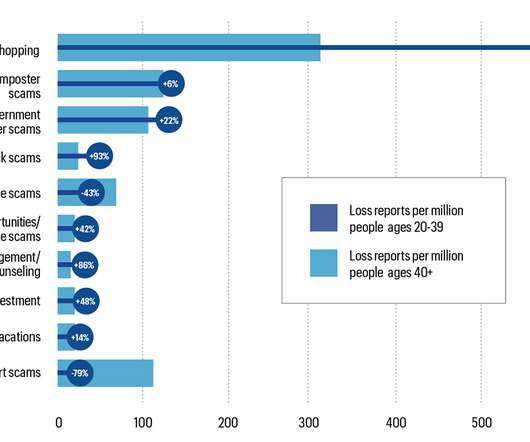

COVID-19 Scams Target The Business Community

PYMNTS

JANUARY 18, 2021

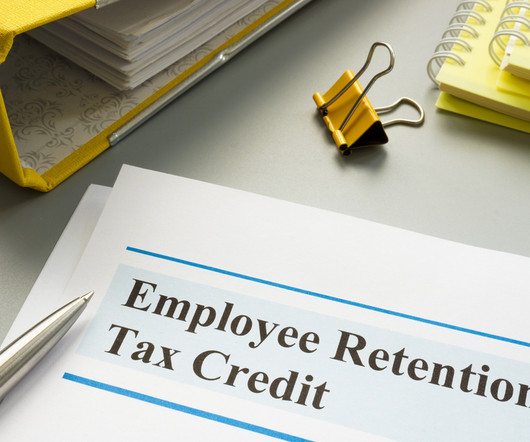

With a second Paycheck Protection Program (PPP) on the way, small businesses have yet another chance to secure much-needed financial relief. Yet the new bill fails to address the gaps that allowed for fraudulent activity among some businesses that had secured PPP loans in the first round of stimulus, the publication alleges.

Let's personalize your content