Scottsdale Community Bank: Making microloans

Independent Banker

JANUARY 31, 2023

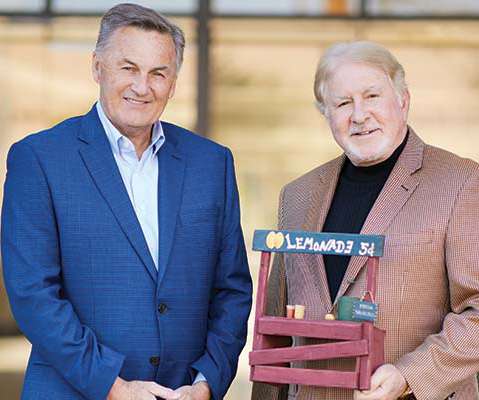

George Weisz, Scottsdale Community Bank But for all its embrace of technology, the community bank took its inspiration for an innovative lending program from an old-school tradition: kids’ lemonade stands. The diverse board, staff and leadership team aim to implement a plan of “doing well for investors by doing good for the community.” “We

Let's personalize your content