Here Is How To Calculate Your Bank’s Cost Of Capital [Calculator]

South State Correspondent

NOVEMBER 15, 2022

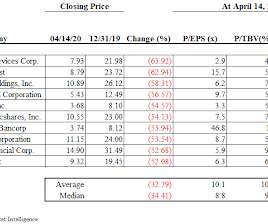

the As interest rates go back up and volatility continues to remain high, banks’ cost of capital has undergone a significant shift up. Your cost of capital is essential to know for several reasons. Produce over your cost, and you will be able to attract more capital. Why Calculate Your Cost of Capital?

Let's personalize your content