ECOMMPAY launches innovative graph analysis for payments fraud defences

The Paypers

MARCH 28, 2023

UK-based payment service provider ECOMMPAY has implemented innovative graph analysis to augment its proprietary Risk Control Management System (RCMS).

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

The Paypers

MARCH 28, 2023

UK-based payment service provider ECOMMPAY has implemented innovative graph analysis to augment its proprietary Risk Control Management System (RCMS).

The Paypers

MARCH 28, 2023

UK-based payment service provider ECOMMPAY has implemented innovative graph analysis to augment its proprietary Risk Control Management System (RCMS).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Elevating Accounting Practices: The Power of Outsourcing and Automation in the Digital Age

Independent Banker

APRIL 30, 2022

Community bankers are embracing innovation like never before—with impressive results. But with so much emphasis placed on customer-facing products and technologies, innovating back-office operations can fall to the bottom of the priority list. Unbundle your end-to-end operations and conduct a SWOT analysis.

PYMNTS

JUNE 22, 2017

There’s another way, though, in which the fear of fraud bears down on the enterprise. A new report from Vesta Corporation finds fraud positions itself in the way of innovation and growth, even compliance. to understand how payments fraud is limiting corporates’ path to success. cents per every $100 transacted.

PYMNTS

NOVEMBER 9, 2017

But new research from treasury management firm Kyriba suggests treasurers and CFOs are falling short in delivering on some of the top priorities of the corporate board. More than a third (36 percent) of survey respondents said fraud monitoring and risk mitigation are the areas in which CFOs are most falling short. The Data Connection.

Perficient

FEBRUARY 29, 2024

Through the analysis of diverse data sets, automation of loan processing, and consideration of varied factors, financial institutions are not only increasing customer satisfaction and reducing operational costs but also fostering resilience in the face of evolving economic landscapes.

Celent Banking

MARCH 4, 2017

It is my privilege to be part of the judging panel for Celent Model Bank Awards for 2017 for the following three categories: Fraud Management and Cybersecurity – for the most creative and effective approach to fraud management or cybersecurity. At the moment we are staying tight-lipped about who won the awards.

PYMNTS

JANUARY 30, 2020

Widely publicized data breaches and hacks have made today’s consumers especially concerned about fraud. Cautious shoppers may find comfort in debit, with fraud losses associated with the payment method declining over the past several years. Card fraud is an ever-present threat. A Big-Picture Approach To Thwarting Debit Fraud.

Insights on Business

FEBRUARY 11, 2019

They require employment of dedicated server administrators to manage and maintain the databases and related resources, as well as acquiring the extra hardware to house the database software. This is magnified by the necessity of a tailored approach while implementing payment fraud prevention as well.

PYMNTS

MAY 28, 2020

This means FIs must be able to ferret out and defend against an ever-more complex array of attacks, and they deploy advanced fraud detection strategies and designate additional resources to keep themselves and their customers safe. Staying ahead of fraud requires constant innovation. Red Flag Behaviors.

PYMNTS

DECEMBER 19, 2018

19) that it has inked a partnership deal with Feedzai, an artificial intelligence (AI) developer for real-time risk management across banking and commerce. Our strategic partnership with Feedzai demonstrates our deep commitment to using technology to drive innovation.

South State Correspondent

JANUARY 23, 2023

Our innovation working group, called Spark, has been playing with the tool for the past several months, and this article details how we use it to jump our productivity by 20%. How should I pitch treasury management services? This AI-powered digital assistant, technically called “generative AI,” has taken banking, and society, by storm.

PYMNTS

OCTOBER 16, 2020

Numerous quick-service restaurants (QSRs) have deployed these technologies to support their operations, tailor their customer service approaches and even boost sales, but many players, including several big names, have been reluctant to invest in such innovations. How AI Can Aid In Fraud Detection, Sales.

FICO

SEPTEMBER 8, 2022

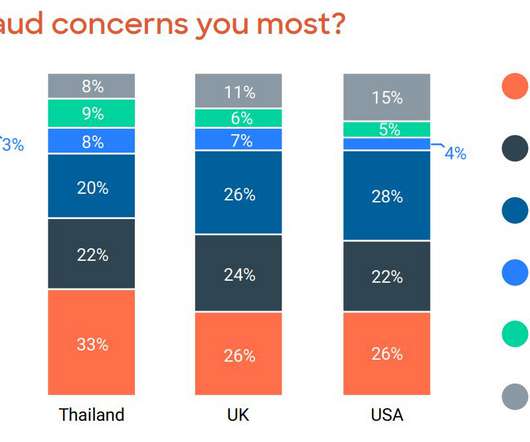

Payments Fraud in Asia Post Pandemic. Why consumers are moving to banks with the best fraud and scam prevention. Senior Consultant, Fraud and Financial Crime. The growth of real-time payments and fraud in Asia. The appeal of these banking innovations has also made it a honeypot for fraud. Saxon Shirley.

FICO

JULY 1, 2022

Global Fraud Trends: What’s Happening and What’s Next? Here are the highlights from the fraud trends breakout session at FICO World 2022 with a panel of fraud professionals from Brazil, Turkey and North America. Ulisses Okamoto , Fraud Risk Management Superintendent at Itaú Unibanco (Brazil). by TJ Horan.

Insights on Business

MAY 6, 2019

Payment fraud detection has always had a bit more latitude than its counterparts in anti-money laundering, customer due diligence and even trade surveillance compliance. Unlike the latter areas, fraud prevention is an area not as heavily governed by regulations or specific rules of what a financial institution should or should not allow.

PYMNTS

NOVEMBER 12, 2018

However, these professionals have their own ideas about where corporate payments innovation should be headed. Analysis suggests that executives are pushing for faster internal payments and exploring how the innovation would affect their credit management strategies.

PYMNTS

JANUARY 26, 2017

B2B payments have a reputation for being slow to innovate , though the last couple years has challenged that notoriety. Still, according to the latest Mercator Advisory Group report on FinTech disruption, B2B payments will have to wait a bit longer to see true change from these innovations.

PYMNTS

MARCH 14, 2019

Corporate treasurers are increasingly concerned about a complex regulatory environment, according to the latest analysis from Strategic Treasurer and TD Bank. Most also said payments management is the most time-consuming process, followed by cash forecasting.

PYMNTS

JUNE 19, 2020

There are ways to effectively manage these logistical issues, however. A payments orchestration layer can serve as an intermediary between a merchant and its various PSPs while extending services that support payments analysis, regulatory compliance, cybersecurity, anti-fraud protection and more.

PYMNTS

MAY 9, 2016

But the connected vehicle also has benefits in the enterprise space, with the ability to provide useful data that ties directly into expense management and a watchful eye on margins. The average cost of lost revenues estimated across the fraud cases? Roughly $2.7

FICO

JANUARY 10, 2023

Top 5 Fraud Posts for 2022: Scams, Contactless and Money Mules. In a year that saw the word "scamdemic" coined, scams such as authorised push payment fraud were top of mind, along with various other fraud schemes. Few things change faster in the financial services space than fraud trends. FICO Admin.

Abrigo

MARCH 7, 2022

Takeaway 2 Planning ahead and informing management of expected changes will help financial institutions adapt to anticipated rules and guidance. However, the panel suggested thinking and planning around AMLA requirements and informing executive management of expected changes. 2022 Regulatory Focus. 2022 Regulatory Focus.

FICO

DECEMBER 8, 2020

This prestigious ranking of the top 100 players in risk technology is determined by Chartis Research , the leading provider of research and analysis on the global market for risk and finance technology. Driving innovation across a global organization. First of all, innovation is front-and-center in FICO’s culture.

PYMNTS

JULY 21, 2020

At the same time, however, these innovations have also introduced unfamiliar disruptions to antiquated workflows, creating new challenges for treasurers to understand how to readjust their processes and cash flow management strategies as their role within the enterprise grows more complex and valuable.

FICO

DECEMBER 4, 2018

I’m excited to announce that FICO has been named as a category leader in the Chartis Financial Crime Risk Management Systems for Enterprise Fraud report. The Chartis report Vendor Analysis: FICO (Financial Crime Risk Management Systems: Enterprise Fraud; Market Update 2018) provides further analysis of FICO’s rating.

FICO

DECEMBER 12, 2022

However, in terms of artificial intelligence (AI) and analytics, 2022 has been a great year for FICO, my data science team, and AI innovation in general. Perhaps the most visible focal point of that innovation is software patents; we recently announced that FICO was granted 11 U.S. The Power of Patents.

FICO

JANUARY 5, 2021

It’s no surprise that COVID-19 would be one of the subjects that drew readers to the FICO Blog last year, but for the Fraud Protection and Compliance category it wasn’t the only top draw. Two of our top five posts focused on digital transformation innovations in biometrics and customer identification.

PYMNTS

APRIL 10, 2019

The Association of Financial Professionals released new data this week that revealed the threat of payments fraud continues to climb, particularly for large enterprises, as scams like ACH fraud and the Business Email Compromise climb to record levels. But the latest analysis of U.S. But the latest analysis of U.S.

PYMNTS

MAY 10, 2019

Among the highest ideals for digital payments – driving innovation in transactions and customer experience – is, of course, the concept of seamlessness. In short, the new rule might require companies that deal with ACH payments to retool their fraud detection systems. How much effort will that require, then?

PYMNTS

AUGUST 7, 2019

6), Bottomline announced the launch of its Digital Banking IQ Intelligent Engagement suite, a range of products that includes payments, cash management, risk and fraud management, relationship development and client onboarding and account opening. In a press release on Tuesday (Aug.

PYMNTS

SEPTEMBER 23, 2019

“A firm attempting to make purchases from a new overseas supplier can trigger a fraud warning, for example, but AI solutions might compare it to a cluster of similar SMB accounts and further examine it before raising a flag,” the report noted. . On average, an organization will manage 300 APIs. Empowerment Through Data.

PYMNTS

JANUARY 2, 2019

While commercial card innovation certainly accelerated in 2018, progress can always continue. Morgan Managing Director and Head of Commercial Card Product Management Naney Pandit says should be a focus this year is in mobilizing the corporate card. One area of development that J.P. ” Providing Convenience.

PYMNTS

APRIL 29, 2019

By leveraging innovation, we continue our strategic journey to drive digitization throughout our worldwide operations,” John Ahearn, global head of trade for Citi Treasury and Trade Solutions, said in the press release. “We managed services CIO, in the press release. Innovative technology helps change the game entirely.”.

NCR

JULY 28, 2017

The ongoing development of digital technology has created unprecedented choice and freedom for consumers in how they manage their financial affairs. Research has shown that fraud has become a bigger threat as consumers and businesses have moved more of their financial processes into the digital space. An escalating threat.

PYMNTS

JUNE 15, 2018

The simulation technology enables the automated recognition of a significant event in quantitative analysis, enabling entities to simulate more complex scenarios. In its announcement, Barclays explained that agent-based modeling differs from regression-based models, which rely on historical behavior data analysis. “By

FICO

NOVEMBER 24, 2021

The 2022 Chartis RiskTech100® Report is live, and I am proud to announce that FICO ranked 6th overall in the annual report and was named the category winner for: Innovation (5th consecutive year). Financial Crime – Enterprise Fraud. Artificial Intelligence Applications. Retail Credit Analytics. What a way to wrap the year!

FICO

OCTOBER 2, 2018

This is not the best approach to AML case management, as this example illustrates: The Swiss Financial Market Supervisory Authority (FINMA) internally maintains a "Red List" listing some 20 Swiss banks are listed that the supervisors believe are most likely to have customers who might be involved in crooked business — specifically, money laundering.

PYMNTS

AUGUST 10, 2016

Employee travel has been an area of innovation and technological advancement in recent times, but the space is far from where it should be, according to Runzheimer. Runzheimer spoke with PYMNTS earlier this year to discuss the threat of expense fraud. spent per mile traveled.

Abrigo

MARCH 11, 2022

Takeaway 2 Planning now and informing executive management of expected changes will enable NBFIs to move forward with anticipated rules and guidance. Innovation and Technology Another regulatory focus in 2022 is financial institutions' technology needs, including NBFIs. Regulatory topics for NBFIs to watch for.

PYMNTS

JULY 3, 2019

In a press release issued Tuesday (July 2), Palmarius Advisors announced that its AP solution provides automated reconciliation and increased security to mitigate the risk of fraud while simplifying accounts payable transactions. Our clients love how they can now generate additional revenue every time they pay their suppliers or vendors.”.

FICO

JUNE 5, 2019

China Minsheng Bank Credit Card Center has used FICO® Blaze Advisor® decision rules management system to help grow its business by creating an intelligent, automated marketing system that delivers targeted offers, which have seen a 10 to 15 percent jump in response rates. Credit Card Growth - Response Rates Up, Costs Down.

South State Correspondent

MARCH 21, 2023

This article breaks down how you can use the ERC Assist product to generate deposits in an innovative way. ERC Assist provides clients with a technology platform that showcases bank innovation and demonstrates the bank is forward-thinking. The IRS processes quarter-by-quarter and refunds once each quarter analysis is complete.

PYMNTS

FEBRUARY 15, 2019

The higher education sector is facing rising pressure to manage spend, as operating costs climb and organizations face greater scrutiny over tuition levels. According to Rotoli, that means the concept of procurement modernization and spend management has evolved into something far beyond simply getting rid of paper.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content