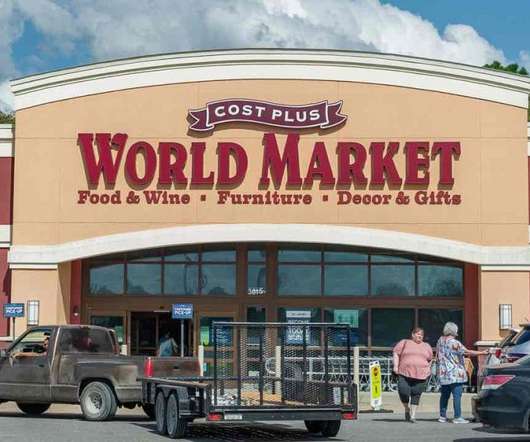

Today In Retail: Bed Bath & Beyond Completes Sales Of Cost Plus World Market; Starbucks To Help Out Washington State With Vaccine Distribution

PYMNTS

JANUARY 19, 2021

In today’s top retail news, Bed Bath & Beyond said it has finished its sale of Cost Plus World Market (CPWM) to a private equity firm, while Starbucks will help Washington state with the distribution of coronavirus vaccines. Bed Bath & Beyond Finishes Sale Of Cost Plus World Market To PE Firm. Bed Bath & Beyond Inc.

Let's personalize your content