Operation BLACKHAT

Perficient

JUNE 22, 2020

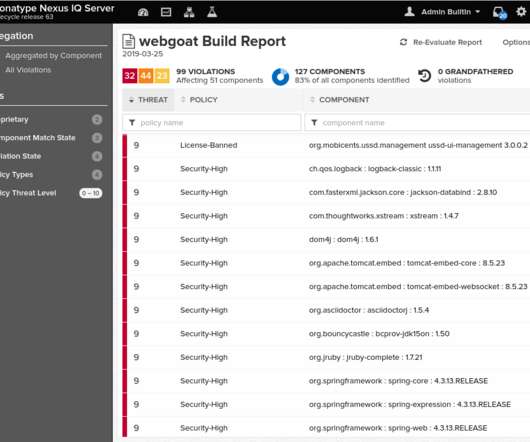

Operation BLACKHAT. He conducts a meeting with his security group, “WHITEHAT” to proceed with the investigation. He has hired other gang members for this operation. The blackhat hired him to research the security gaps to avoid any faults in this plan and report the same. The operation was foiled by the rival gang.

Let's personalize your content