Top 5 Surprises from FICO’s Fraud and Digital Banking Survey

FICO

DECEMBER 5, 2022

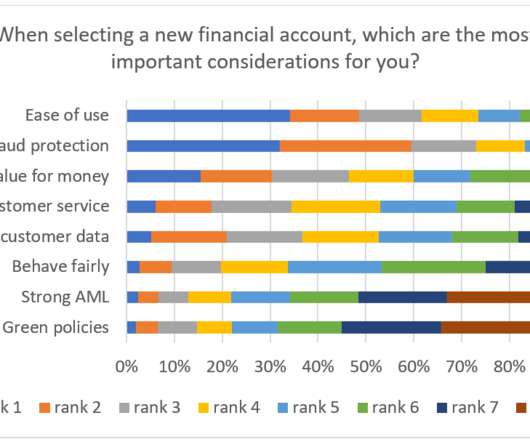

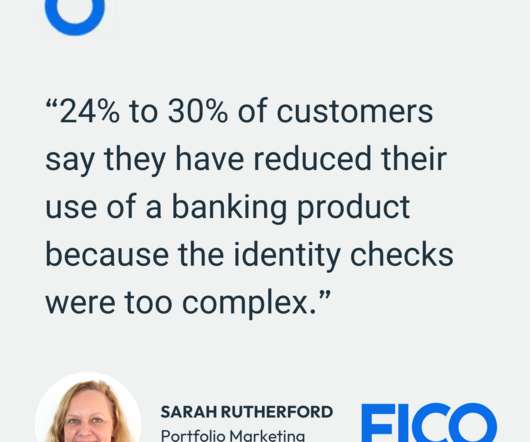

Top 5 Surprises from FICO’s Fraud and Digital Banking Survey. Our survey found that good fraud protection is paramount for customers - even though they themselves may exaggerate income or claims. million consumer fraud and 1.4 FICO Admin. Tue, 07/02/2019 - 02:45. by Sarah Rutherford.

Let's personalize your content