5 Essential Steps to Ensuring Data Regulation Within Your Financial Services Institution

Perficient

JANUARY 18, 2023

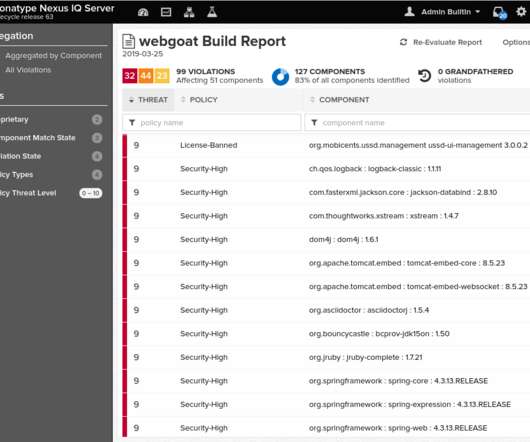

As a result, the pace of data privacy and data regulation has accelerated on a global scale. Ensuring the security of your proprietary and customers’ data is paramount to staying in line with ethical and regulatory standards and retaining customer trust. . Sensitive Data: Regulated. Classify your data.

Let's personalize your content