Newly delinquent credit card users now top pre-pandemic levels: New York Fed

American Banker

NOVEMBER 7, 2023

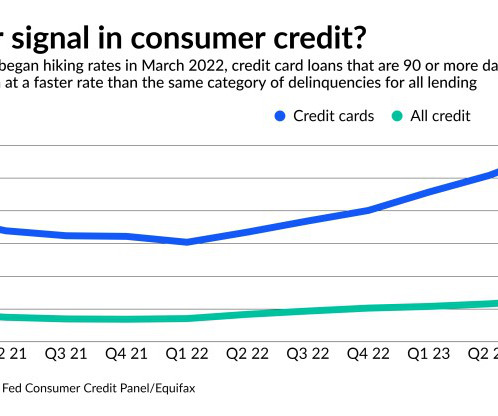

credit card balances continue to march above $1 trillion, the number of newly delinquent credit card users now exceeds the pre-pandemic average and millennials and those with student or auto loans are driving the increase in past-due payments, the New York Fed said.

Let's personalize your content