Industries Document Generation

Perficient

JULY 11, 2023

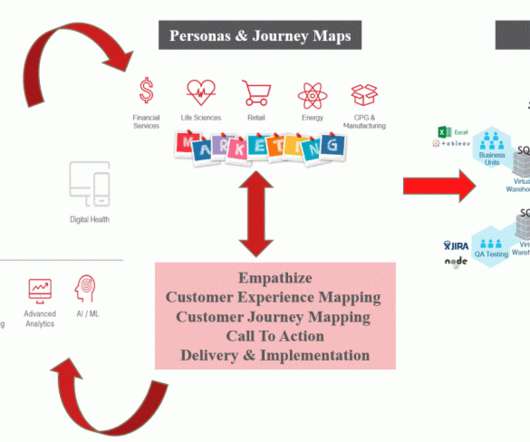

Every company needs documents for its processes, information, contracts, proposals, quotes, reports, non-disclosure agreements, service agreements, and for various other purposes. Document creation and management is a crucial part of their operations. What is Industries Document Generation? How to generate documents?

Let's personalize your content