Federal Reserve Releases 2021 CCAR Testing Scenarios

Perficient

FEBRUARY 16, 2021

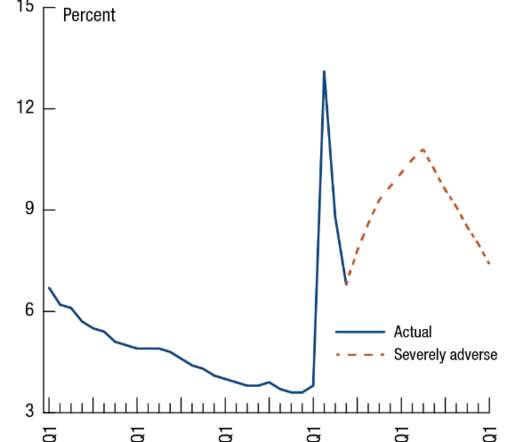

The Fed’s Comprehensive Capital Analysis and Review (“CCAR”) stress tests are designed to ensure that large banks are able to lend to households and businesses even in a severe recession. Also, banks with substantial trading or processing operations will be tested against the default of their largest counterparty.

Let's personalize your content