, Capgemini

Those choices reflect the increasing pressure on marketers to gather as much first-party data as possible, due to regulatory changes and to the inability to use third-party cookies on many mainstream browsers.

The technical and regulatory changes to the availability of customer data may have the greatest impact on digital marketing ever seen, Jim Marous predicts.

Capgemini’s Venkatesan believes the trend could be a marketing opportunity. “We see the new privacy laws and rules as an opportunity for banks to create an even deeper customer focus, to better understand their customers with first-party data, and focus on campaigns and strategies that create long-term customer value.”

Read More: Why Content Marketing Is Important To Financial Institutions

So Much Martech, But Much of it Goes Unused

Spending on marketing technology doubled from 2017 to 2019, according to data from Chiefmartec.com. Yet just a little over half (58%) of marketers are using the potential of their marketing stack, according to Gartner. Venkatesan attributes that to three factors: 1. Bad customer data, 2. outdated, inefficient processes and 3. a shortage of the right talent.

The data issue was covered above. Regarding inefficient processes, Venkatesan states that issues such as multiple touchpoints to execute a campaign, lack of standardization of campaign components and manual handling of data should be solved by a marketing resource management solution. The problem is that many of these software tools are out of date.

Talent is a tougher challenge. To have an agile marketing team an institution needs a blend of expertise in digital marketing technology, data, marketing and creative, says Venkatesan. He acknowledges that external help will likely be needed.

Marous puts it bluntly in the State of Financial Marketing report: “It is becoming increasingly challenging to deploy modern marketing with legacy talent, skills and mindset.” He believes that most financial institutions will be better advised to partner with specialty organizations to provide the needed skills.

Better use of marketing technology is imperative in banking as the industry lags many other industries, according to Marous. As in other areas, his report found that the largest financial institutions were much further ahead in use of marketing technology. Credit unions are beginning to do more, he observed, but very few community banks are using any martech software.

Salesforce lists the most commonly used martech solutions, according to marketers:

- Customer relationship management (CRM)

- Email service provider (ESP)

- Advertising platforms

- Data management platform (DMP)

- Customer data platform (CDP)

Personalization By Any Other Name Remains Vital

Bank marketers have long been aware of the importance of personalization. Now practitioners have begun to embrace the concept of contextual engagement — consumers’ expectation of real-time personalized offers and messages.

Capgemini calls this type of messaging “individualization.”

“The goal is to deliver the right message to the right customer with the right intent on the right channel at the right time,” Venkatesan states. This consistent and personalized cross-channel marketing is an area where banking lags by comparison to big techs and fintechs, he believes.

“Are you only using marketing channels to sell products and services, or are you also using these channels to educate, ask questions and build engagement?”

— Jim Marous, Digital Banking Report

One aspect of context in which banks and credit unions could have an edge is in helping consumers deal with personal economic issues they are facing during the pandemic recession. “The question is, are you only using marketing channels to sell products and services, or are you also using these channels to educate, ask questions and build engagement? asks Jim Marous. “More importantly, do you build on insight collected as you continue to communicate with a customer or prospect?”

It’s an increasingly relevant point in this era of multi-channel marketing. 54% of consumers say they get annoyed if they are targeted with an ad for something they’ve already bought, according to Salesforce. Adding to the significance of that figure, the firm points out that 71% of customers use multiple channels to start and complete a single transaction.

Future Role of Brand, Trust and Loyalty

The large and growing importance of digital marketing will continue to dominate in 2021 and beyond especially considering the impact of COVID-19, which Venkatesan calls “the biggest digital disruptor of the decade.” Still, the role of brand will continue to be important, and in some ways more important, the analyst states.

“Financial services relationships have always been built upon the trust,” he observes, “and ultimately, trust unlocks deeper, more resilient relationships between the brand and its consumers.” Venkatesan points out that Edelman highlights brand trust as second only to price in consumer consideration. Further, Edelman states that 81% of consumers say personal vulnerability (around health, financial stability, and privacy) is a reason why brand trust has become more important.

As Marous observes, social consciousness, sustainability and brand accountability have surged in importance during the pandemic and the social justice events of 2020.

The increased importance of brand values and trust combined with changes in consumer behaviors is changing the rules of the game, states Venkatesan.

One immediate effect he notes: Major banks are rethinking their loyalty programs. They’re moving from being transaction-based point systems to being a means of building and reinforcing an emotional connection and trust with the consumer.