Survey: When Do Fraud Controls Ruin the Customer Experience?

FICO

MARCH 9, 2022

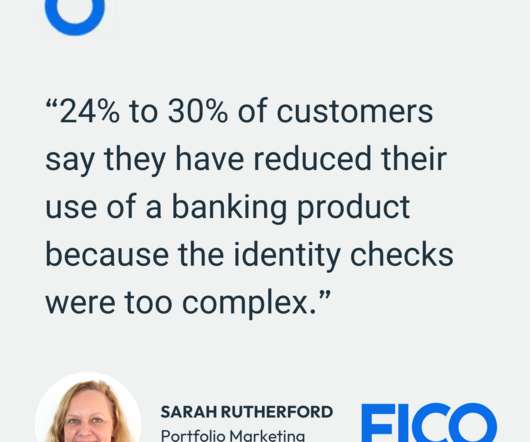

The last few years have thrown up many challenges for banks and card providers as everything has shifted online, one of the primary challenges being fraud scams. But the online shift has also created opportunities for financial institutions to demonstrate their strong fraud controls in the digital space.

Let's personalize your content