APIs, Data Analytics Bring Cash Flow Control To The Back Office

PYMNTS

JANUARY 18, 2021

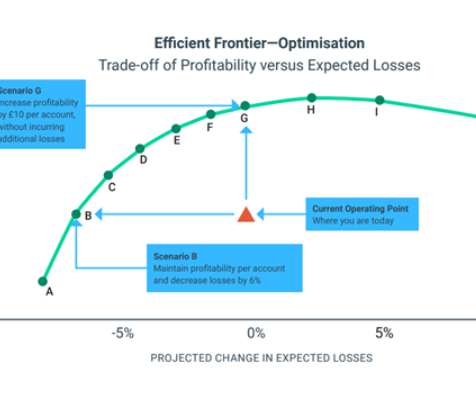

Such silos prevent treasurers from comprehensively analyzing and gaining insights into companies’ cash flows and expenditures, hindering organizations from operating efficiently and reacting to customers’ needs in an agile manner. Each company’s risk management approach must therefore be tailored to its specific business needs.

Let's personalize your content