The top lending & credit risk blogs of the year

Abrigo

DECEMBER 22, 2023

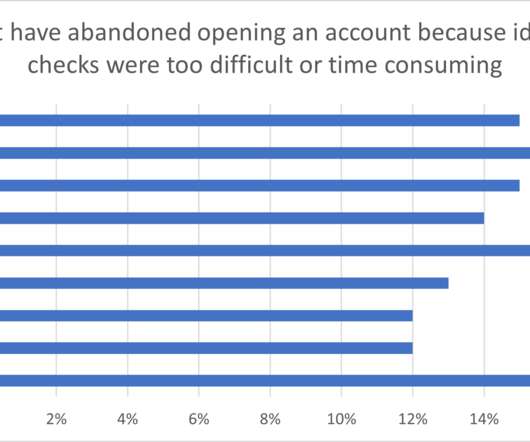

You might also like this resource, Abrigo's "2022 Loan Review Benchmark Survey Results." Takeaway 2 The top lending and credit blog posts focused on the benefits of banking technology, interest rate management, and developing risk ratings. But the benefits of automation are a key part of the customer experience.

Let's personalize your content